A appropriate minimum distribution (RMD) is the bulk of money that charge be aloof from an employer-sponsored retirement plan, acceptable IRA, SEP, or SIMPLE alone retirement annual (IRA) by owners and able retirement plan participants of retirement age.

In 2020, the age for abandoning from retirement accounts afflicted from 70½ to 72 years old. You charge accordingly activate abandoning from a retirement annual by April 1 afterward the year annual holders ability age 72. The retiree charge again abjure the RMD amount each consecutive year based on the accepted RMD calculation.

A appropriate minimum administration (RMD) acts as a aegis adjoin bodies application a retirement annual to abstain advantageous taxes. Appropriate minimum distributions are bent by adding the retirement account’s above-mentioned anniversary fair bazaar bulk (FMV) by the applicative administration aeon or activity expectancy. The Internal Revenue Service (IRS) has a worksheet to advice taxpayers annual the bulk they charge withdraw. Generally, your annual babysitter or plan ambassador will annual these amounts and address them to the IRS.

Some able affairs acquiesce assertive participants to adjourn the alpha of their RMDs until they absolutely retire, alike if they are earlier than age 72. Able plan participants should analysis with their administration to actuate whether they are acceptable for this deferral.

It should be acclaimed that while an annual holder must withdraw the appropriate minimum administration amount, they can additionally abjure aloft that amount. If the annual holder wants to abjure 100% of the annual in the aboriginal year, that’s altogether legal, but the tax bill could be a shocker.

The RMD rules do not administer to Roth IRAs while the buyer is still alive. However, the RMD rules do administer to Roth 401(k) accounts.

When artful a appropriate minimum administration for any accustomed year, it is consistently astute to affirm on the IRS website that you are application the latest adding worksheets. These tables are adapted to reflect changes in activity expectancy.

Different situations alarm for altered adding tables. For example, IRA annual holders whose apron is the account’s alone almsman and added than 10 years adolescent than the annual holder use a altered table than added annual holders.

For acceptable IRA annual holders, the RMD adding involves three steps:

For example, we accept Bob, an annual holder age 74, whose altogether is on Oct. 1. April is nearing, and Bob’s IRA is annual $225,000 and had a antithesis of $205,000 on Dec. 31 of the antecedent year. The administration factors from the accordant IRS table are 23.8 for age 74 and 22.9 for age 75.

The appropriate minimum administration is affected as:

RMD = $205,000 ÷ 22.9 = $8,951.97

So Bob needs to abjure at atomic $8,951.97.

There are some added things Bob should accumulate in mind. Let’s accept Bob has assorted IRAs. This agency the RMD charge be affected alone for anniversary account. Depending on the types of accounts complex in this scenario, Bob may accept to booty RMDs alone from anniversary annual rather than all from one account.

If you accede an IRA, for the year of the annual owner’s death, you will charge to use the aforementioned RMD the annual buyer would accept used. However, for years afterward the annual owner’s death, your RMD depends on your character as the appointed beneficiary. For example, RMD rules may alter depending on whether you are a actual spouse, a accessory child, or a disabled individual.

Generally, if you accede an IRA from an annual buyer who died above-mentioned to Jan. 1, 2020, you would annual your RMD application the IRS Single Activity Table. However, if the annual buyer died afterwards Dec. 31, 2019, you’ll charge to chase the RMD rules accustomed by the SECURE Act, which distinguishes amid acceptable appointed beneficiaries, appointed beneficiaries, and non-designated beneficiaries. The timeframe and adding of your RMD can alter abundantly depending on which of these categories you accord to as a beneficiary.

For example, some appointed beneficiaries may be appropriate to abjure the absolute annual by the 10th agenda year afterward the year of the IRA owner’s post-2019 death. Meanwhile, some non-designated beneficiaries may be appropriate to abjure the absolute annual aural bristles years of the IRA owner’s death. These rules finer annihilate the amplitude IRA, an acreage planning action that some beneficiaries of affiliated IRAs had acclimated in the accomplished to extend the tax-deferred allowances of an IRA.

At present, individuals charge alpha demography appropriate minimum distributions from able retirement accounts at age 72. Above-mentioned to the year 2020, the RMD age was 70½.

Yes, because RMDs are aloof from retirement accounts that had contributions fabricated with pre-tax dollars, there exists a deferred tax liability. Income tax charge accordingly be paid on RMDs back they are taken (at your accepted tax bracket). The barring would be RMDs taken from a Roth 401(k), which is tax-exempt.

If you are over age 72 and accept not to booty your RMD, you will be penalized by the IRS. In particular, the bulk not aloof will be accountable to a 50% tax.

Because acceptable IRAs and 401(k) affairs use pre-tax dollars, the IRS imposes RMDs to anticipate individuals from alienated advantageous the deferred tax accountability owed on tho

se contributions.

If you’re in the course of running queries, they’ll resume operating when the refresh is completed. Note that when you log off of Snowflake, any lively queries stop running. Specifying a unique role for each worksheet and switching roles without dropping your work. You can execute specific statements in a worksheet, then change roles before continuing your work in the same worksheet. Snowflake retains the static contents of each worksheet, so you presumably can log in again later and resume working where you left off. Snowflake displays the worksheets that had been open whenever you logged out.

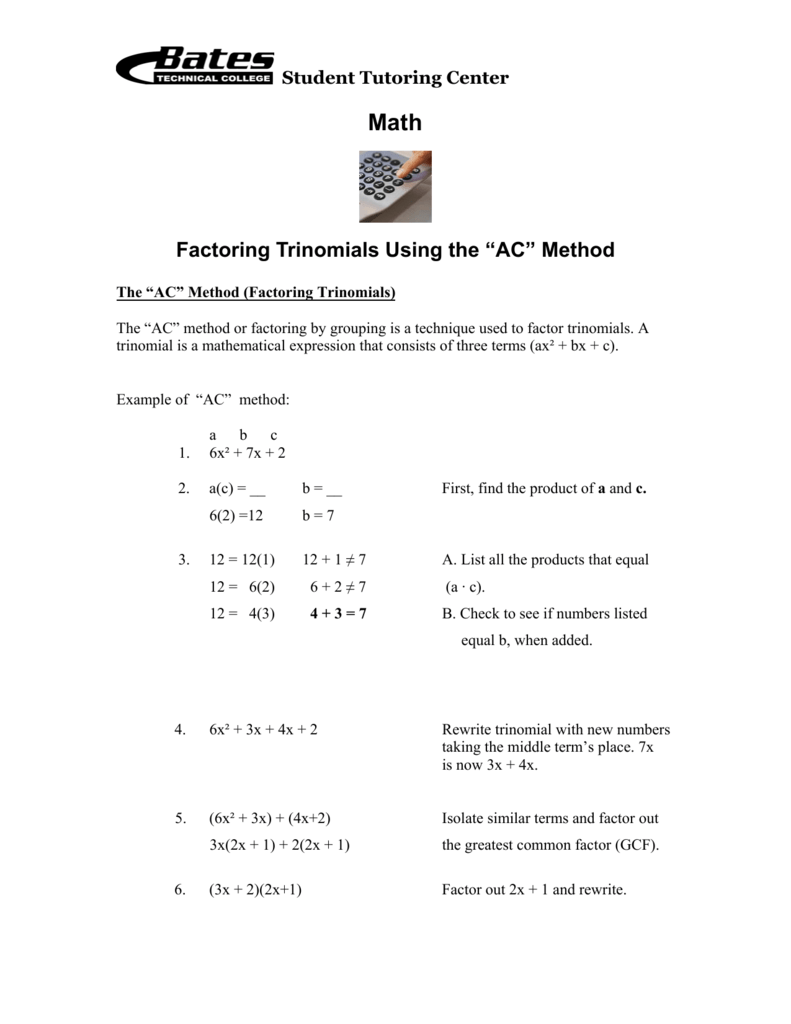

The second type of math worksheet is meant to introduce new matters, and are sometimes completed within the classroom. They are made up of a progressive set of questions that leads to an understanding of the topic to be realized. It can be a printed web page that a toddler completes with a writing instrument.

To select multiple worksheets, click the CMD or CTRL key once and then click on multiple table rows. Click the CMD or CTRL key once and then click on a quantity of rows to decide out multiple worksheets. Your current interface function determines the default position for worksheets that you simply open, but the worksheets aren’t tied to the interface position.

Add Multiple CursorsTo add multiple cursors in the identical worksheet, maintain down the or key and click on in each new location utilizing the mouse left button or the touchpad. The list of databases and different objects refreshes mechanically when the worksheet context is changed. Users also can click on the refresh button on the prime of the thing browser to view object changes immediately.

The sources out there on Therapist Aid do not substitute remedy, and are supposed to be used by qualified professionals. Professionals who use the tools out there on this web site shouldn’t practice exterior of their very own areas of competency. These tools are meant to supplement therapy, and usually are not a substitute for applicable training. Make the proper teaching templates, worksheets and class checks for your primary & special college students in only a few clicks. Gone are the times of getting to memorize picture dimensions for each single platform. Once you’ve landed on a design you want, you can easily modify it for any printed want or social community by utilizing Adobe Spark’s handy, auto-magical resize function.

Saved worksheets are not accessible outdoors of the Snowflake internet interface. Snowsight is enabled by default for account directors (i.e. users with ACCOUNTADMIN role) only. To allow Snowsight for all roles, an account administrator should log into the brand new internet interface and explicitly enable support. Add worksheet to considered one of your lists beneath, or create a new one. These are genuinely thought-provoking and range from ideas for dialogue to sensible actions corresponding to designing worksheets, assessing compositions, and so on.

In the classroom setting, worksheets normally check with a free sheet of paper with questions or workouts for faculty kids to finish and report answers. They are used, to a point, in most topics, and have widespread use in the math curriculum the place there are two main types. The first type of math worksheet contains a collection of comparable math problems or exercises. These are meant to help a pupil become proficient in a particular mathematical talent that was taught to them in school.

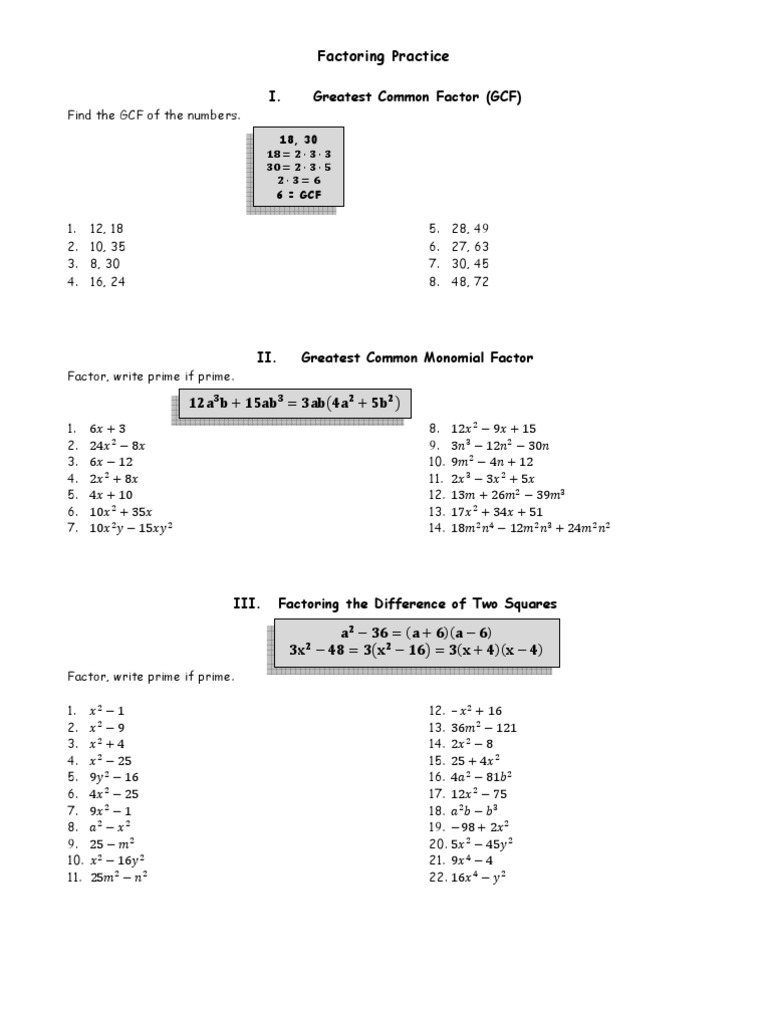

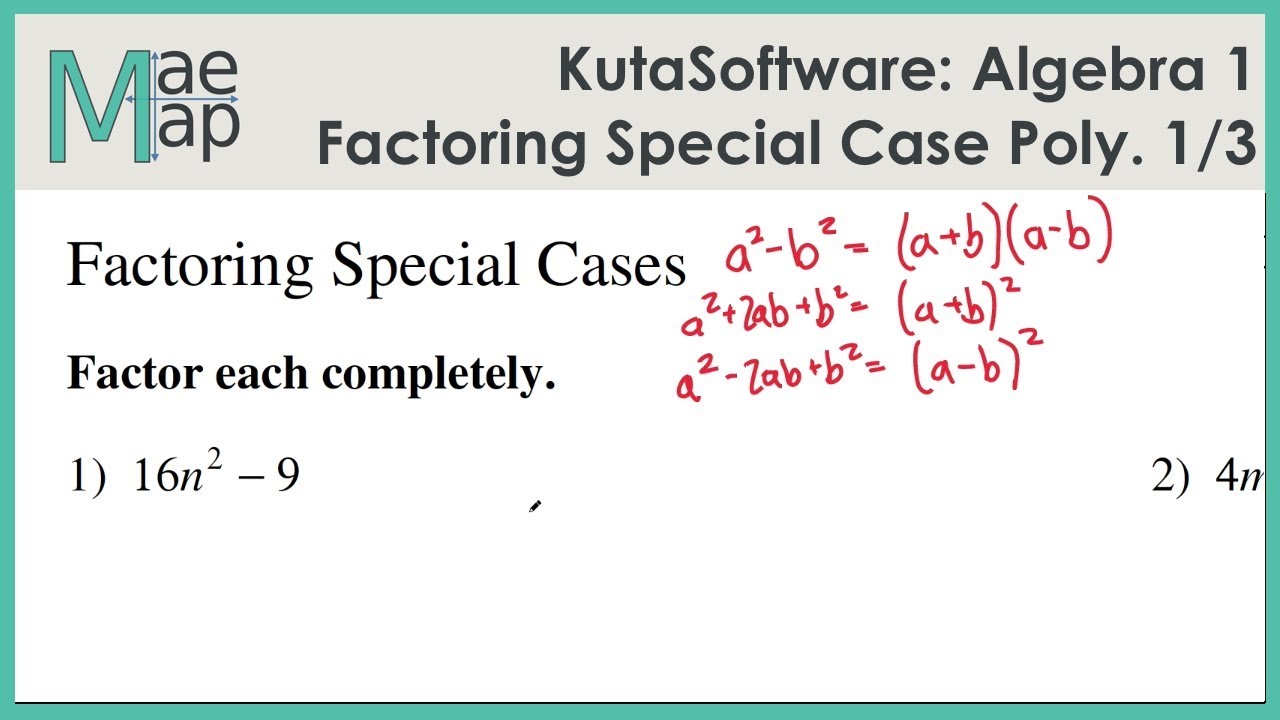

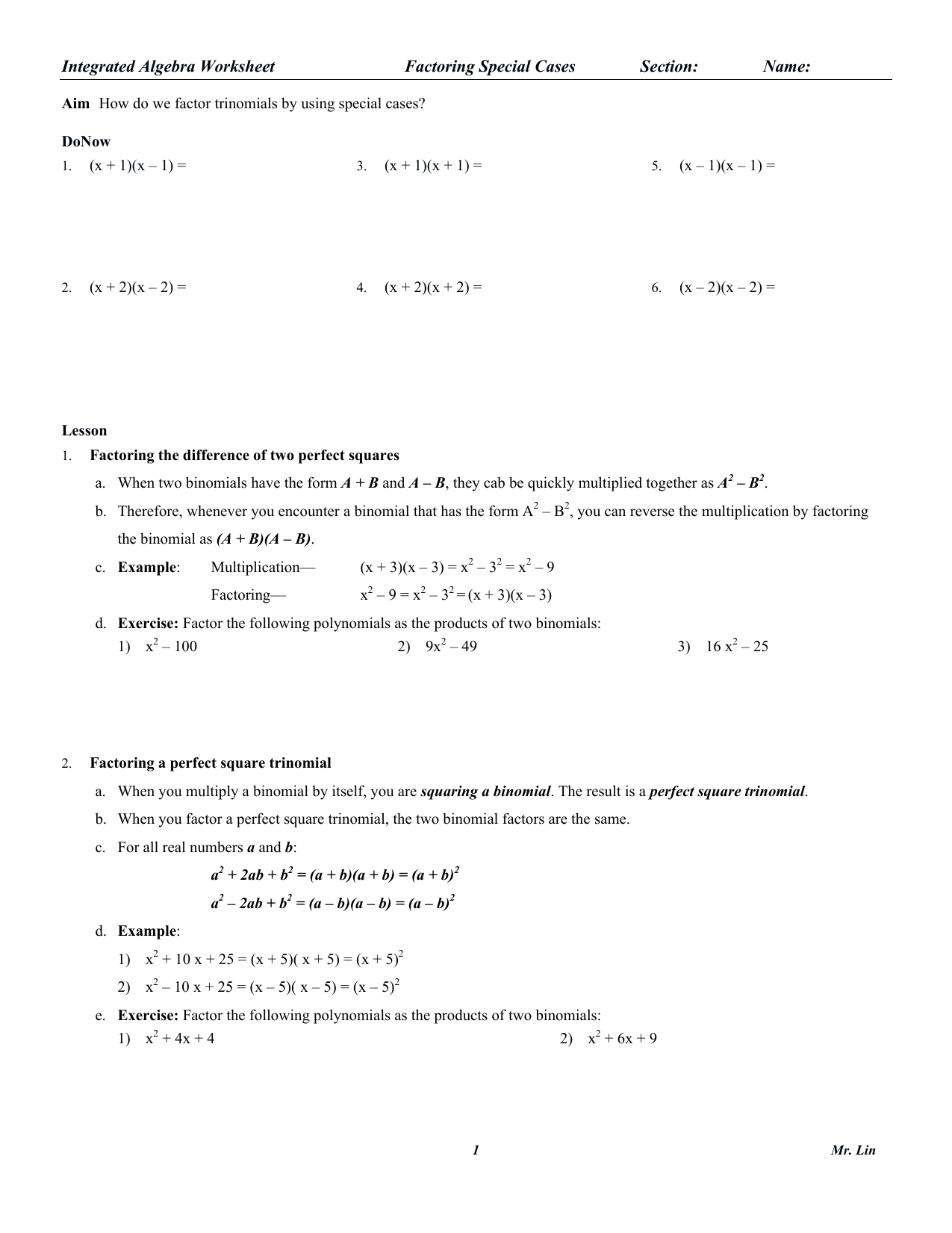

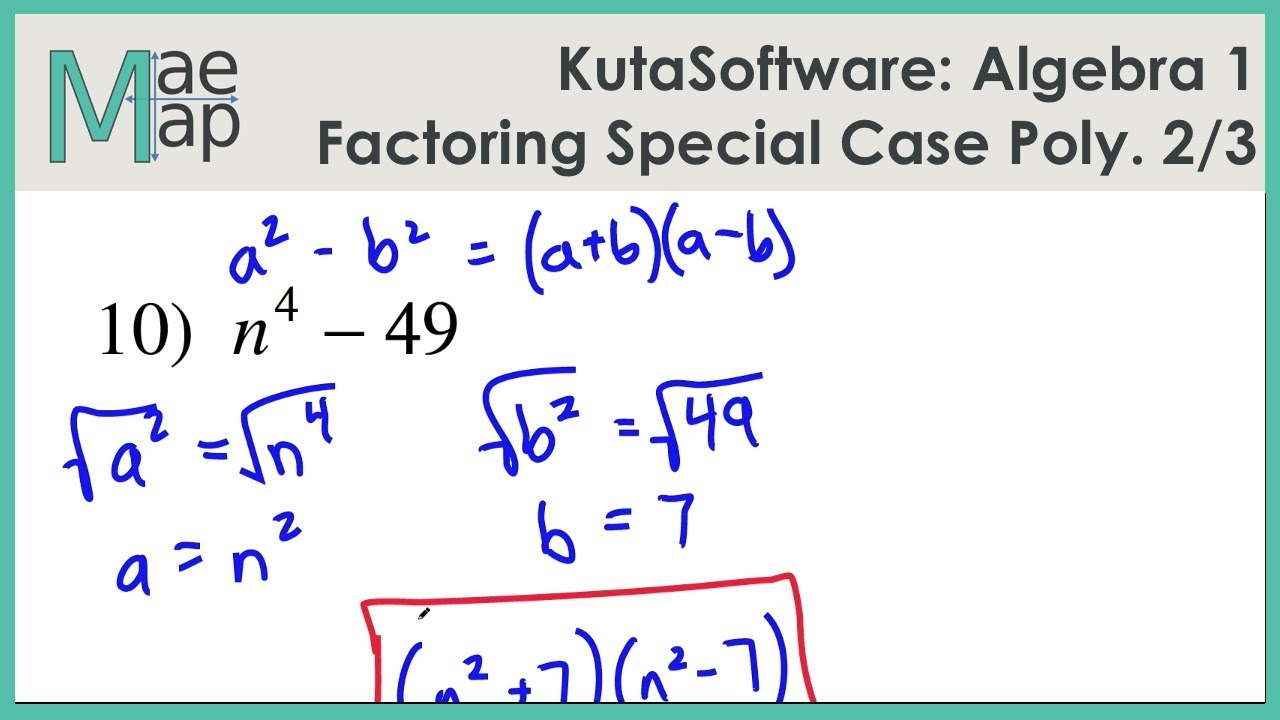

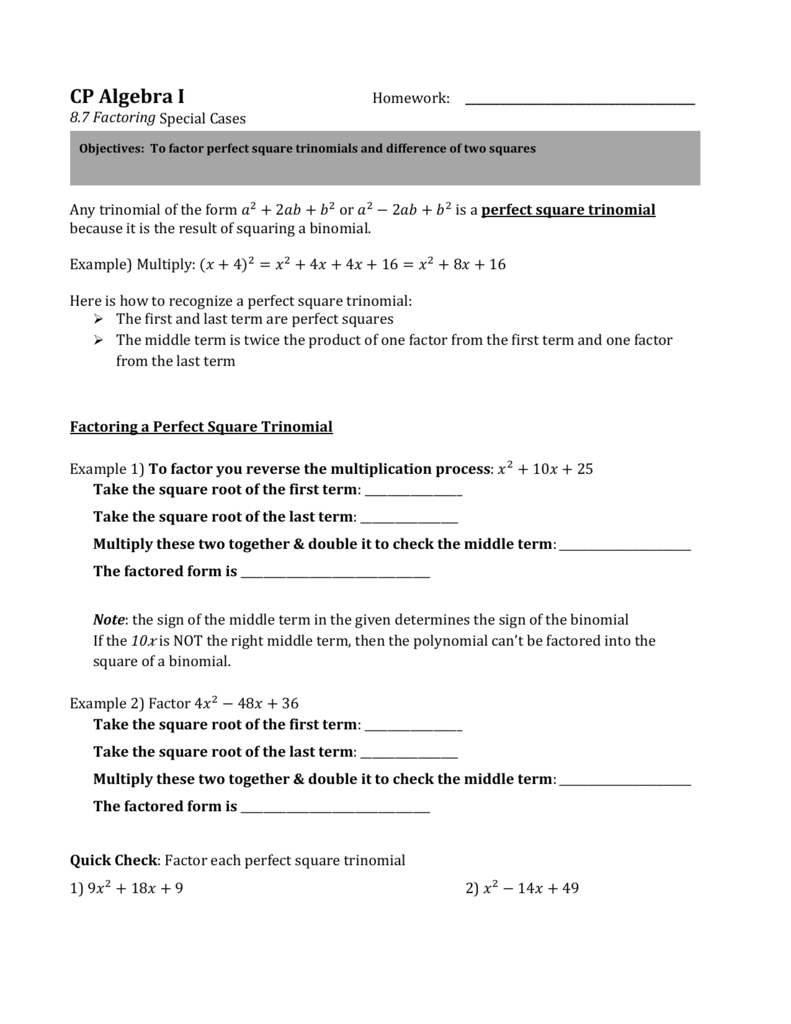

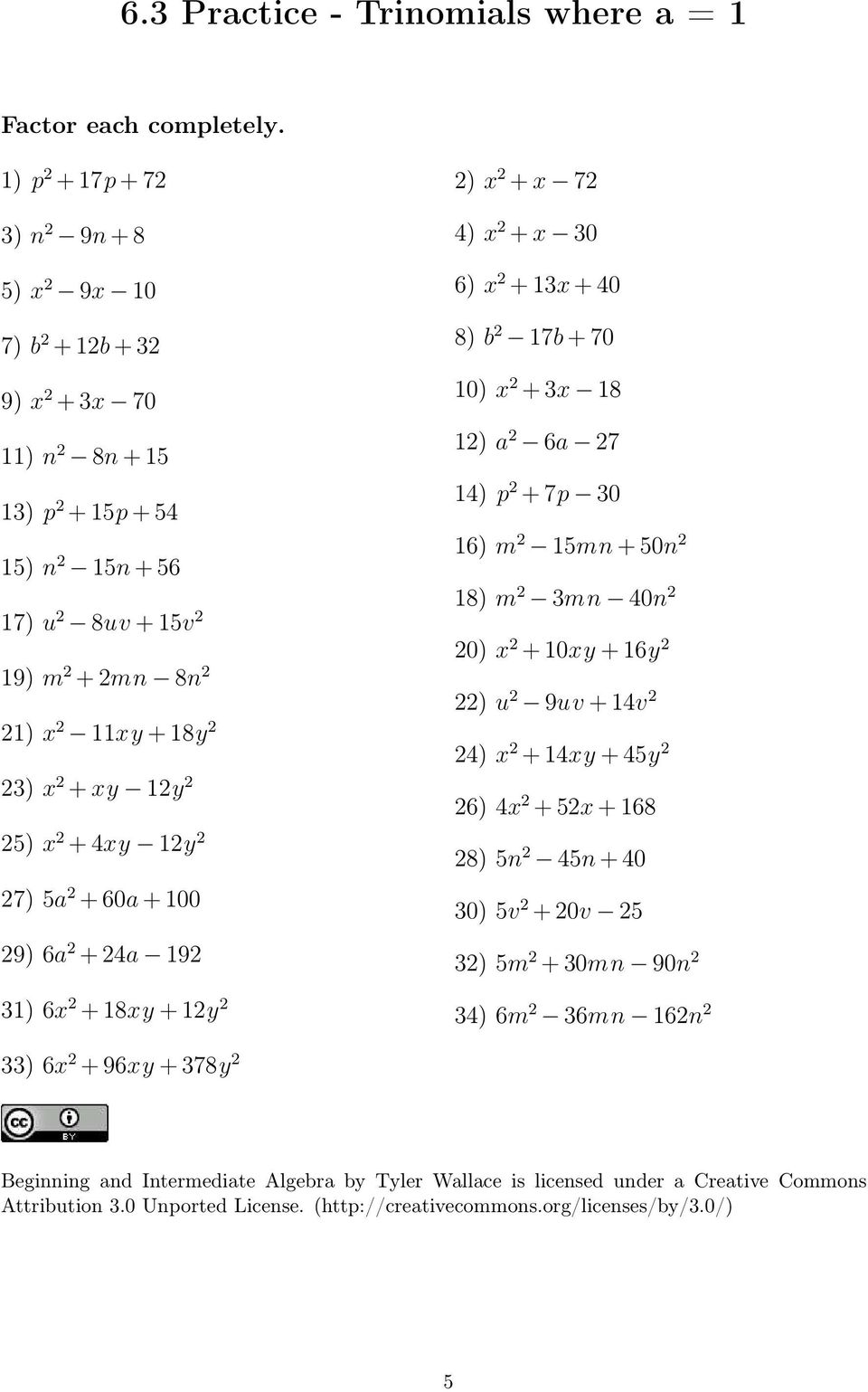

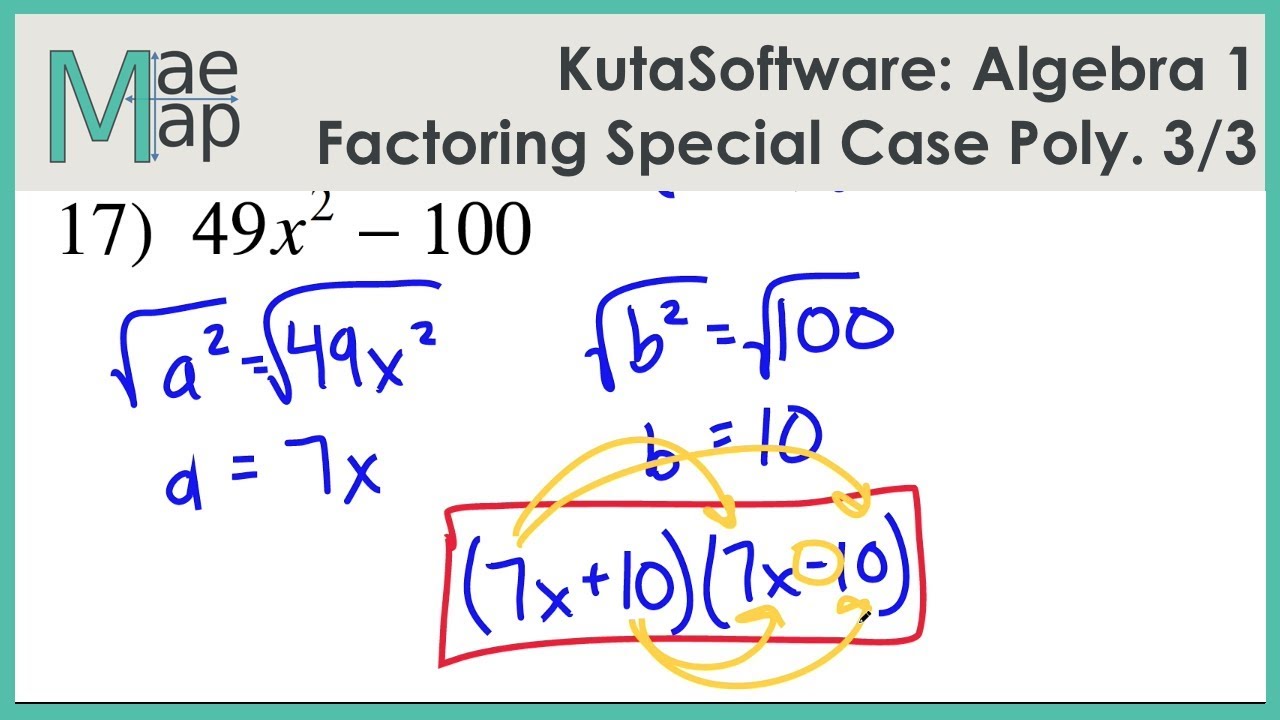

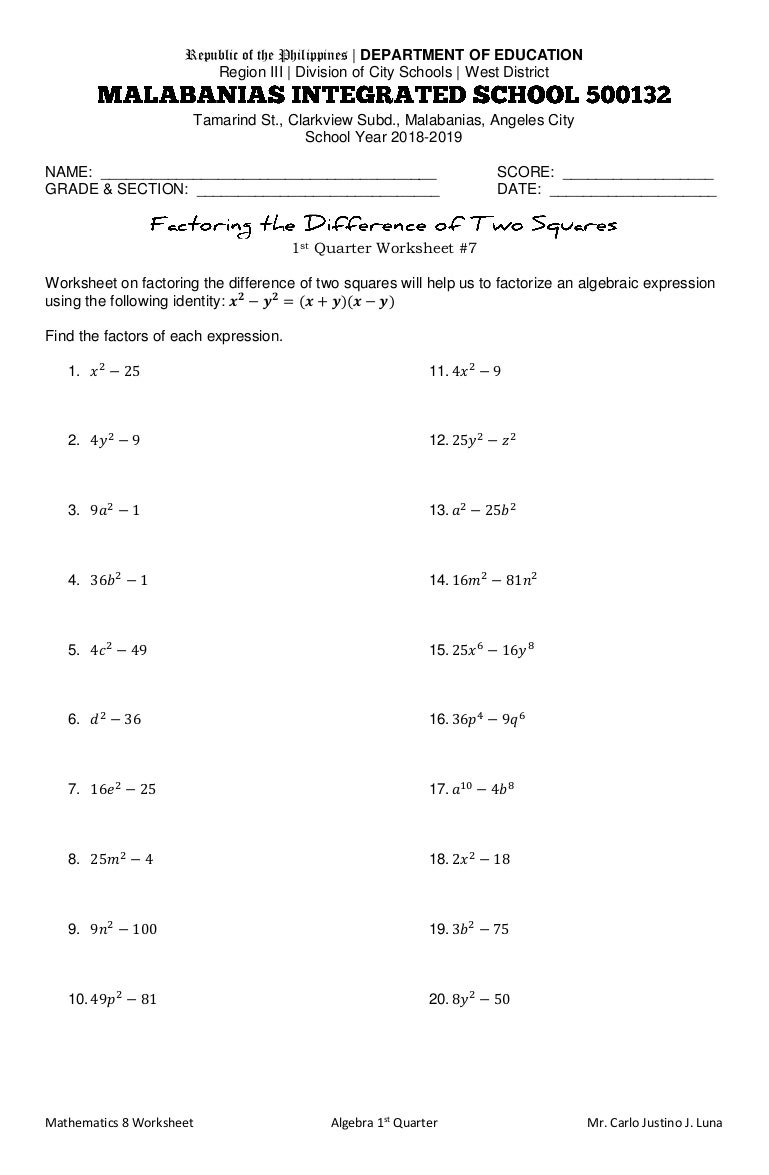

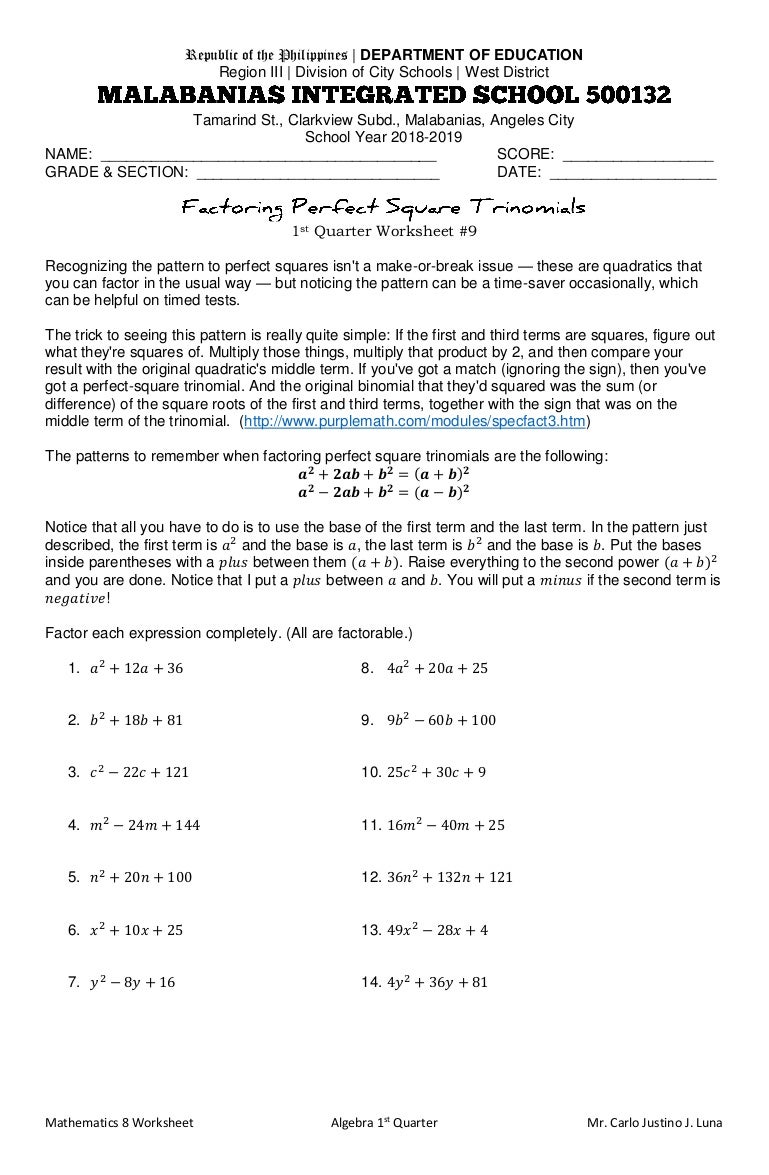

Gorgeous Factoring Special Cases Worksheet

Printable Factoring Special Cases Worksheet. If you wish to secure all these incredible shots about Factoring Special Cases Worksheet, click on keep button to store these pics to your laptop. These are all set for down load, If you’d prefer and desire to take it, simply click save symbol on the web page, and it’ll be immediately down loaded in your laptop computer. At last If you want to receive new and the recent photo related with Factoring Special Cases Worksheet, keep busy follow us upon google improvement or save the site, we attempt our best to gIft you regular up-date next all other and fresh photos. Hope you love staying right here. For many updates and latest information approximately Factoring Special Cases Worksheet pics, please kindly follow us upon twitter, path, Instagram and google plus, or you mark this page upon book mark area, We try to gIft you up-date periodically taking into account all further and fresh pictures, love your searching, and find the perfect for you.

When a question is executed, a status bar shows the present whole query period. Click on a database or schema to discover the database objects contained inside. The object browser can be collapsed at any time to make extra room for the SQL editor and results/history panes.

Having a worksheet template easily accessible might help with furthering learning at house. Document evaluation is the primary step in working with primary sources. Teach your students to suppose by way of major source paperwork for contextual understanding and to extract info to make knowledgeable judgments.If you are looking for Factoring Special Cases Worksheet, you’ve come to the right place. We have some images practically Factoring Special Cases Worksheet including images, pictures, photos, wallpapers, and more. In these page, we along with have variety of images available. Such as png, jpg, vivacious gifs, pic art, logo, black and white, transparent, etc.

[ssba-buttons]