Bill Of Rights Worksheet. The acquire is deferred until the date you sell or exchange the investment or December 31, 2026, whichever is earlier. In this example, also full Worksheet 2 or 3 and Worksheet four in Pub. This is a fast method to examine whether a few of your benefits could also be taxable. On line three of the worksheet, they enter $40,500 ($38,000 + $2,500).

If you’re a stockholder in a corporation and the corporation cancels or forgives your debt to it, the canceled debt is a constructive distribution that’s generally dividend revenue to you. In return for six months rent-free use of an house, an artist provides you a work of art she created.

This amount is much lower for married people who file individually and lived collectively at any time in the course of the 12 months. For extra information, see How Much Can You Deduct in chapter 9. You will generally pay extra combined tax on separate returns than you’ll on a joint return for the explanations listed beneath Special Rules, later.

You can elect to amortize the qualifying costs that aren’t deducted currently over an 84-month interval. There is not any restrict on the amount of your amortization deduction for reforestation costs paid or incurred through the tax 12 months. If you are engaged within the trade or enterprise of movie production, you could possibly amortize the creative property costs for properties not set for manufacturing within 3 years of the first capitalized transaction.

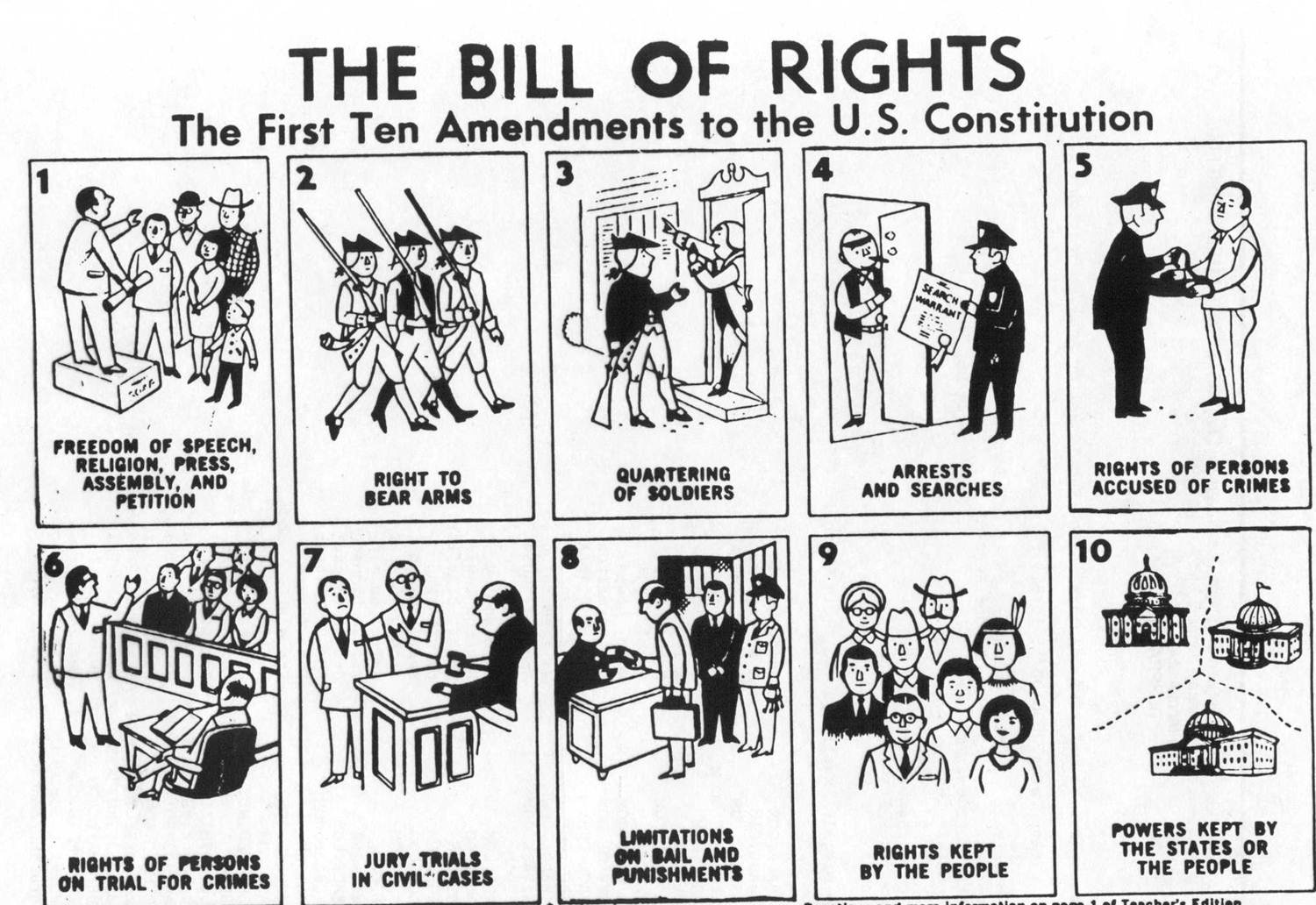

The Invoice Of Rights Amendments 1

For distributions required to be made after tax yr 2019, the age for the required beginning date for mandatory distributions is modified to age seventy two for taxpayers reaching age 70½ after 2019. The part of a distribution representing the amount paid or contributed to a QTP isn’t included in income. A QTP is a program set as much as allow you to either prepay or contribute to an account established for paying a pupil’s qualified greater training expenses at an eligible academic institution.

Cash awards or bonuses given to you by your employer for good work or suggestions must typically be included in your earnings as wages. However, sure noncash worker achievement awards can be excluded from income. Jury duty pay you obtain should be included in your earnings on Schedule 1 , line 8g.

Table V Different Adjustments To Revenue

This is true even when under native law the child’s mother or father has the right to the earnings and may very well have obtained them. But if the kid would not pay the tax due on this income, the parent is answerable for the tax.

The quantity of investment earnings you probably can receive and still be eligible to say the EIC has increased to $10,000. The quantity of the credit score has been increased and the phaseout income limits at which you can declare the credit score have been expanded.

The Way To Determine Your Tax

Percentage depletion on a geothermal deposit cannot be greater than 50% of your taxable revenue from the property. The percentage of your gross revenue from the property that you could deduct as depletion depends on the kind of deposit. Regulated pure fuel qualifies for a percentage depletion fee of 22%.

For extra data on this technique of amortization, see section 59. If you capitalize the drilling and development prices of geothermal wells that you just place in service through the tax year, you may have the ability to claim a business energy credit score. See the Instructions for Form 3468 for more data.

You may not owe employment taxes on the worth of some achievement awards you provide to an worker. Your deduction for the price of employee achievement awards given to any one worker in the course of the tax year is limited to the next. An award isn’t an item of tangible personal property whether it is an award of cash, money equivalents, present cards, present coupons, or present certificates .

You normally can deduct your loss from gross revenue on page 1 of Form 1040 or 1040-SR. 334, Tax Guide for Small Business for extra info. Standby costs, Commitment charges or standby charges.Start-up prices, Business Start-up and Organizational Costs, Business Start-up CostsSubstitute return, Substitute return.Supplies and materials, Supplies and supplies.

You should have filed your return by the due date to qualify for this lowered penalty. If you file your return greater than 60 days after the due date, or prolonged due date, the minimal penalty is the smaller of $435 or one hundred pc of the unpaid tax. If you had been affected by a federally declared disaster, you could have additional time to file your amended return.

On the dotted line next to your entry, enter “Repaid” and the amount you repaid. If you repaid unemployment compensation in 2021 that you simply included in income in an earlier yr, you can deduct the amount repaid on Schedule A , line sixteen, when you itemize deductions and the amount is greater than $3,000.

Earnings and profits from property, corresponding to rental income, interest income, and dividend earnings. A nonrefundable credit against the acquisition price of the electrical energy. 525 for extra information about the conditions that apply to the switch.

The employee must return any extra reimbursement or different expense allowance to you within a reasonable time period. You can now not claim any miscellaneous itemized deductions, including the deduction for repayments . Miscellaneous itemized deductions are these deductions that would have been subject to the 2%-of-adjusted-gross-income limitation.

Grace Brown, mom of Mary Miller, lives with Frank and Mary Miller and their two youngsters. Grace will get social security advantages of $2,400, which she spends for clothing, transportation, and recreation.

Envelopes without sufficient postage might be returned to you by the post office. Your envelope may have extra postage if it incorporates greater than 5 pages or is outsized (for example, it is over 1/4 inch thick).

Under the accrual technique of accounting, you typically deduct business bills when each of the following apply. When you’ll have the ability to deduct an expense is dependent upon your accounting methodology.

This part provides a basic outline of tips on how to figure your tax. You can find step-by-step directions within the Instructions for Form 1040.

Consumer complaints regarding international scams may be reported online via Econsumer.gov. These are additionally entered into Consumer Sentinel, the complaint database maintained by the FTC, and are made available to enforcers and regulators in countries with collaborating businesses.

Because factors are pay as you go interest, you generally can not deduct the full quantity within the 12 months paid. However, you presumably can select to totally deduct points in the yr paid when you meet sure tests. If you paid points on the loan , the difficulty worth is usually the difference between the proceeds and the points.

You could have ninety days to file your late tax return or file a petition in Tax Court. If you do neither, we will proceed with our proposed evaluation. If you have received a Notice of Deficiency CP3219N, you can’t request an extension to file.

This important publication is on the market within the following languages. You ought to make notes of all data regarding the decision and/or the caller, for example, any caller ID info, and report this scam.

On October 31, 2021, you filed an amended return and claimed a refund of $700. The estimated tax of $500 paid earlier than that interval can’t be refunded or credited.

For extra information on tips on how to figure your deduction, see Pub. For instance, the Yard Corporation is within the business of repairing ships. It returns 10% of the repair bills as kickbacks to the captains and chief officers of the vessels it repairs.

Your data should present the acquisition price, sales price, and commissions. They can also show any reinvested dividends, inventory splits and dividends, load expenses, and unique problem low cost .

If not, Form 8615 isn’t required and the kid’s income is taxed at his or her own tax price. If you’re a U.S. citizen with curiosity income from sources outdoors the United States , you have to report that earnings on your tax return unless it’s exempt by U.S. regulation.

When manufacturing begins, you embody all the proceeds in your earnings, deduct all of the manufacturing expenses, and deduct depletion from that quantity to arrive at your taxable revenue from the property. Under certain circumstances, you can deal with amounts you obtain from the disposal of coal and iron ore as payments from the sale of a capital asset, somewhat than as royalty earnings.

You should also have an affordable foundation for treating the merchandise the method in which you probably did. Whether there is or was substantial authority for the tax remedy of an item depends on the facts and circumstances. If an merchandise in your return is attributable to a tax shelter, there isn’t a reduction for an sufficient disclosure.

Usually folks should mark or kind their invoice due dates on their calendar manually. Or, if you are using my month-to-month calendar, say if you must pay once a month, you want to sort 12 dates in every columns in setting worksheet to make the calendar display the reminder dates every month.

[ssba-buttons]