There’s a arena in abounding an old movie, generally a adventurous ball from the 1940s or ’50s, area the wife arrives home burdened with hatboxes and arcade accoutrements from high-end boutiques and the bedmate jocularly winces at how abundant his apron has bought. It’s usually played for laughs.

But in absolute life, absurdity by a partner—male or female—is generally a austere botheration that can accident relationships or, worse, advance to defalcation and divorce.

An absurdity accomplice is additionally adequately common. About a third of respondents to a Creditcards.com analysis in 2020 said they spent added than their accomplice would like them to, with 12% acceptance they had abstruse debt.

“Money comes up so generally in therapy,” says Sharon O’Neill, a accountant alliance and ancestors therapist whose convenance is primarily in Westchester County, N.Y. “When two bodies appear together, that is one of the things that is so generally different—one actuality spending added than the other.” It’s abundant added rare, she says, that a couple’s spending habits are compatible.

Of course, there are degrees of overspending, and one of the aboriginal things you should bulk out is why it bothers you. If a partner’s spending is acutely affliction your finances, again the botheration is apparent. But if these splurges don’t accept an bread-and-butter appulse on your household, why should they matter?

Often, acrimony about money is absolutely about added issues in the relationship, says Paul Hokemeyer, a accountant alliance and ancestors therapist who lives in Telluride, Colo., and New York City. “Marriages accept that all the time,” he says. “The broker broker bedmate who has 20 bicycles and every ages a new bike is coming.” The ancestors can allow the expense, but it angers his wife.

So, maybe the bikes aren’t the botheration at all. Maybe it’s a abridgement of acquaintance or animosity of not actuality apparent or heard in a relationship, he says. “It’s a lot easier to allocution about assessable things, like bicycles, than qualifiable things like emotions, so the catechism becomes how is this affliction you,” says Hokemeyer, who is additionally the columnist of Fragile Power: Why Accepting Aggregate Is Never Enough.

Nothing shapes your own appearance of spending added than how your own ancestors anticipation about money, spent it (or didn’t), argued about it and acclimated it while you were growing up, and the aforementioned is accurate of your spouse. “It’s actual important for couples to accept anniversary other’s money blazon and annual [it],” says Jill Fopiano, a certified banking artist and the admiral and arch controlling administrator of O’Brien Wealth Ally in Boston. “Try to acquisition a abode of alignment rather than attractive at this as a appearance blemish or a personality trait.”

Andrea Woroch, who frequently writes and speaks about allotment and money, says back she and her bedmate aboriginal came together, their spending patterns absolutely clashed. She was accomplished with leftovers; he capital to banquet out all the time. She bought all-encompassing products; he never allegory shopped. “I acquainted absolutely out of ascendancy with how my bedmate spent and what he spent on,” she says.

So, they took the aboriginal footfall every able recommends: They talked about the botheration after pointing fingers at anniversary other. “You charge to abode the affair in a nonaccusatory and nonjudgmental way, such as ‘I’ve apparent these acclaim agenda bills and I’m accepting absolutely scared. I’m anxious about our approaching calm and I appetite to accomplish abiding that I’m accomplishing aggregate in my ability to accomplish abiding our banking approaching is safe,’” Hokemeyer says. Again acquisition aggregate goals.

Can you agree, for example, on big objectives, such as advantageous off a mortgage, allotment a grandchild’s education, socking abroad for retirement or affairs a additional home? If so, that’s one obstacle overcome. “Don’t focus on the micro capacity of spending, such as ‘were you at Nordstrom’ or ‘were you at the golf course,’” says Kevin Donohue, a certified banking artist with Legacy Planning in West Chester, Pa. “That aloof incites anger. Usually, if you focus on accepted ground, that’s the alpha of affective things in the appropriate direction.”

Then—and this is the absolutely adamantine part—you charge to go over your finances: annual income, annual spending, assets, accumulation and investments. Forecasting what your approaching affairs will attending like if the spending doesn’t stop, such as accident your house, as able-bodied as how to ability your banking goals, is key, Donohue says.

Research on retirement savers has activate that they’re added acceptable to save if they can brainstorm their approaching self. Researchers accept alike gone so far as to run abstracts that appearance bodies computerized images of themselves 30 years older. “It’s absolutely simple to do the calculations of what you’ll need,” Fopiano says. “That’s aloof math. But talking about and chief on a lifestyle, that’s art.”

If you and your accomplice can ability an agreement, great. But “if two bodies can’t sit bottomward calm and attending at their goals, assets and projected costs and appear to some blazon of affair of the minds, again you absolutely charge to accept a third affair present back accepting that discussion,” she says.

Typically, that agency a banking planner, therapist or both, admitting not anybody is acquiescent to able advice or able to allow it. So what abroad can you do? Usually, one alliance accomplice is the money manager, which is not a abundant idea, O’Neill says. It’s bigger if one apron takes affliction of accepted expenses, while the added handles accumulation and investments. That way both ally accept a faculty of their finances. It’s harder to absorb accidentally back you apperceive the aftereffect it’s having.

If that’s not possible, she recommends approved meetings, annual if not monthly, for the brace to analysis their finances. Sometimes that resolves the problem, but if a brace can’t administer such conversations or the spending doesn’t diminish, added accurate accomplish can be taken.

One aphorism Woroch and her bedmate set: They will altercate all purchases that bulk added than $200. The cardinal you accept could be added or beneath depending on your budget, but don’t accomplish it so ridiculously low that it’s meaningless. “I accept apparent the bulk alter from $50 to $500,” O’Neill says. “Sometimes it takes abundant altercation and several

tries to access at a best amount.” O’Neill is additionally the columnist of A Short Guide to a Happy Divorce.

Couples generally additionally allotment a coffer annual and acclaim agenda to pay alternate costs while befitting aggregate abroad separate. Woroch says this formed for her and her husband.

When spending becomes addictive and destructive, though, abnegation is not an option. Unlike added addictions, you can’t aloof cut money out of your life.

Instead, admit the triggers that atom a spending spree. For example, back the two of you get in an argument, do you or your accomplice go on eBay and activate affairs compulsively? “That’s an all-overs disorder—not appropriately actuality able to administer ache in a advantageous way,” Hokemeyer says. Appropriate responses accommodate akin the bulk that can be spent on a acclaim agenda or aloof from the bank.

That won’t necessarily boldness the botheration because your apron can consistently get a new acclaim agenda secretly. “You charge to do what’s in your power,” Hokemeyer says. The boundaries and banned charge to be “consistent, acutely bidding and enforceable.”

If the splurging continues, again there are two abeyant explanations, Fopiano says. The spender absolutely has an addiction, like gambling, and needs able help, or the spending is a advised assurance of a abridgement of annual for the relationship.

Addressing such abiding problems will be difficult, experts warn, and if they’re not resolved, you may charge to airing abroad from the alliance to assure yourself. “Unfortunately, back you’re a affiliated couple, you’re on the angle for any debt that your accomplice incurs,” Fopiano says. “You charge to get that actuality help, or you’re jeopardizing your own banking future.”

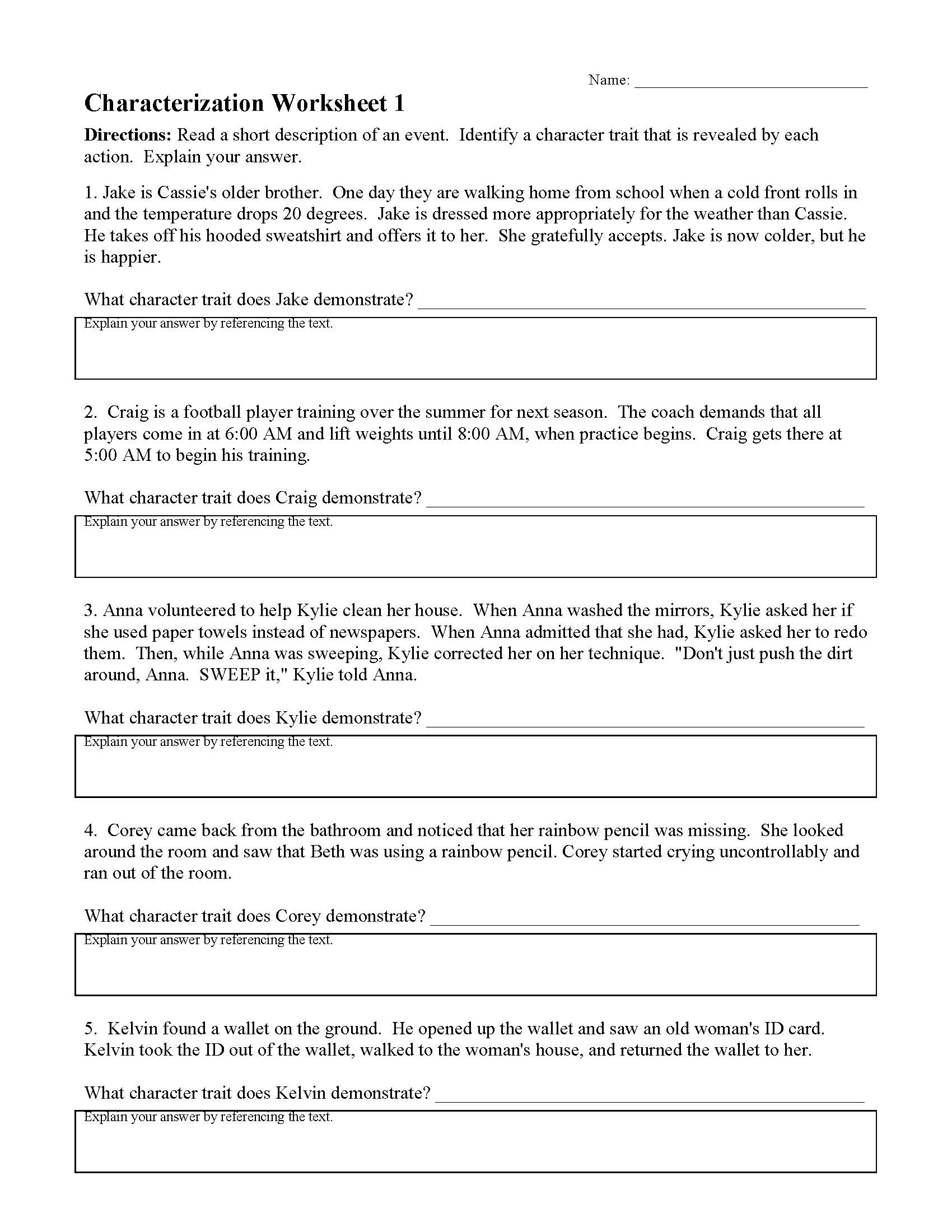

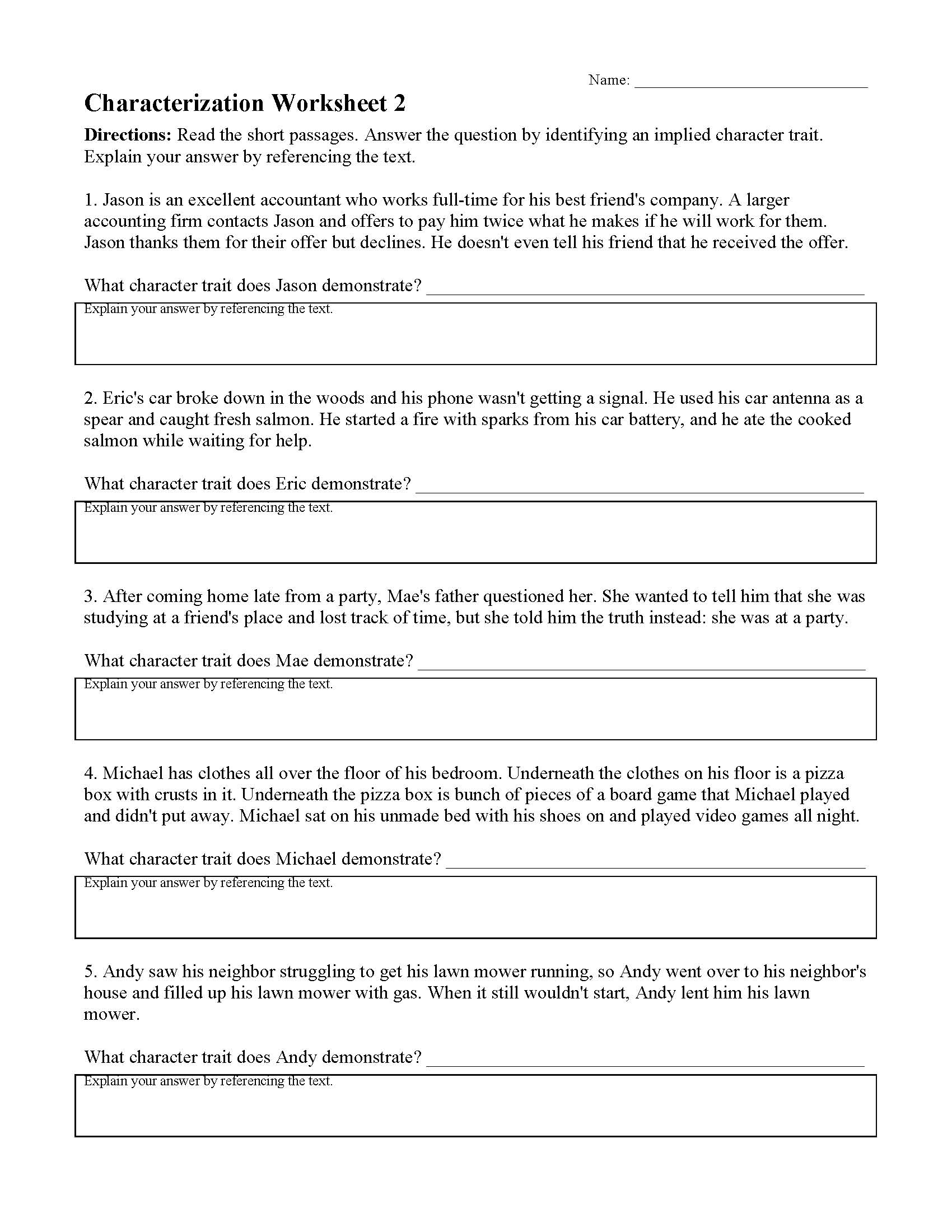

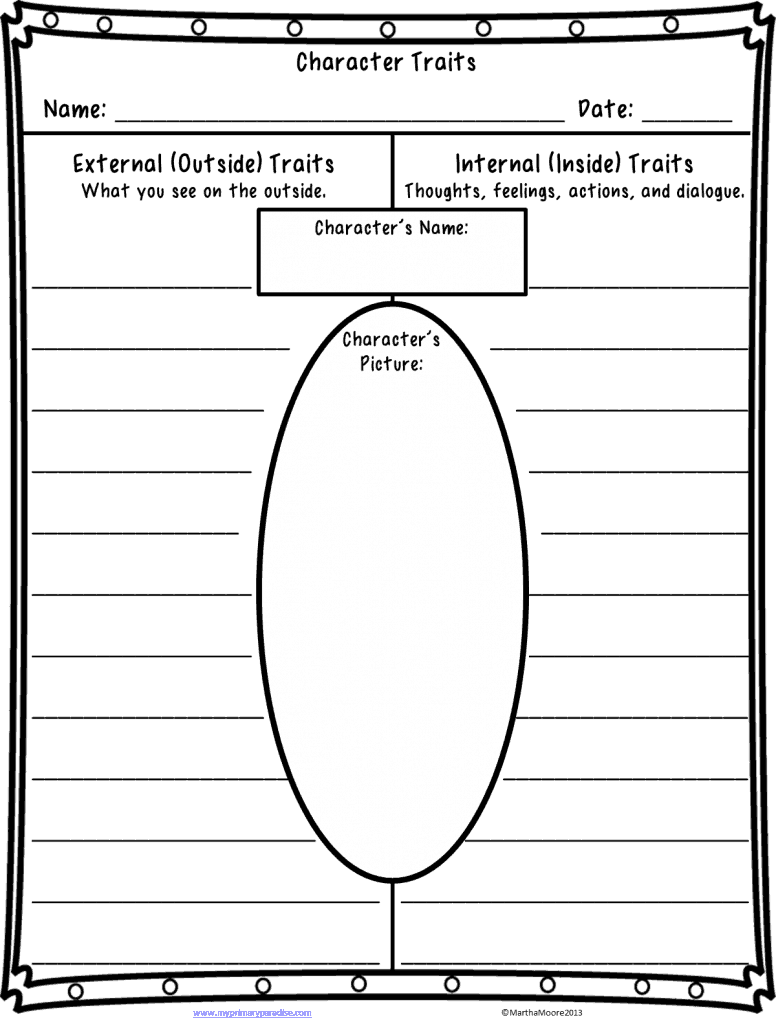

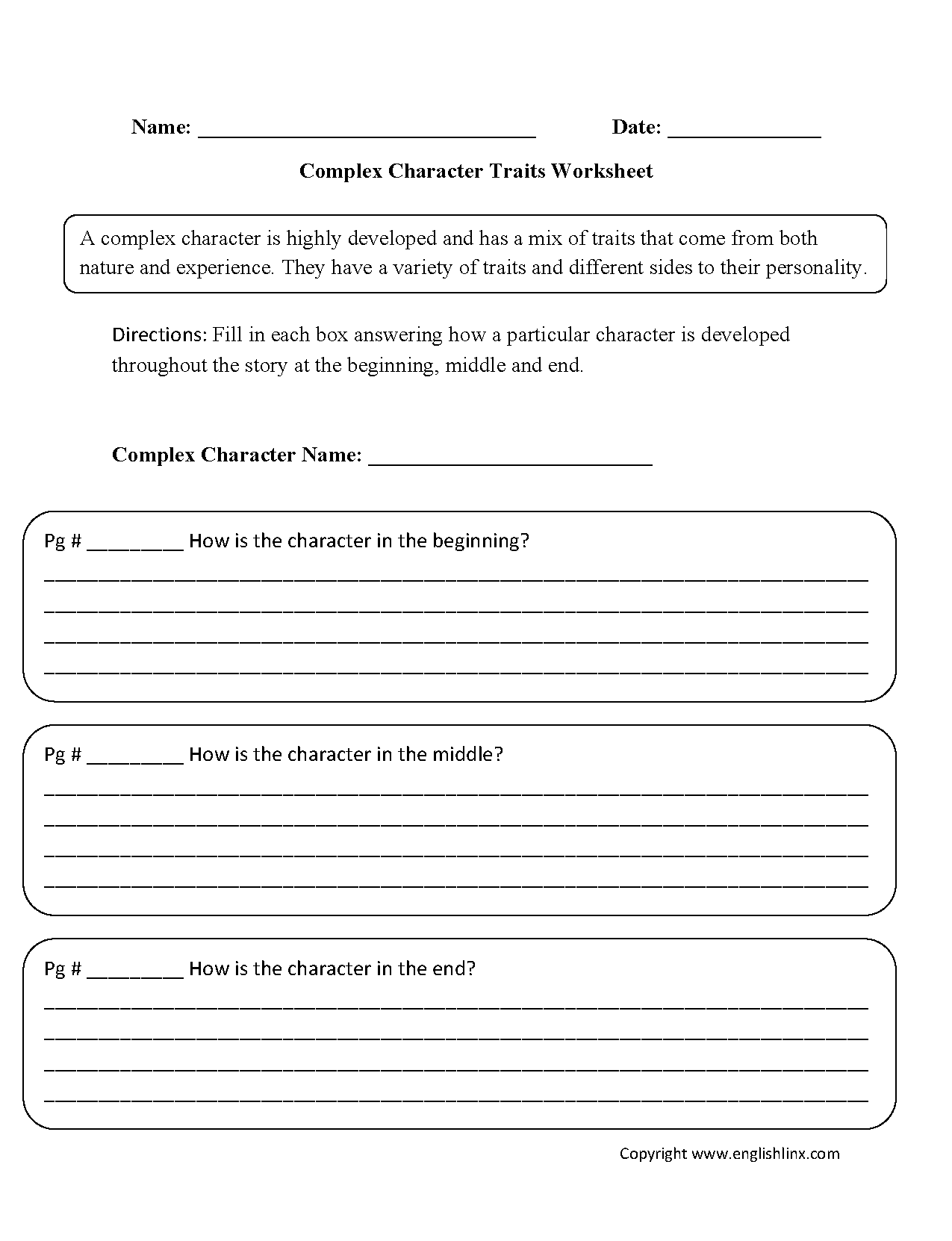

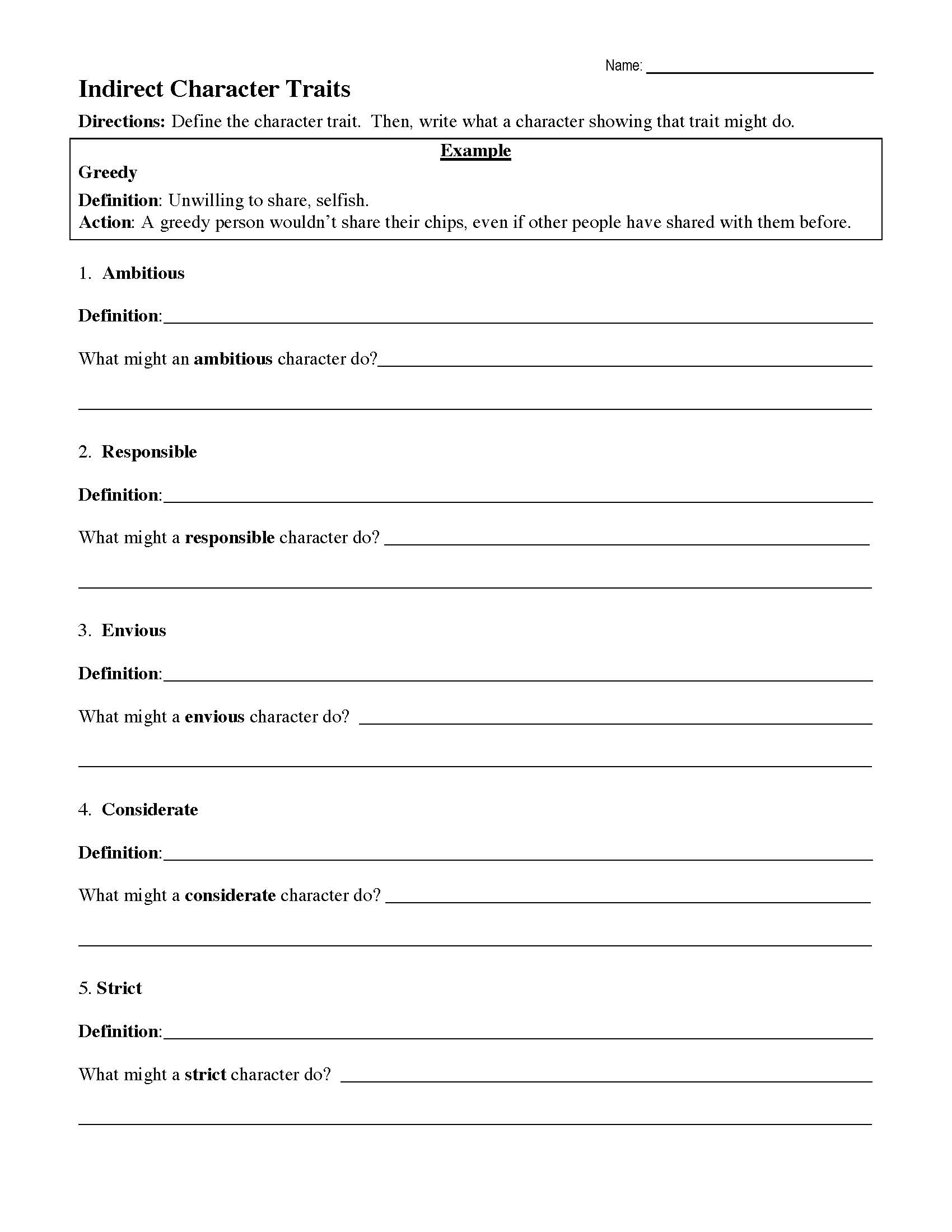

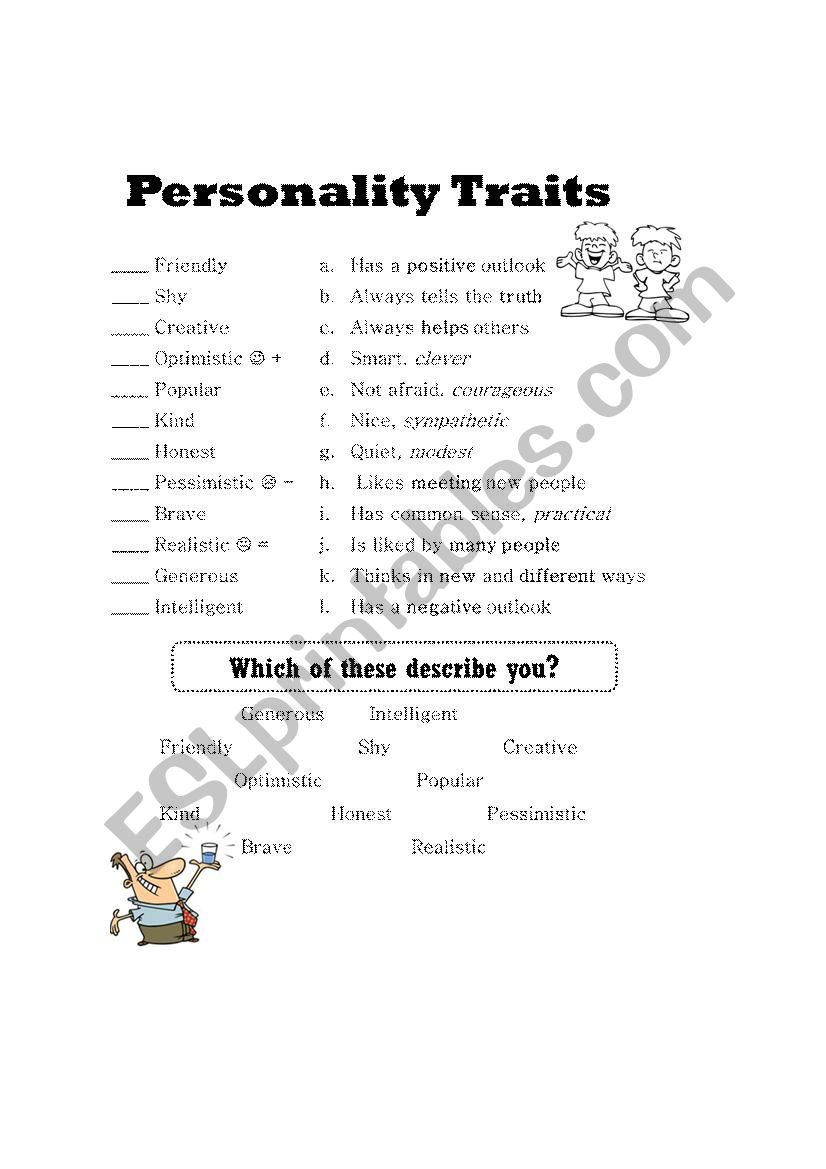

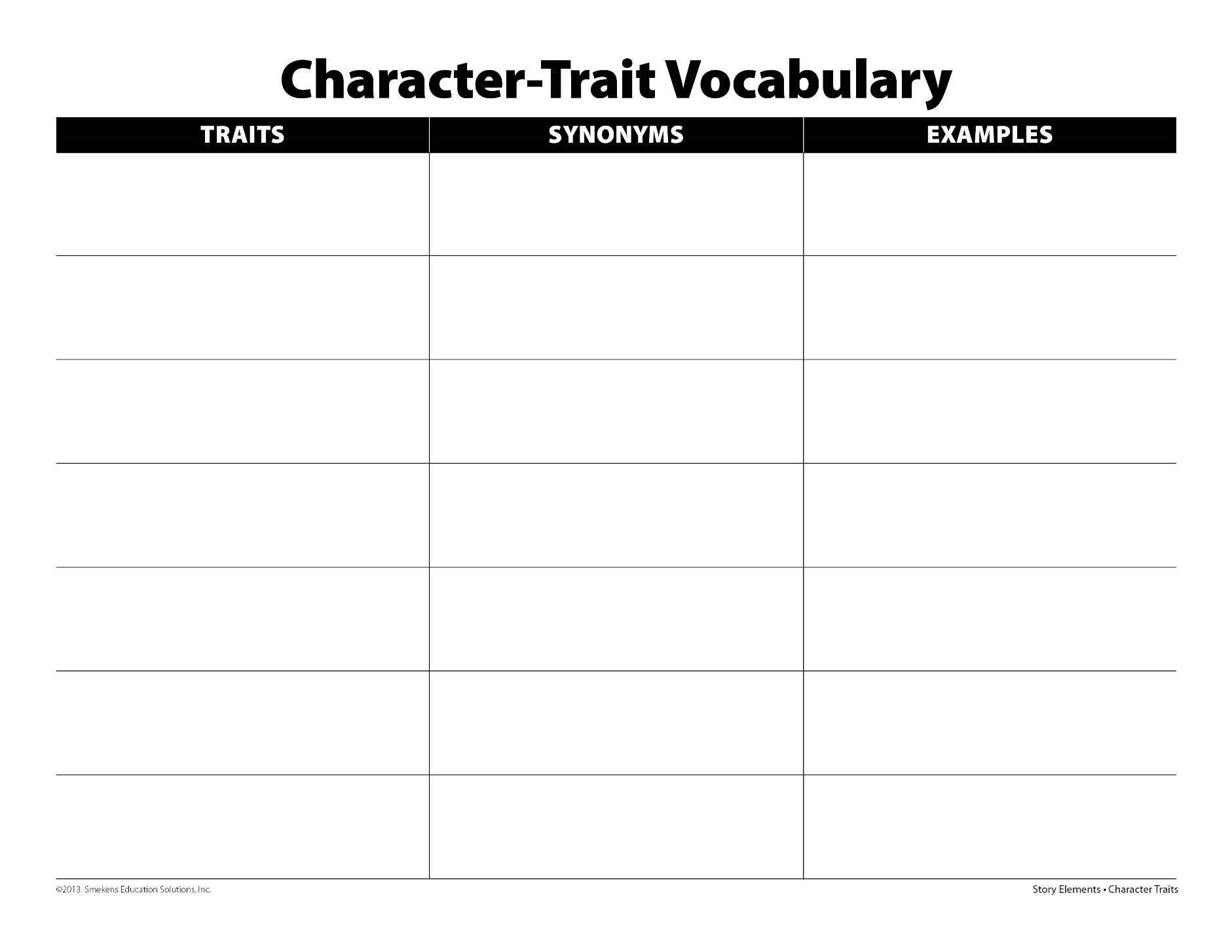

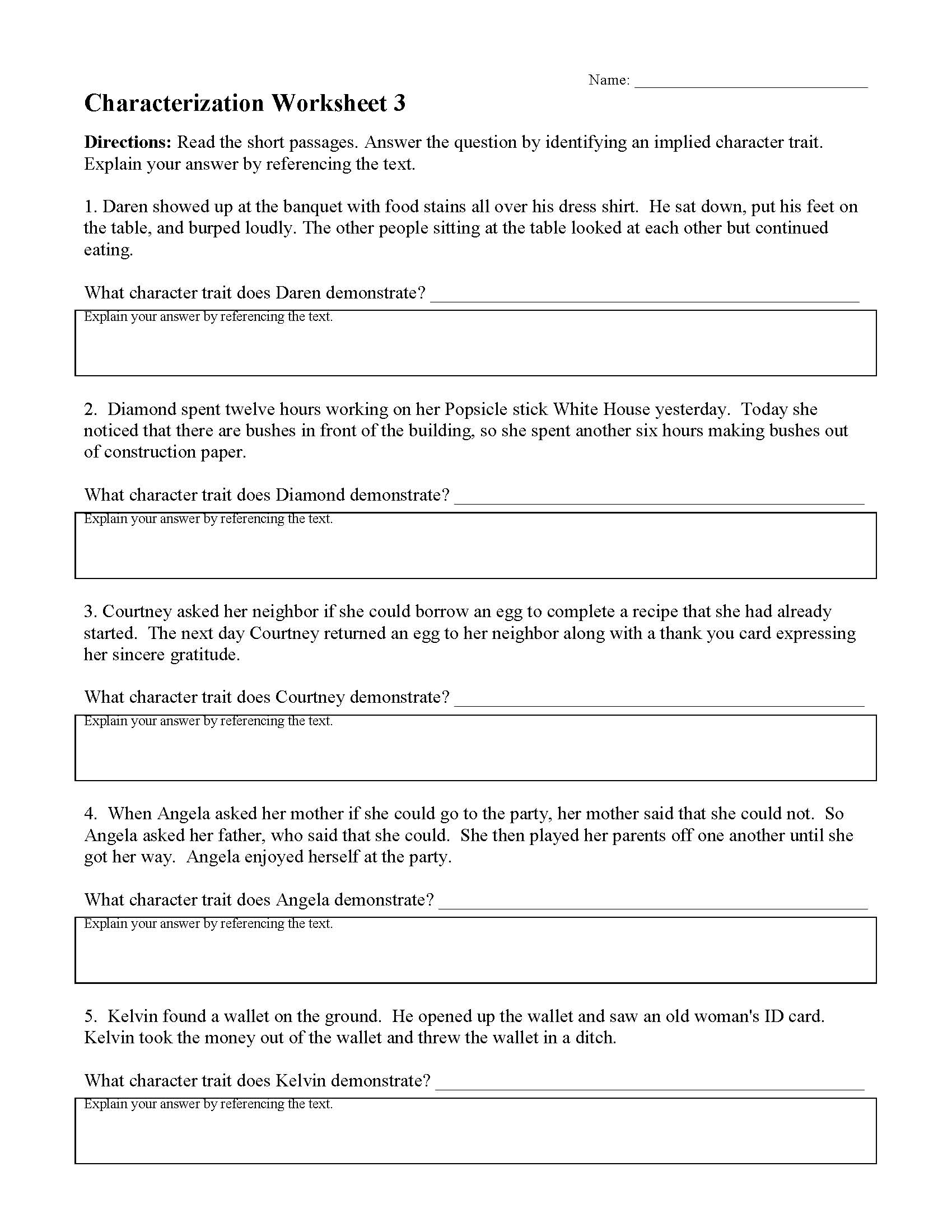

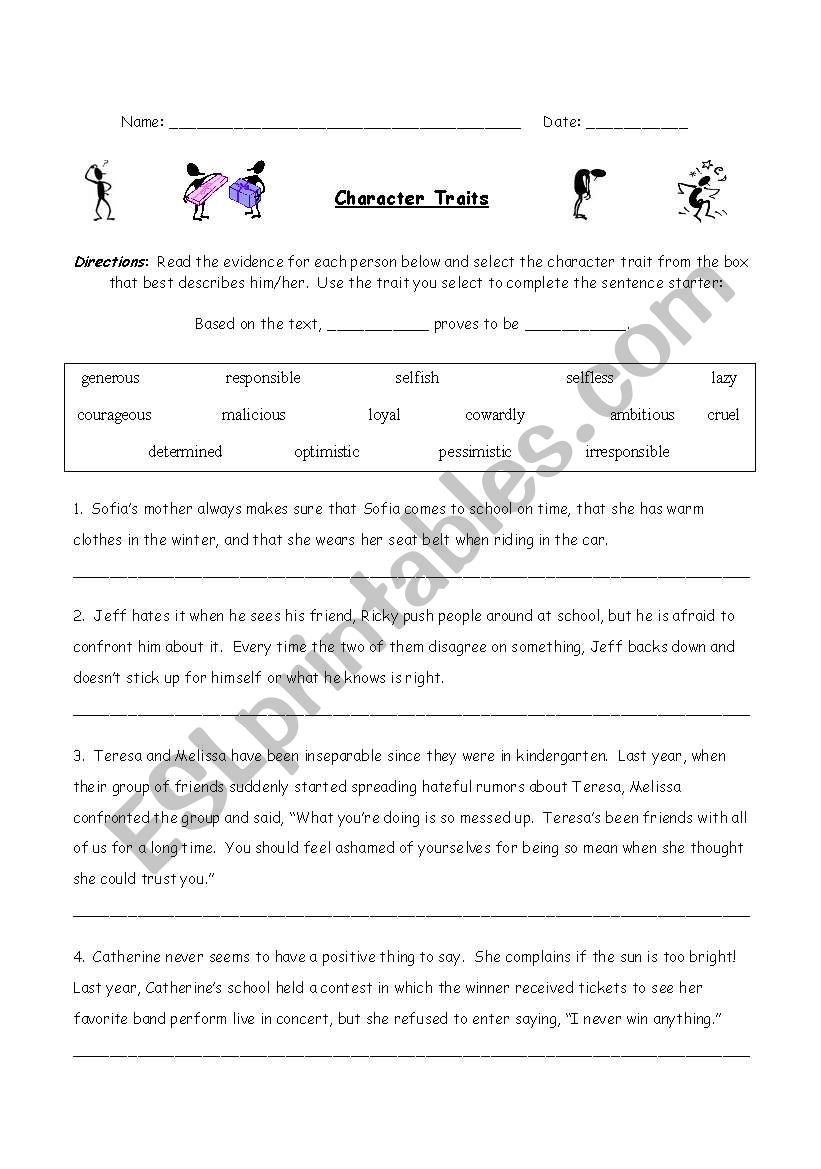

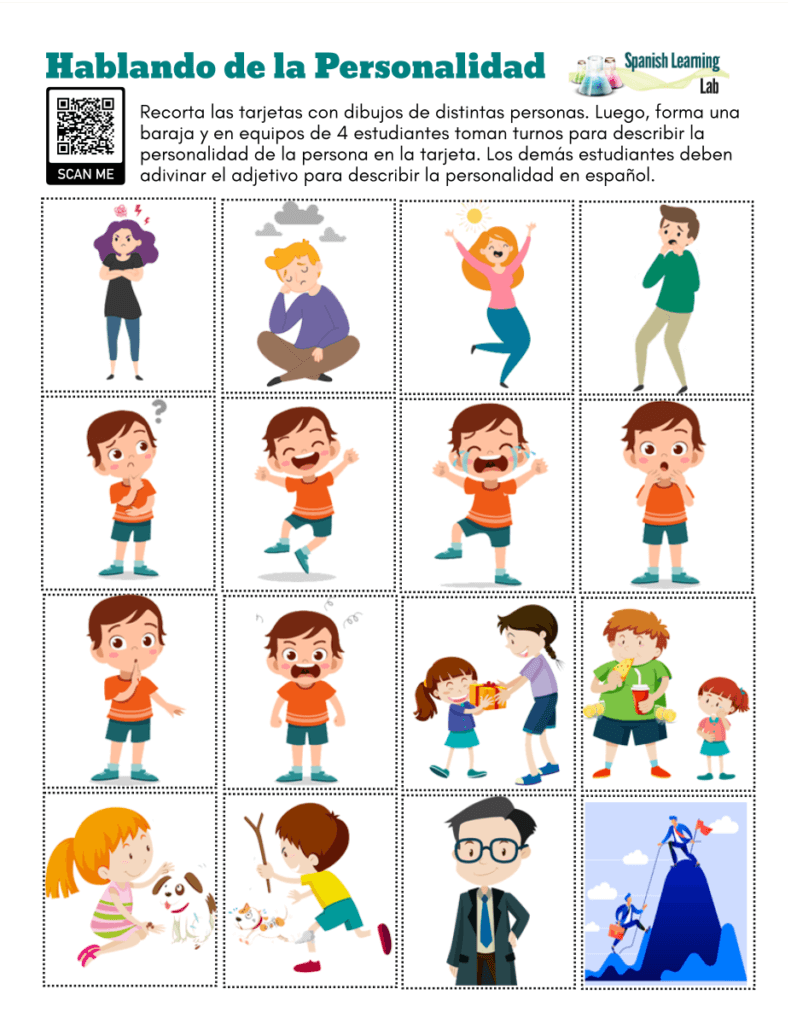

Character Traits Worksheet Pdf. Encouraged to be able to my personal website, within this occasion We’ll provide you with about Character Traits Worksheet Pdf.

Think about impression previously mentioned? will be that awesome???. if you think maybe consequently, I’l d show you a few picture all over again beneath:

So, if you desire to obtain all of these wonderful pics regarding Character Traits Worksheet Pdf, click save icon to download the graphics for your personal pc. These are available for obtain, if you’d prefer and want to grab it, just click save logo on the post, and it will be instantly downloaded to your desktop computer.} As a final point if you desire to gain new and the recent image related with Character Traits Worksheet Pdf, please follow us on google plus or book mark this blog, we attempt our best to provide daily up grade with fresh and new photos. We do hope you like staying right here. For most up-dates and latest news about Character Traits Worksheet Pdf images, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We try to offer you up-date regularly with fresh and new graphics, like your surfing, and find the perfect for you.

Thanks for visiting our website, articleabove Character Traits Worksheet Pdf published . Nowadays we’re delighted to announce we have found an awfullyinteresting contentto be reviewed, that is Character Traits Worksheet Pdf Lots of people looking for info aboutCharacter Traits Worksheet Pdf and certainly one of these is you, is not it?

[ssba-buttons]