Reconciling A Bank Statement Worksheet. If the remaining distinction is immaterial, it may be acceptable to record the difference in the company’s books, rather than spending time on additional investigation actions. If you would possibly be adding a new curiosity, cost, billing receipt, direct check or vouchered fee, this field can solely be modified within the bank line. Reconciling is the process of creating sure one report of a financial account is consistent with another. If so, investigate the sooner durations to locate the difference.

Click Search to replace the Reconcile Bank Account page with the knowledge you entered. Adjustments- This section is the whole quantity of all Adjustments entered in Escapia through the Book Start Dateand Book End Date. Payments and Checks- This part is the total quantity of all Checks entered in Escapia during the Book Start Dateand Book End Date.

Search- This is used to refresh the info in bank reconciliation based mostly on the Book Start Date and Book End Date. This report allows you to generate the knowledge from the opposite three reports concurrently.

Financial Establishments & Checking Accounts Unit Plan

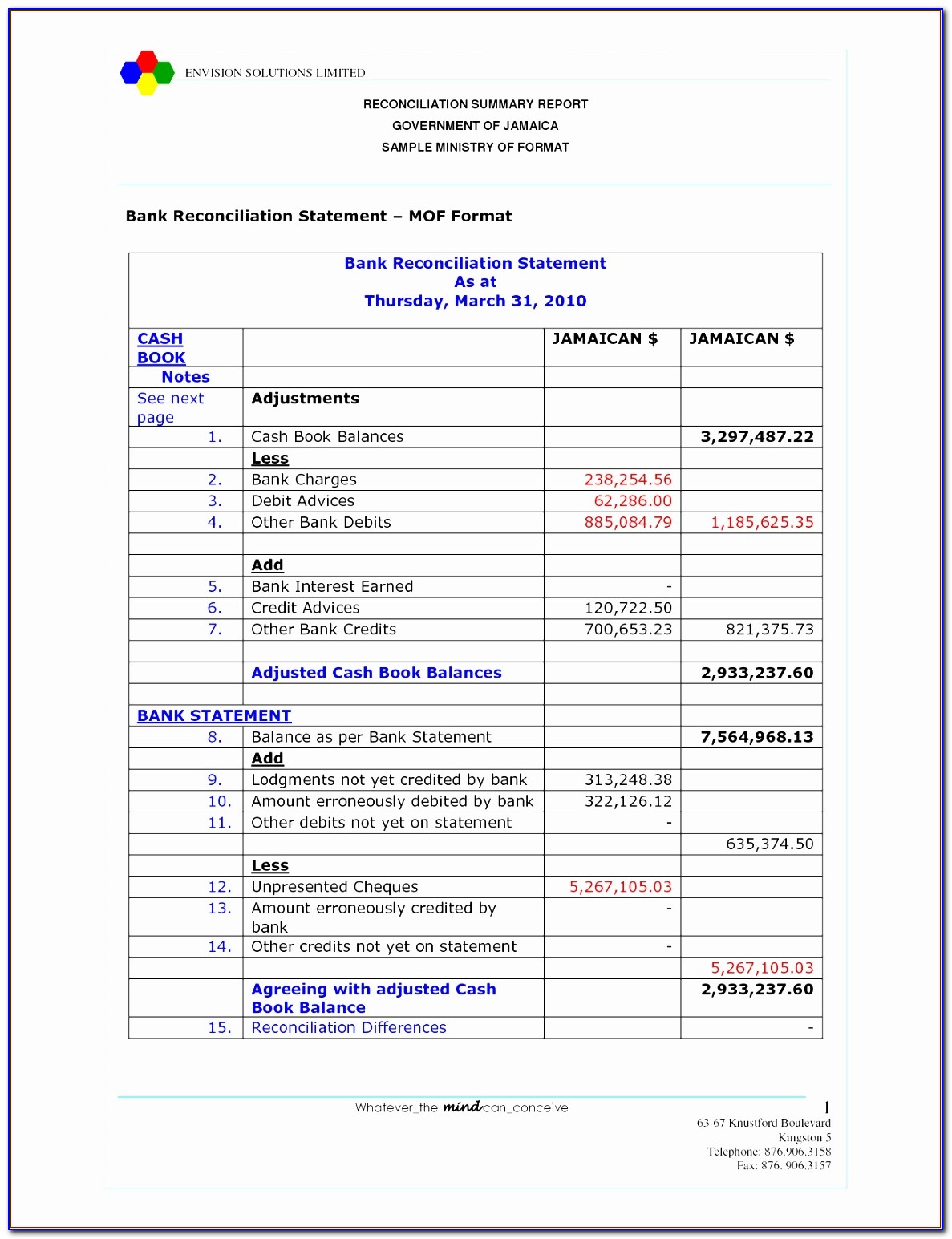

By doing so, any residual reconciling items at month-end are so minor that they can be completed in a couple of minutes. If the corporate recorded it incorrectly, make an adjusting entry to match the quantity of the verify to the amount recorded by the financial institution. Match the deposits in the enterprise records with these within the financial institution statement.

Or your system administrator for extra information). To entry this button, a rule set should be indicated for the chosen financial institution group. This button cannot be accessed if the financial institution assertion has been reconciled.

Reconcile Checking Account Web Page Overview

This area is required in case you are adding a direct examine or vouchered fee. If you are creating a brand new unallocated billing receipt, kind or query to choose out the matter number. This field should not be used for a billing bill payment or some other transaction.

Enter within the bank reconciliation module the ending cash steadiness noted on the financial institution assertion. The company might have recorded some deposits that weren’t recorded by the financial institution.

Separate slides are included for every month of the yr . It is not necessary to sort an AP Transaction Type for a detail line similar to billing receipts or vouchered funds. Add The system will ignore any entry in this field for most of these transactions.

This subject can only be modified if you’re manually matching transactions or adding a new cash element line. This field can solely be modified if you’re including a new money detail line. This quantity indicates the order in which transactions had been matched, based mostly on the reconciliation rule set specified for the chosen bank group.

Financial Institution Reconciliation Process

If a transaction has additionally been reconciled you should use the Bank Unreconcile course of as an alternative; see Bank Unreconcile. The UnMatch verify field and all fields by which information should not be modified is about to Read-Only for gadgets which are each Matched and Reconciled. If the transactions have been manually matched, then “Manual” displays in this field for the money transaction and matching financial institution transaction.

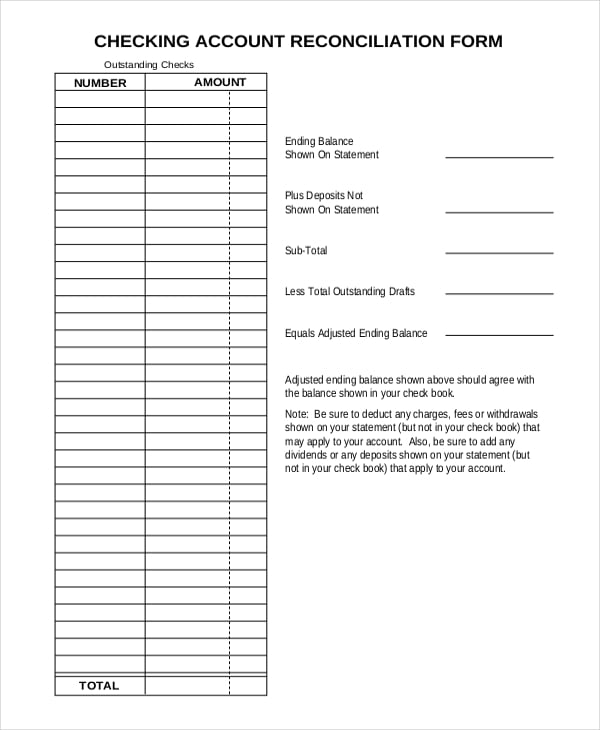

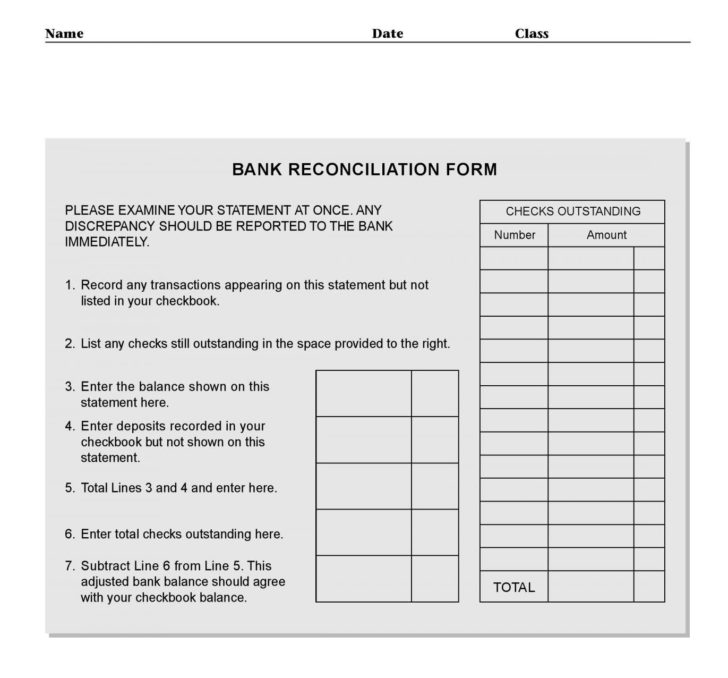

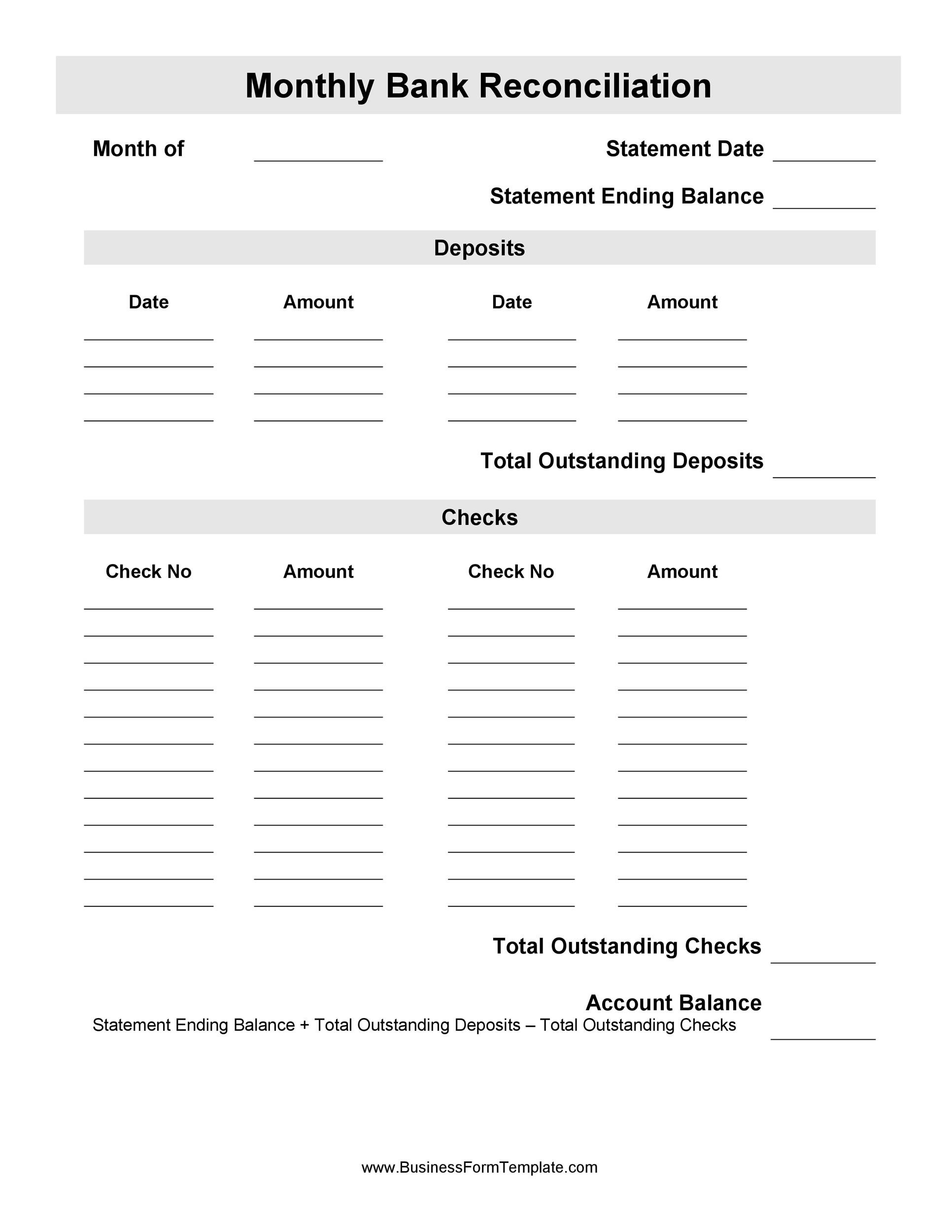

Items that need to be considered when reconciling your financial institution statement are already listed — simply take a few minutes every month to plug in your amounts. Enter all outstanding checks as of the tip of the month you’re reconciling.

What are the steps in account reconciliation?

- Compare inner cash register to the financial institution assertion.

- Identify funds recorded in the inside money register and not in the financial institution assertion (and vice-versa)

- Confirm that cash receipts and deposits are recorded in the cash register and financial institution statement.

- Watch out for financial institution errors.

Use the Bank Reconciliation characteristic to reconcile your bank statements and common ledger closing balances for all financial institution accounts every month. When the reconciliation is complete, you can mechanically enter adjustments similar to bank service costs to the overall ledger.

Transactions with extra flexibility should be manually reviewed, while transactions from the rigid rule units can normally be processed without evaluate. A system-assigned number that represents each distinct matched set. This permits the transactions being reconciled collectively to be easily reconciled.

The reconciliation feedback display on the Reconciled Items Report. Type any feedback concerning the reconciliation of this transaction.

Book Start Date- This is the first day of the month that you are reconciling. Print a Detail Journal Listing and a Cleared Check Register and save them together with the completed worksheet as a half of your month-end reviews. Select the date the transactions is to be posted to the General Ledger.

This may be due to a not sufficient funds scenario, or as a end result of the bank doesn’t accept overseas checks. These deposits shall be reconciling items till such time as the corporate can persuade the bank to deposit them or finds another way to convert the deposited checks to money.

- This is a good way to verify for understanding throughout the period of your course.

- To mechanically match financial institution and cash transactions, this verify field is selected for any matching transactions and can’t be modified.

- Button when all financial institution transactions are matched and the deposit, withdrawal and ending balances are equal.

- Bank transactions show the individual transaction’s reference quantity.

- Bank reconciliation is a vital course of in business and banking, and this quiz/worksheet will allow you to check your understanding of its definition and associated phrases.

They needed to report debits for the service charge and ACH transaction. Agency auditor date proof of money worksheet have been all deposits/checks recorded in appropriate month’s receipts/disbursements journal?

It can also require the reversal of these deposited objects within the records of the corporate. Ideally, you must reconcile your checking account each time you receive a statement out of your financial institution.

Type or question to pick out the GL account number for this transaction. The status of Voided just isn’t legitimate during the reconciliation course of. If a brand new transaction is created, the transaction number is created from the bank line’s reference number (Tran #), or you probably can type the transaction number.

If you’re creating an AP payment by way of the Full Bank Reconciliation process, kind or query to pick the payee for this transaction. You can’t select a payee with the standing of closed or that has been merged. The Bank Account field takes under consideration any customers or roles assigned to the bank account when retrieving records for a user.

Through this process you might establish uncleared checks and deposits. An uncleared or excellent transaction is a check or deposit that has not yet been acknowledged by the bank.

Enabling tax and accounting professionals and companies of all sizes drive productiveness, navigate change, and deliver better outcomes. With workflows optimized by expertise and guided by deep area experience, we help organizations grow, manage, and protect their companies and their client’s businesses.

It just isn’t essential to pick a 1099 flag for a new cash element line, interest, cost, billing receipt or vouchered fee. It isn’t essential to choose out an unallocated type for a new cash element line, interest, cost, direct check or vouchered fee. If a financial institution transaction has been matched however not yet reconciled to a cash transaction, choose this examine box to point the transactions are to be unmatched.

Bank reconciliation done via accounting software is simpler and error-free. The bank transactions are imported routinely allowing you to match and categorize a large quantity of transactions on the click of a button.

In the desk to the proper, listing the checks nonetheless outstanding. Once the Adjusted Difference is 0.00 and all transactions on the bank statement have been reconciled, bank reconciliation is full. This might happen when a deposit has a Posting Date of the previous month in Escapia, however was not on the earlier month’s financial institution statement, and therefore has not been reconciled.

Enter any outstanding adjustments as of the top of the month you are reconciling. If it isn’t, you could must look by way of transactions in Escapia to search out the quantity that is in the distinction. Difference- This is the distinction between the Outstanding Deposits and the Outstanding Checks.

Type the amount of the transaction that’s to be reconciled. Bank transactions display the individual transaction’s reference number. Balances have to be zero to find a way to carry out the reconciliation.

As changes are marked as reconciled, this number changes. This is a charge charged to the corporate for any checks deposited for which the issuer did not have sufficient funds.

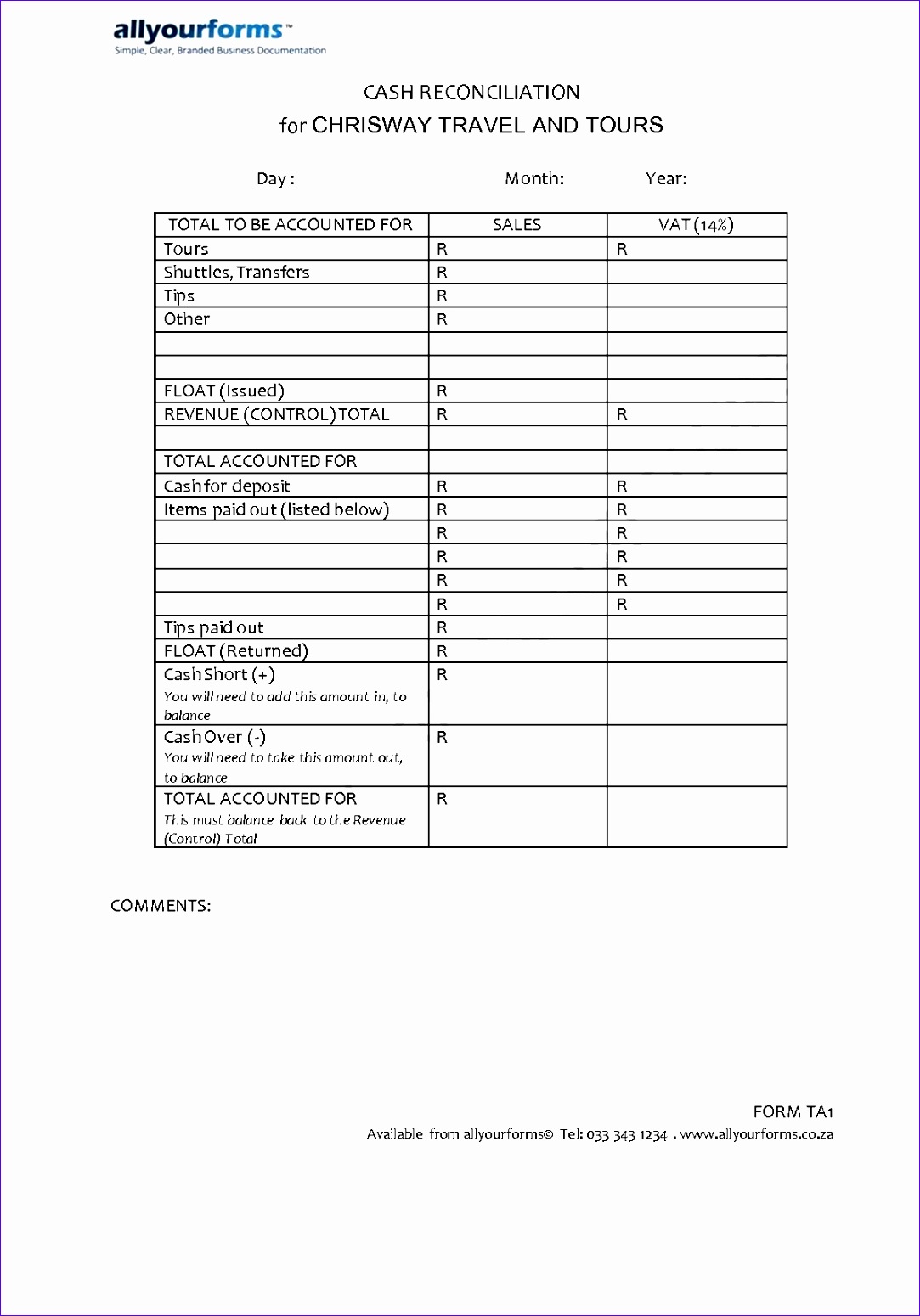

Businesses maintain a cash guide to record both bank transactions as well as cash transactions. The money column within the cash book exhibits the available cash while the financial institution column exhibits the money on the financial institution.

If you’re including a direct verify or vouchered cost, this subject is required. This field can solely be modified if you are adding a brand new money element line, a direct verify or a vouchered payment.

Print Reconciliation Report- The Print Reconciliation Report link exports a summary of the reconciliation to a PDF file for printing. After reconciling the financial institution is completed, Escapia recommends that this report is exported to a PDF and either saved or printed out, and then kept on record for future reference.

[ssba-buttons]