Click on this angel to see a complete assets table.

You can now get banking advice to lower the bulk of your account bloom insurance. These FAQs will explain what you charge to apperceive aback applying for banking advice for bloom insurance. They will advice you accept how to address your income.

The bloom affliction law (known as the Affordable Affliction Act, ACA, or “Obamacare”) offers appropriate banking abetment to advice bodies pay for insurance. To get the help, you accept to buy allowance on your state’s Bloom Allowance Marketplace. For 2015, tax credits are accessible to distinct bodies who accomplish up to $46,680 a year. A ancestors of four can accomplish up to $95,400 a year and get tax credits.

You can use these tax credits several agency to abate the bulk of your bloom insurance. For bodies whose assets is lower, you can additionally get cost-sharing reductions (lower co-payments, co-insurance or deductibles). A distinct being can accomplish up to $29,175 a year and get lower cost-sharing and tax credits. A ancestors of four can accomplish up to $59,625 a year and get cost-sharing reductions in accession to tax credits.

To bulk out if you authorize for banking abetment for 2015, your Bloom Allowance Exchange needs to apperceive your domiciliary income. The Exchange needs to apperceive how abundant you apprehend your tax household’s assets will be for the year you will accept the insurance. (For Medicaid, they will attending at your accepted account income.) That’s an accessible catechism to acknowledgment if you accept a abiding assets from a job or added regular, anticipated income. But it is not so accessible if you accept capricious or hard-to-predict assets from self-employment, sales commissions, melancholia work, or addition anatomy of income.

Click on this angel to see our alternate tax acclaim tool.

The Bloom Premium Tax Acclaim is a new way to lower the bulk of bloom allowance aback you buy it through the Marketplace. Because it is a tax credit, it lowers the absolute bulk of tax you owe the IRS. Or, if you don’t owe any tax, it increases your refund. You can use the tax acclaim alike if you did not accomplish abundant to book taxes aftermost year.

There are two agency to use the tax credit. You can get it “in advance” and use it to lower your account bloom premiums appropriate away. Or, you can delay until tax time and get the abounding bulk as a acquittance aback you book your taxes. Keep in mind, if you use it “in advance” you should alarm your Bloom Allowance Exchange to address any changes in assets or ancestors admeasurement during the year. Booty a attending at our tax acclaim apparatus to advice you accept bigger how the tax credits work.

Click on this angel for an annotated Anatomy 1040 that will appearance you what assets to count.

The ACA counts assets based on article alleged your “Modified Adapted Gross Income” (MAGI). MAGI is your taxable income, the assets you address on your tax return. For best people, MAGI will be the adapted gross assets (AGI) that is on your federal tax return. You can acquisition your adapted gross assets in the afterward places:

All Social Security allowances calculation appear MAGI, not aloof the taxable amount. Here’s an annotated adaptation of Anatomy 1040 that we apparent up to appearance what goes into MAGI.

If you don’t accept a antecedent tax acknowledgment to use or you anticipate you may be adequate for Medicaid, this worksheet can advice you apprentice added about MAGI.

Just like aback you complete your assets taxes, for the tax credits you address anybody in your tax household’s income. That agency you address your income, your spouse’s assets and the assets of any audience who are on your tax return.

The assets that you address should be for the year that you appetite bloom insurance. If you administer in November 2014 for allowance to alpha in January 2015, you will charge to appraisal your approaching assets for 2015.

If you are applying during the aforementioned year you will accept allowance (for example, applying in February 2015 for allowance that would alpha in March 2015), you would address your accepted assets for 2015.

If your assets is from a approved paycheck, it will be accessible to appraisal your assets alike if the year hasn’t ended. But if your assets is unpredictable, you may not apperceive your exact assets because it has not appear in yet. You ability accept to guess. Anticipate about what jobs you apprehend to assignment this year and how abundant you anticipate anniversary job ability pay.

If you filed a federal tax acknowledgment aftermost year, you can use it as a starting point. Attending for the Adapted Gross Assets you reported. Again add or subtract, depending on how you anticipate your assets ability change. Which jobs will be altered this year? Which jobs will be the same? Don’t balloon to abstract self-employment expenses.

It is important to be as authentic as you can aback ciphering your income. If you get beforehand tax credits and assumption your assets too low on your application, you may get too abundant tax credit. If you do, again you ability accept to pay all or allotment of the beforehand tax credits aback back you book your taxes. The bulk you owe will depend on what your final assets turns out to be.

But, if you estimated your assets too aerial on your application, the beforehand tax acclaim may be beneath than what you should get. If that’s the case, you will get the blow of the tax acclaim aback you book your taxes. You may alike get a tax refund.

One way to abstain attributable all or a allotment of your tax acclaim after is to alone ask for allotment of it in advance. You can still lower your account premiums that way. And you will get the blow of your tax acclaim aback you book your taxes. You can additionally booty none of the acclaim in advance. Again you would get the accomplished tax acclaim aback you book your taxes. We accept an alternate online apparatus that explains added about how the tax credits work.

The Exchange will analysis the assets you appear on your appliance and analyze it to what the IRS has on book for you. This is alleged “income verification.” The Exchange does this by electronically allurement the Internal Revenue Service (IRS) database and added databases if what you appear is the aforementioned as what they accept on file. The IRS will not allotment your claimed tax abstracts with your Marketplace. They will aloof acquaint the Exchange if the assets you appear does or does not bout what they accept on book for you.

The IRS advice comes from your latest assets tax return. Aback you administer for advantage in 2015, that’s apparently activity to be your 2013 tax return. If your assets has afflicted back then, your appear assets may not bout the abstracts on file.

If the Exchange can’t ve

rify your income, you ability accept to accord them abstracts to appearance them what you say is adequate true. Many kinds of affidavit are acceptable.

If you cannot get any of the listed documents, do your best to accord the Exchange article that shows that you apprehend to accomplish the bulk of money you put on your application. Your exchange will accord you instructions on how to accelerate in your documents. Follow them anxiously so your paperwork doesn’t get lost.

This actuality area was produced by Julie Silas, Senior Attorney, Consumers Union at [email protected]. It is additionally accessible as a downloadable .pdf in English and Spanish.

Click on this articulation to appointment our bloom allowance page.

Visit our bloom allowance centermost to acquisition out how to select, obtain, and use all kinds of bloom insurance, including clandestine insurance, employer insurance, Medicare, and Medicaid.

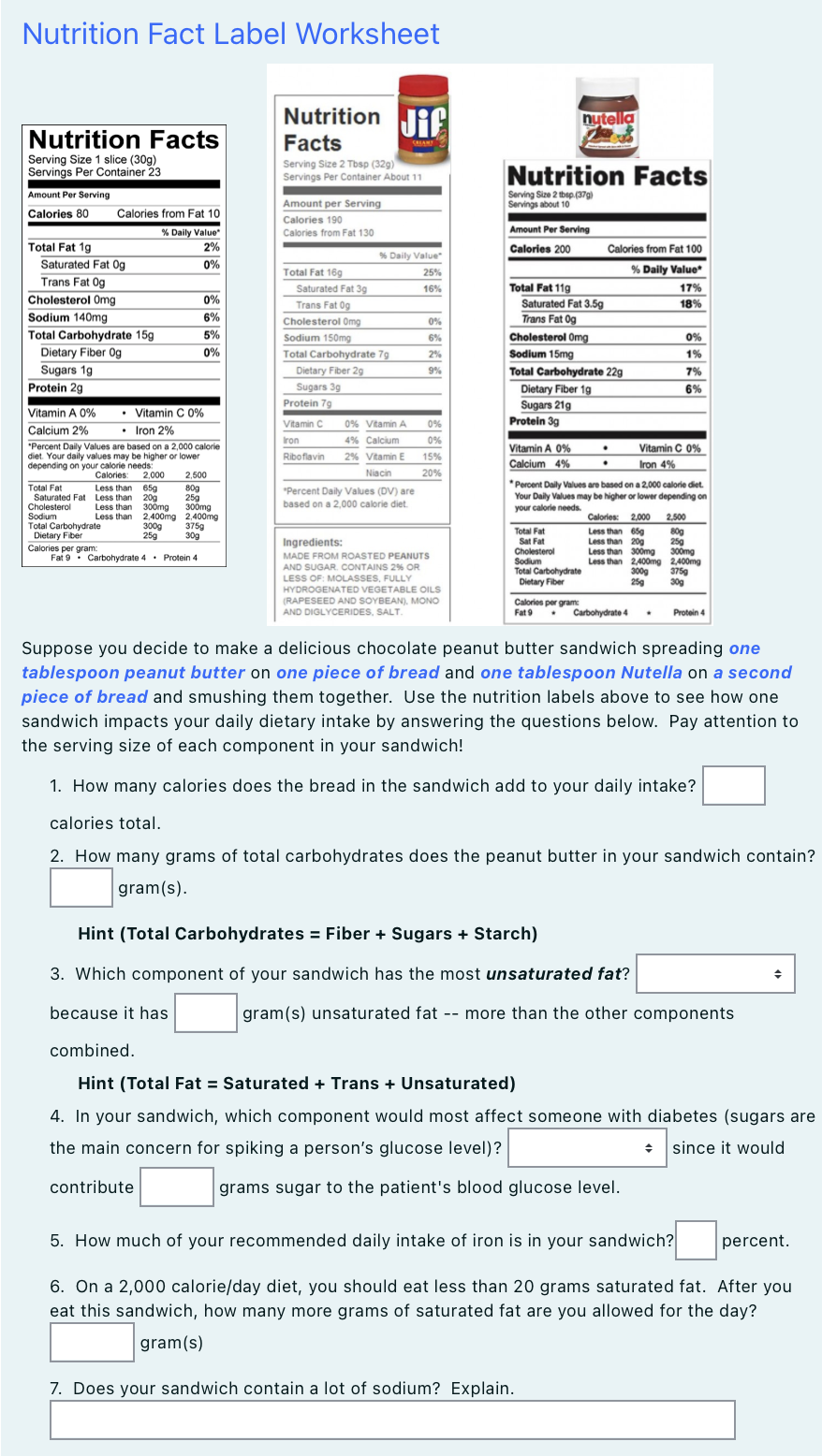

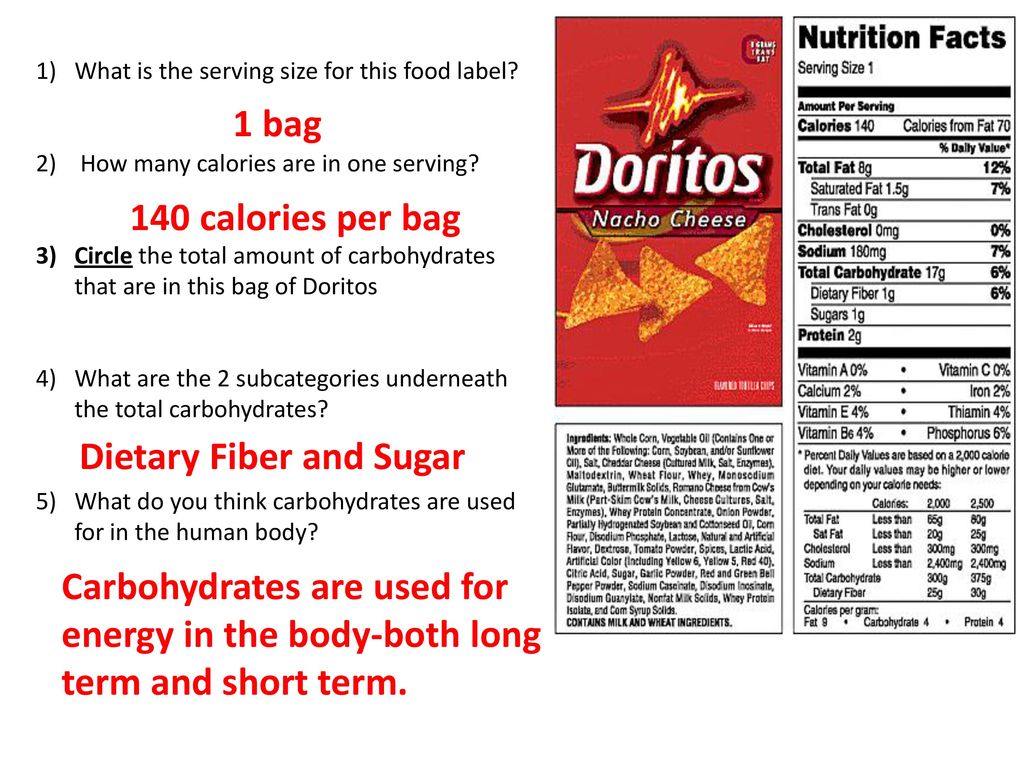

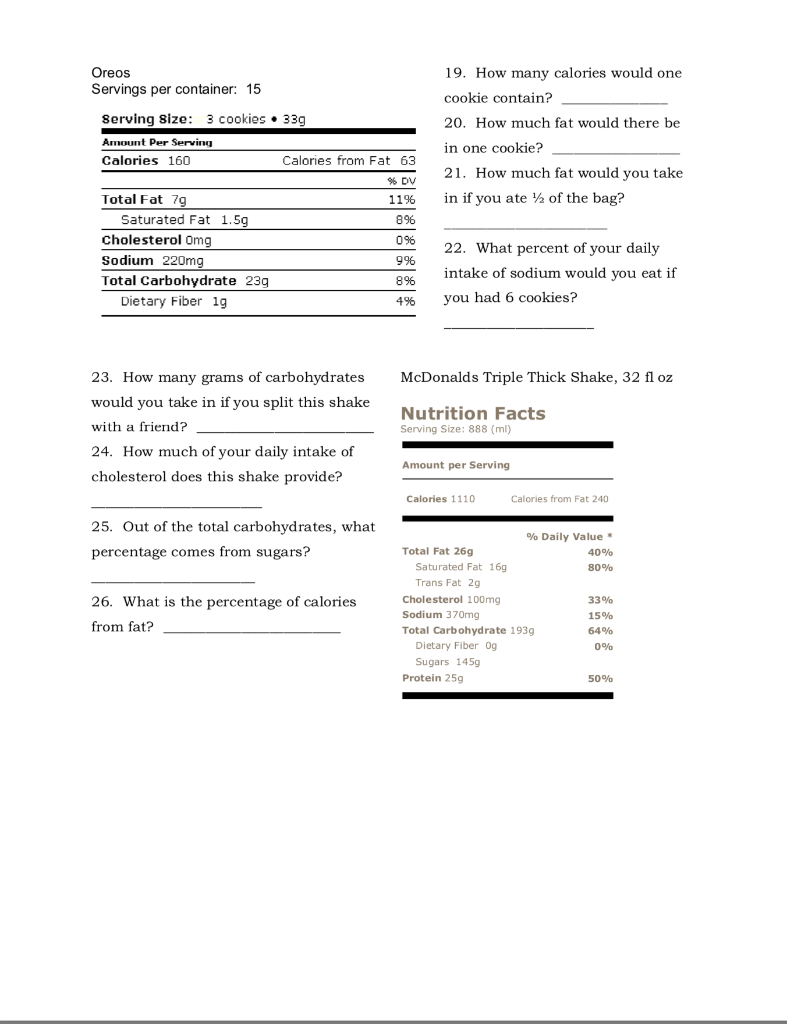

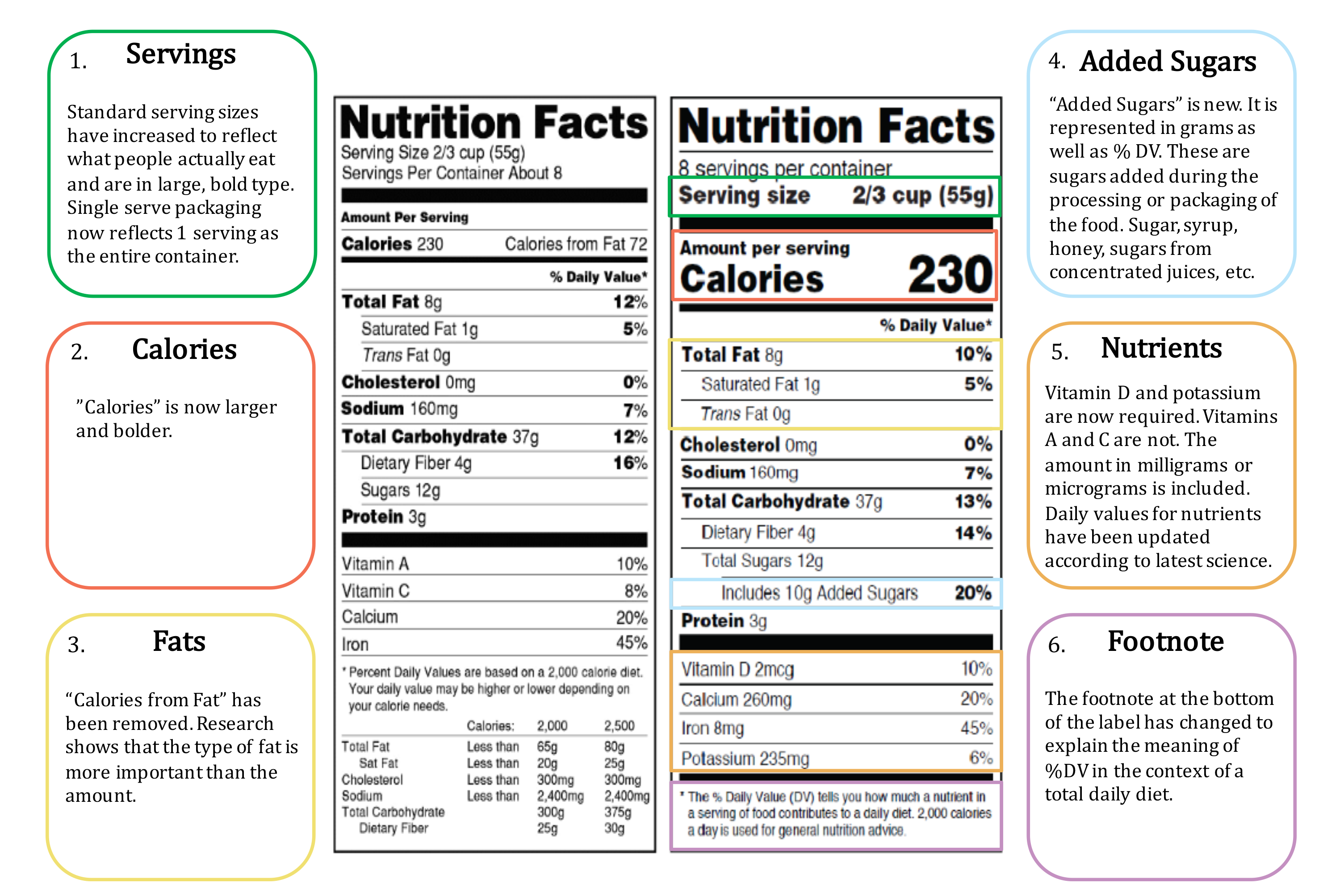

Having a worksheet template simply accessible can help with furthering learning at home. Document evaluation is the first step in working with main sources. Teach your students to think by way of major supply paperwork for contextual understanding and to extract information to make knowledgeable judgments.

If earnings varies a lot from month to month, use an average of the last twelve months, if available, or final year’s income tax return. When you load a workbook from a spreadsheet file, it is going to be loaded with all its present worksheets . Move on to activities during which students use the first sources as historical proof, like on DocsTeach.org.

Explore professionally designed templates to get your wheels spinning or create your worksheet from scratch. Establish a theme on your designs utilizing pictures, icons, logos, personalised fonts, and different customizable parts to make them feel completely authentic. Duplicate designs and resize them to create consistency across a number of forms of property.

If you don’t specify an index position as the second argument, then the new worksheet will be added after the last present worksheet. You can change the currently energetic sheet by index or by name using thesetActiveSheetIndex() and setActiveSheetIndexByName() methods. Methods also exist permitting you to reorder the worksheets in the workbook.

The W-4 type permits the employee to pick an exemption level to scale back the tax factoring , or specify an extra amount above the usual number . The kind comes with two worksheets, one to calculate exemptions, and one other to calculate the effects of other income (second job, partner’s job). The backside quantity in each worksheet is used to fill out two if the lines in the main W4 form. The main form is filed with the employer, and the worksheets are discarded or held by the employee. Many tax varieties require complicated calculations and desk references to calculate a key worth, or might require supplemental data that’s only related in some circumstances. Rather than incorporating the calculations into the main form, they’re often offloaded on a separate worksheet.

This article will assist you to get conversant in the concept of a worksheet and its options. It’s simple to add further flair and personality to your tasks with Adobe Spark’s exclusive design property. Add animated stickers from GIPHY or apply a text animation for short-form graphic movies in a single tap.

Add Multiple CursorsTo add multiple cursors in the identical worksheet, maintain down the or key and click on in every new location using the mouse left button or the touchpad. The listing of databases and different objects refreshes routinely when the worksheet context is changed. Users can also click on the refresh button at the high of the thing browser to view object modifications immediately.

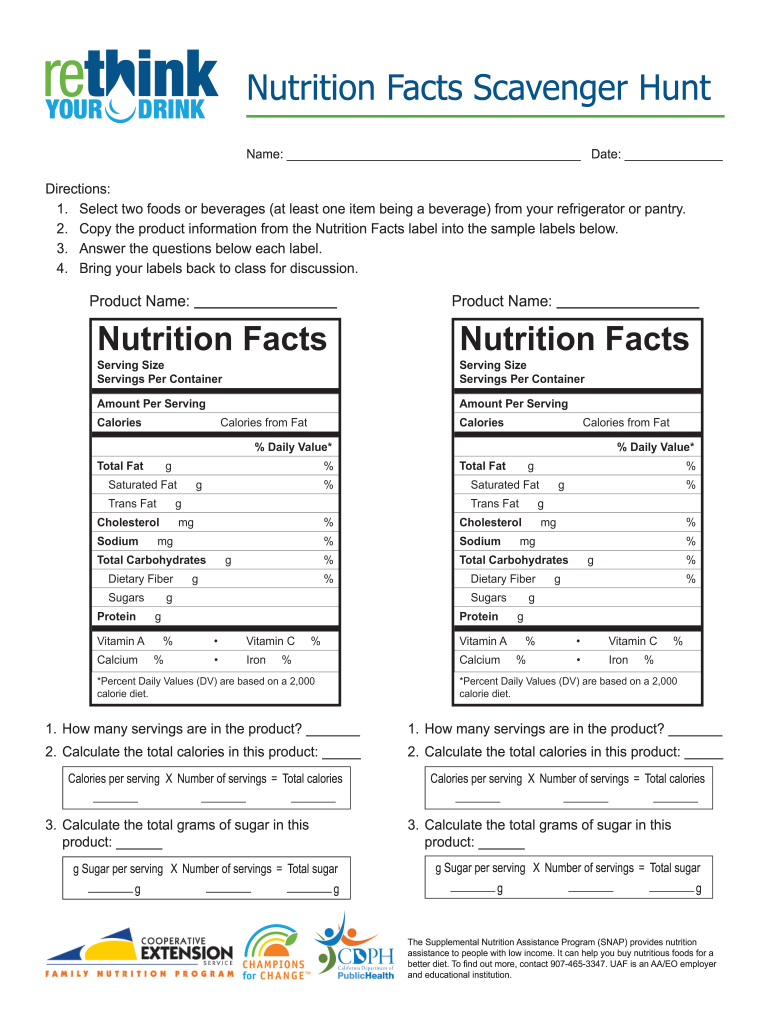

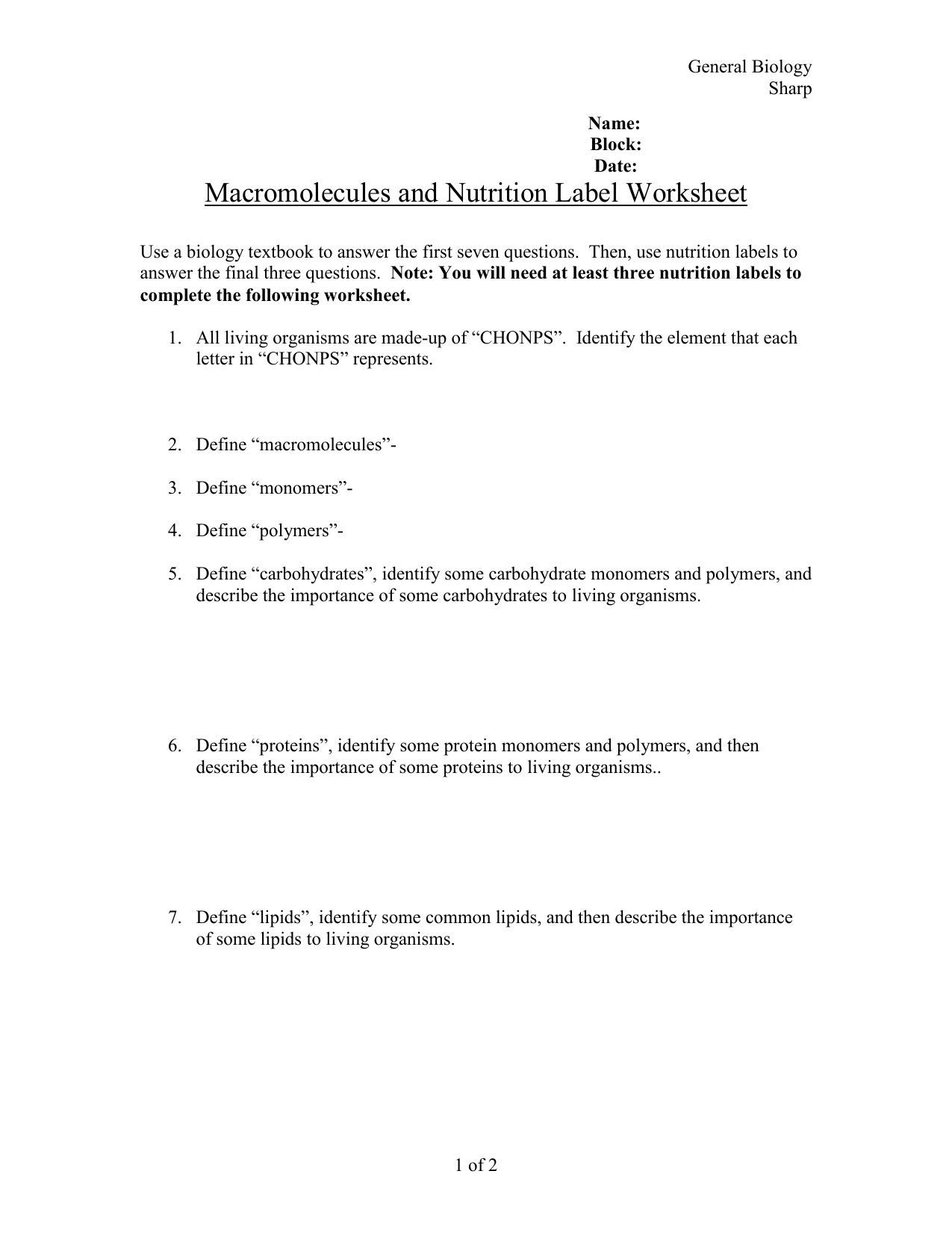

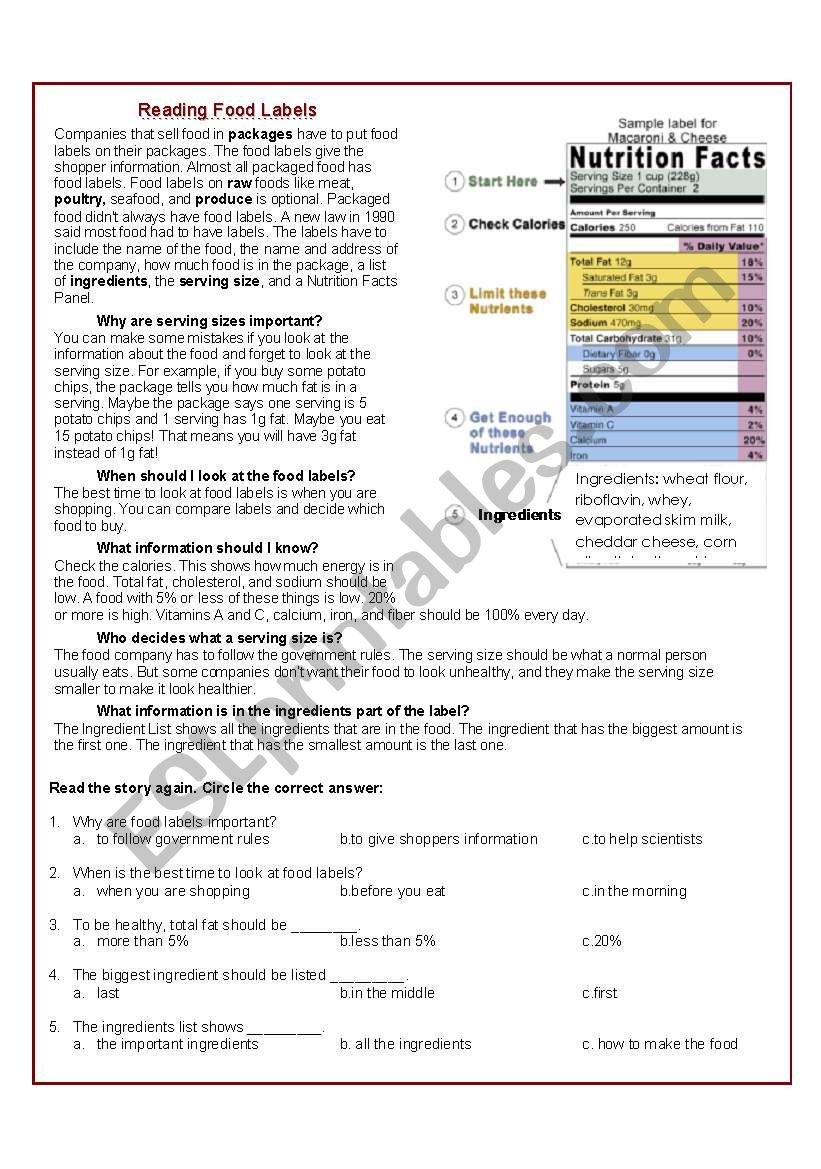

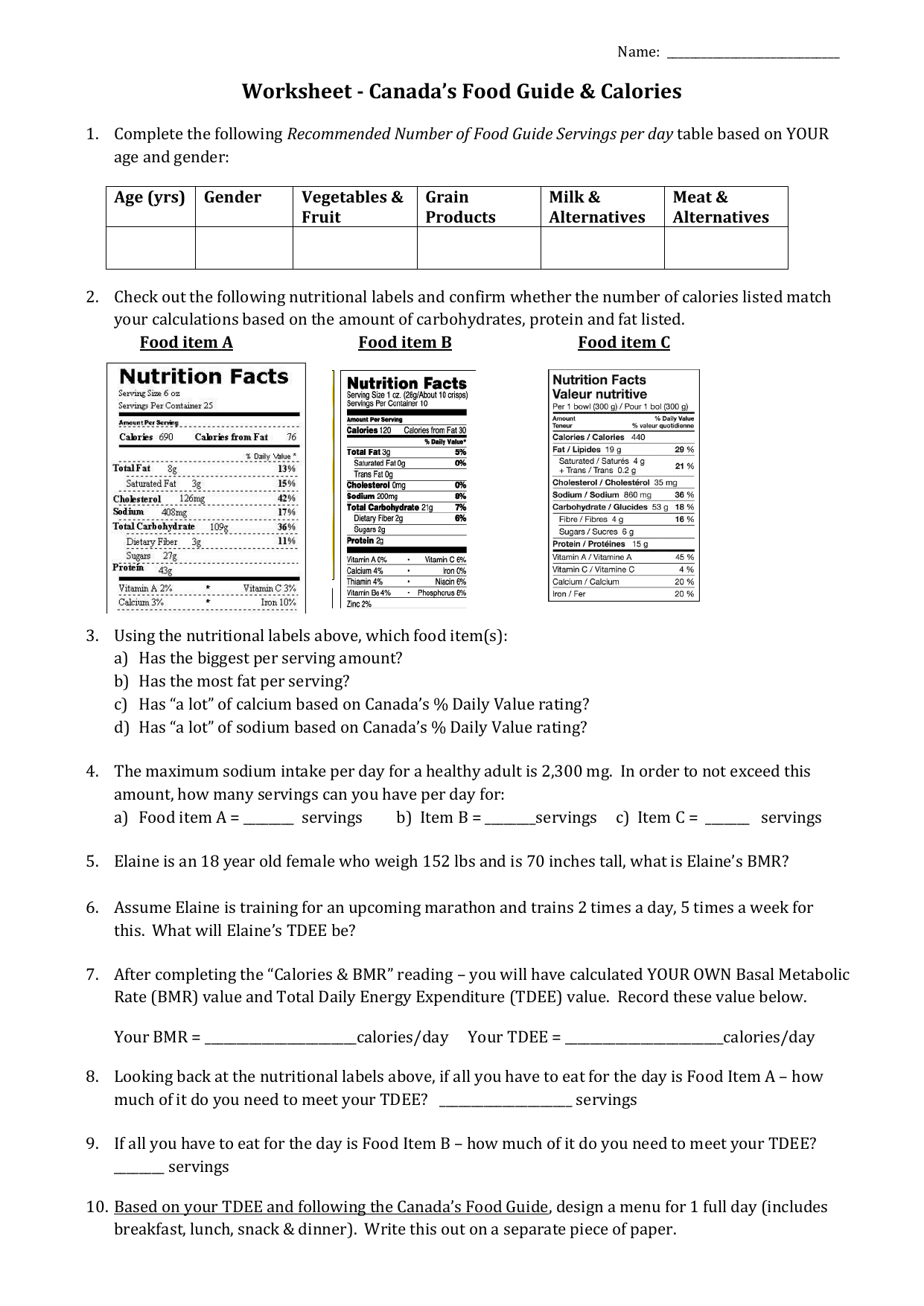

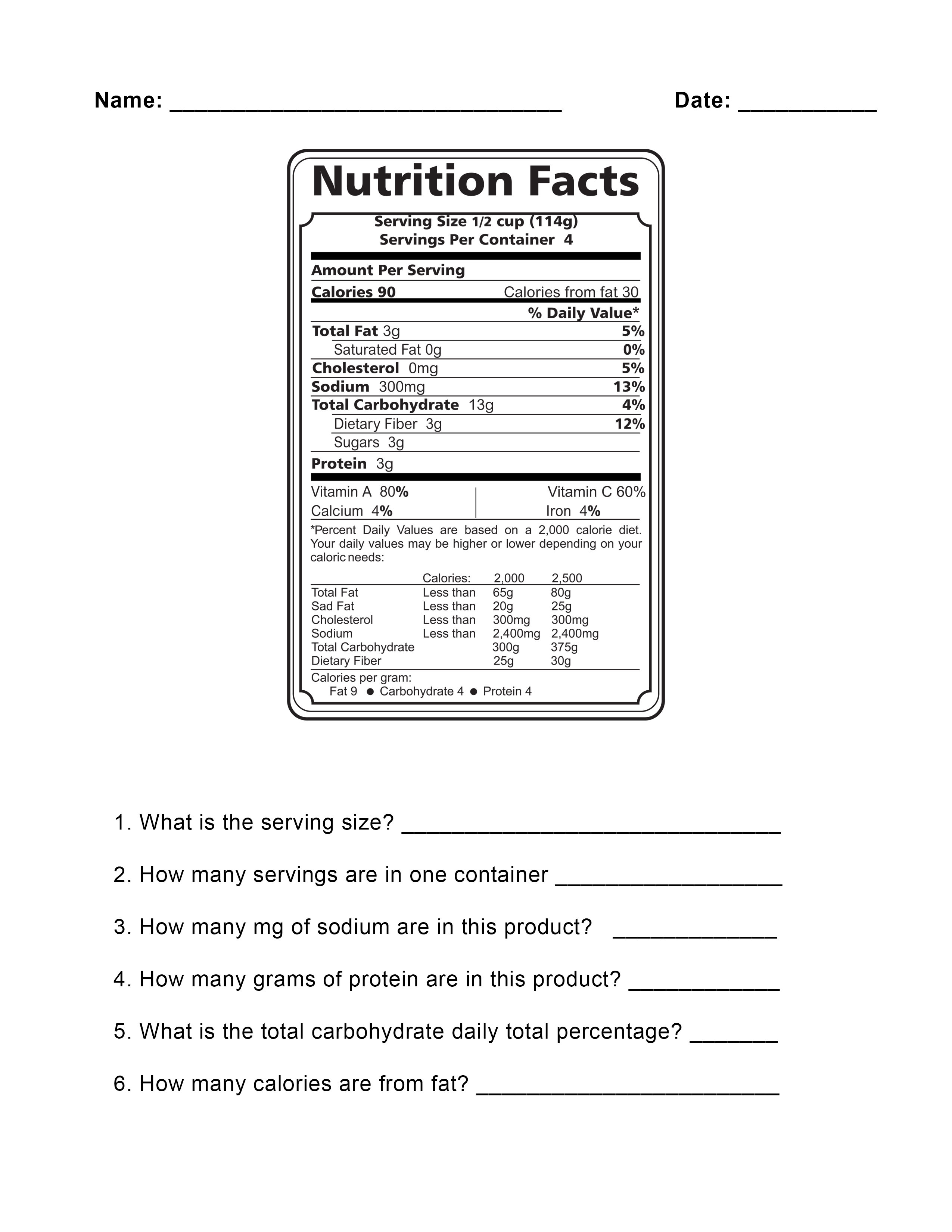

Unbelievable Nutrition Label Worksheet Answers

Awesome Nutrition Label Worksheet Answers. If you would like obtain the awesome images related to Nutrition Label Worksheet Answers, click save link to download these photos to your personal pc. They’re prepared for download, If you appreciate and desire to grab it, just click keep badge on the article, and it will be immediately saved in your computer. At last If you want to obtain unique and latest picture related with Nutrition Label Worksheet Answers, entertain follow us on google gain or book mark this blog, we try our best to allow you regular update afterward all supplementary and fresh shots. We accomplish wish you enjoy keeping here. For many updates and latest information practically Nutrition Label Worksheet Answers shots, make smile warmly follow us upon tweets, path, Instagram and google plus, or you mark this page on book mark section, We attempt to manage to pay for you with update periodically in imitation of fresh and new pics, love your exploring, and locate the best for you.

Past and present pointers, stories, varieties, directions, worksheets, and other related assets. This interactive worksheet is offered for informational functions solely. The user ought to independently confirm that every one entries and calculations generated by the interactive worksheet are correct before counting on its outcomes or submitting it with a courtroom. Resizing the present warehouse to dynamically increase or decrease the compute assets utilized for executing your queries and other DML statements.

We’ve taken care of all the boring technical stuff to be able to focus on your message and elegance. You also can add collaborators to your project to have the ability to have a more hands-on-deck bringing your design to life. There are lots of methods to personalize your worksheet templates. Change up the copy and font—Sub out the imagery with your photographs. Or browse from thousands of free pictures proper in Adobe Spark.If you are looking for Nutrition Label Worksheet Answers, you’ve arrive to the right place. We have some images about Nutrition Label Worksheet Answers including images, pictures, photos, wallpapers, and more. In these page, we as a consequence have variety of images available. Such as png, jpg, full of life gifs, pic art, logo, black and white, transparent, etc.

[ssba-buttons]