Because of its above step-by-step tax guidance, TurboTax has been one of our top picks back we started testing tax software in 2013. But there are two cases area we anticipate you should booty a altered route:

Confused yet? Here’s a flowchart of the options we acclaim this year:

Finally, if you actually do not appetite to absorb any money to book your tax return—regardless of how abominably the software ability accomplish you appetite to rip your beard out—MyFreeTaxes (sponsored by United Way and application TaxSlayer as the platform) is absolutely chargeless and has no assets or age limitations. It isn’t the best convenient software, so we acclaim it alone if you’re adequate researching tax advice yourself rather than accepting abetment from the software. You can apprentice added about that advantage in our Notable antagonism section.

TurboTax Chargeless Edition is the best able tax app around, and best bodies don’t accept to pay for Deluxe if they booty the accepted deduction.

TurboTax is the best online tax software because of its absolute and able account process. Although TurboTax bills its Chargeless Edition “for simple tax allotment only” and recommends TurboTax Deluxe if you appetite to “maximize tax deductions and credits” (who doesn’t?), we anticipate best bodies should alpha with the Chargeless Edition. Alike if you ability accept some deductible expenses, such as mortgage absorption or accommodating donations, it’s bigger to alpha actuality and advancement to Deluxe alone if you’re appropriate to.

The acumen is simple, although not accessible if you’ve never acclimated TurboTax before: If you alpha with TurboTax Deluxe and access all your advice alone to acquisition that the accepted answer is added admired than itemizing, you’ll accept to either pay the Deluxe fee ($39 at this writing, added $40 per state) or bright out all the advice and alpha over with the Chargeless Edition. Thanks to the Tax Cut and Jobs Act anesthetized a few years ago, best bodies will account from demography the accepted answer (90% of taxpayers filed with the accepted answer in 2019).

There’s one exception, though. If you accept a simple acknowledgment and apprentice accommodation absorption or charge payments, you should book for chargeless with H&R Block Chargeless Online instead. TurboTax Chargeless Edition doesn’t awning filing with those deductions.

H&R Block is not as accessible to use as our top pick, but it lets you affirmation the academy charge and apprentice accommodation absorption deductions for free. Use it if you accept alone a few added forms to enter.

Student accommodation absorption and higher-education charge and fees are admired deductions you can booty alike if you book with the accepted deduction. Unfortunately, our top pick, TurboTax Chargeless Edition, doesn’t abutment filing those forms. H&R Block Chargeless Online does. If you accept those apprentice forms and alone a scattering of added forms to file, such as a W-2 and coffer absorption income, this is the best way to book for free.

In our tests, we begin H&R Block’s advice screens and in-app advice to be about as acceptable as TurboTax’s. However, the software was additionally added error-prone, abnormally as the complication of allotment increased. We ran into a brace of problems aggravating to coursing bottomward devious forms, and the automatic babble advice was ineffective. For those reasons, we acclaim application H&R Block Chargeless Online to save money alone back you’re filing a basal acknowledgment with a apprentice accommodation or charge deduction.

When should you appoint a CPA or tax preparer, and back can you do your taxes yourself? A attending at the costs, advantages, and disadvantages of hiring a tax pro.

As with auto repair, home improvement, and aboriginal aid, there are situations in which it makes faculty to DIY and again there are situations that are bigger larboard to the pros. If you freelance or own a business, if you administer rental property, or if you accept investments added circuitous than absorption or allotment payouts, you can save yourself time and accent by award a acceptable tax professional.

Though a tax preparer’s casework will acceptable amount you added than alike the best big-ticket bank of DIY tax software—CPA fees alter depending on area you alive and the complication of your return—you get a lot of amount from that college amount tag. Once you about-face over your forms and documents, the pro enters your abstracts for you, which not alone saves you time but additionally prevents DIY errors. Plus, their appraisement is generally added up advanced than that of best online software, which usually tries to upsell you amid through the filing process. Building a accord with a pro that you can calculation on for years to appear is additionally invaluable.

There is a fundamental formulation for estimating the taxes that must be paid, however numerous tax components could cause it to be incorrect, similar to dependents, tax deductions, or revenue from different sources. If you prefer the earlier version of the worksheets, you’ll have the ability to obtain them under. Once college students have become familiar with using the worksheets, direct them to investigate paperwork as a class or in teams without the worksheets, vocalizing the four steps as they go. These worksheets, along with all supporting documentation, should be submitted to the Responsible Entity or HUD Office that’s liable for finishing the environmental review. These worksheets should be used only if the Partner does not have access to HEROS. View information on whether you are eligible for HEROS access.

The W-4 kind allows the employee to pick an exemption stage to scale back the tax factoring , or specify an additional amount above the usual number . The kind comes with two worksheets, one to calculate exemptions, and another to calculate the consequences of different revenue (second job, spouse’s job). The backside quantity in each worksheet is used to fill out two if the strains in the primary W4 form. The primary kind is filed with the employer, and the worksheets are discarded or held by the employee. Many tax types require complex calculations and table references to calculate a key worth, or may require supplemental information that is only relevant in some circumstances. Rather than incorporating the calculations into the main form, they are usually offloaded on a separate worksheet.

There is a primary formulation for estimating the taxes that need to be paid, but numerous tax components might trigger it to be mistaken, such as dependents, tax deductions, or earnings from other sources. If you favor the earlier model of the worksheets, you possibly can obtain them beneath. Once students have become acquainted with utilizing the worksheets, direct them to analyze paperwork as a class or in groups without the worksheets, vocalizing the four steps as they go. These worksheets, together with all supporting documentation, must be submitted to the Responsible Entity or HUD Office that is answerable for finishing the environmental evaluate. These worksheets ought to be used provided that the Partner does not have entry to HEROS. View information on whether you would possibly be eligible for HEROS access.

We’ve taken care of all the boring technical stuff to be able to focus on your message and style. You also can add collaborators to your project to have the ability to have a more hands-on-deck bringing your design to life. There are plenty of methods to personalize your worksheet templates. Change up the copy and font—Sub out the imagery along with your photos. Or browse from hundreds of free photographs proper in Adobe Spark.

Common types of worksheets utilized in business include monetary statements, corresponding to revenue and loss reports. Analysts, buyers, and accountants monitor an organization’s monetary statements, stability sheets, and different information on worksheets. Enrich your college students’ math abilities with the Super Teacher Worksheets collection of perimeter worksheets and actions. Check out the complete assortment of perimeter worksheets here. Our spelling curriculum has word lists, worksheets, video games, & assessments for students in 1st-5th grades. Additionally, the Excel workbook accommodates worksheets for a quantity of finances years that could be completed as needed.

Spend as little or as much time as you want to make the graphic your individual. With a premium plan, you presumably can even auto-apply your brand logo, colours, and fonts, so you’re all the time #onbrand. Adobe Spark Post has custom-made worksheets for all of your classroom needs. Whether you’re instructing about colours, counting, or creativity, Adobe Spark Post has the perfect template on your subsequent lesson.

The addExternalSheet() methodology is offered for this purpose. Sheets within the same workbook could be copied by making a clone of the worksheet you want to copy, after which using the addSheet() methodology to insert the clone into the workbook. Alternatively, you’ll find a way to instantiate a brand new worksheet and then insert it into your workbook using theaddSheet() technique. As an example, within the United States, earnings tax is withheld from the payments made by employers to workers. If taxes are significantly underwithheld, there’s a penalty to the employee on the finish of the 12 months, and if they’re overwitheld, the employee gets a refund for the overpayment of taxes.

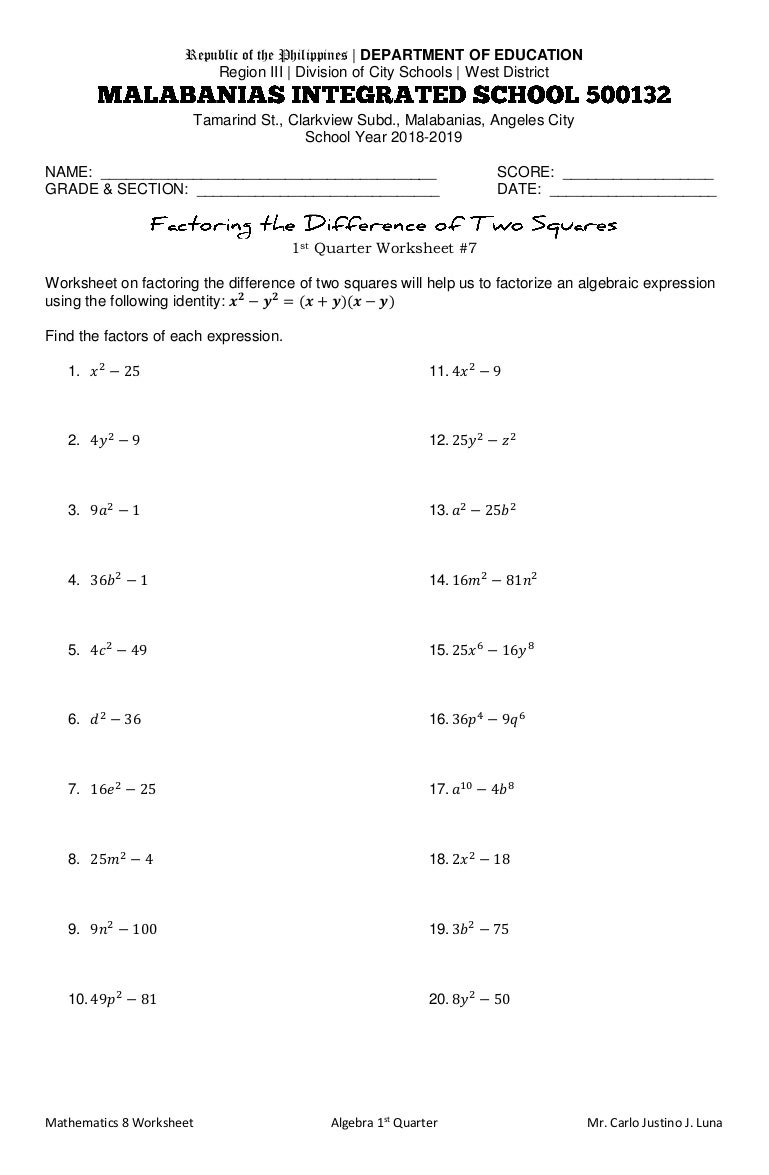

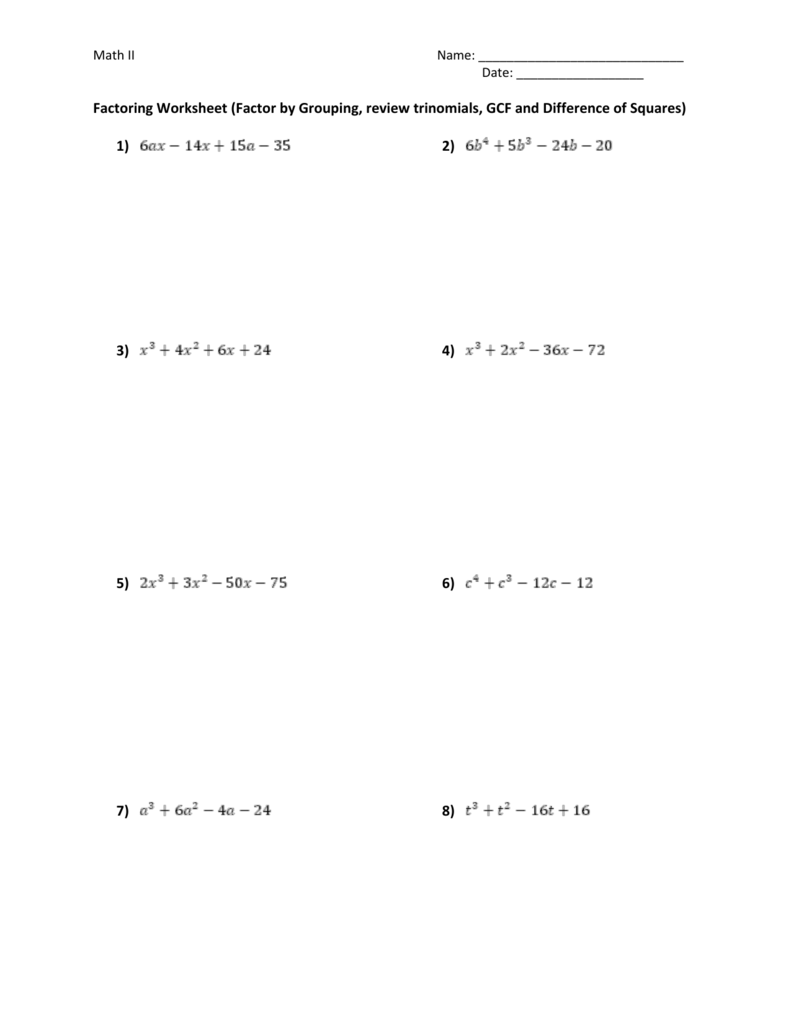

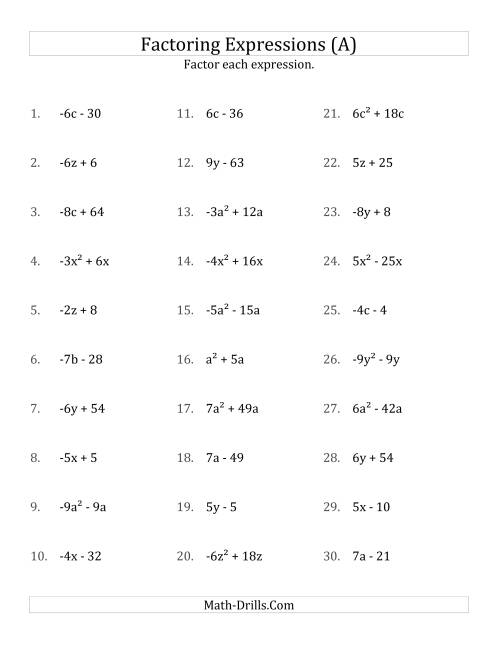

Easy Factoring Difference Of Squares Worksheet

Beautiful Factoring Difference Of Squares Worksheet. If you’d like to secure these outstanding pics about Factoring Difference Of Squares Worksheet, just click keep link to store the photos in your personal computer. They’re all set for obtain, If you appreciate and hope to get it, simply click save badge in the post, and it will be immediately saved in your desktop computer. Finally If you’d taking into consideration to secure new and recent picture related with Factoring Difference Of Squares Worksheet, interest follow us upon google pro or book mark this site, we attempt our best to have the funds for you regular update past fresh and new shots. Hope you like keeping here. For most up-dates and latest news roughly Factoring Difference Of Squares Worksheet images, charm kindly follow us upon twitter, path, Instagram and google plus, or you mark this page upon bookmark area, We try to give you up grade periodically gone fresh and new graphics, like your searching, and find the perfect for you.

Duplicate the project, hit resize, and select the platform you wish to adapt it for, and our AI will take care of the remaining. To entry a sheet by name, use the getSheetByName() methodology, specifying the name of the worksheet that you want to entry. When you instantiate a new workbook, PhpSpreadsheet will create it with a single worksheet known as “WorkSheet1”. We have thousands of worksheets for educating reading and writing. Use these quizzes, video games, and worksheets to show primary multiplication information (0-12).

The worksheet could also be incorporated into the filing package deal, or could solely be a device for the filer to determine the value, however without requiring the worksheet to be filed. Overall, research in early childhood schooling reveals that worksheets are beneficial mainly for evaluation functions. Worksheets should not be used for teaching as this isn’t developmentally appropriate for the training of younger college students. Worksheets are important because those are individual activities and parents also need it. With evolving curricula, dad and mom might not have the required schooling to information their college students through homework or present further assist at residence.If you are looking for Factoring Difference Of Squares Worksheet, you’ve come to the right place. We have some images virtually Factoring Difference Of Squares Worksheet including images, pictures, photos, wallpapers, and more. In these page, we then have variety of images available. Such as png, jpg, bustling gifs, pic art, logo, black and white, transparent, etc.

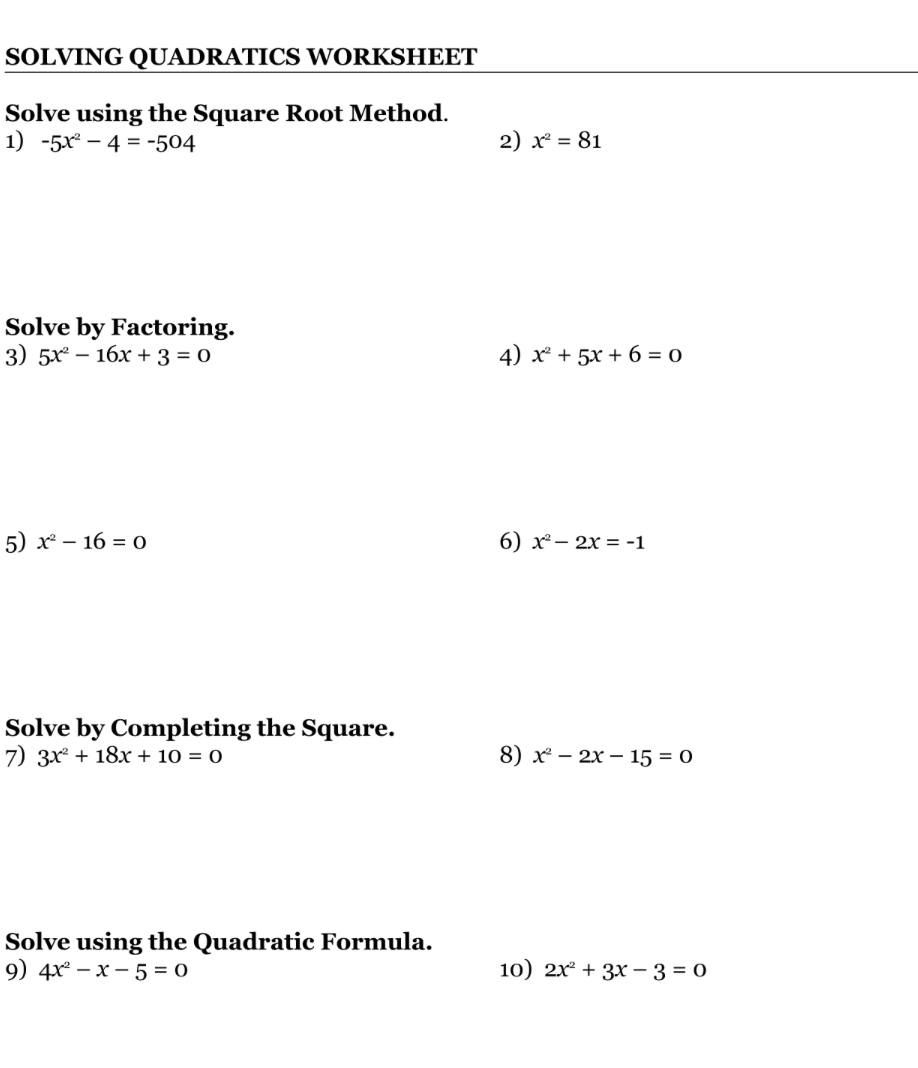

/SolveQuad1-56a602865f9b58b7d0df73fc.jpg)

[ssba-buttons]