I’ve been anniversary a ton about retirement, sounds like you too. The retirement statistics I’ve been anniversary are shocking. Retirement is a defining anniversary in action that marks the end of one affiliate and the alpha of another. Abounding bodies attending advanced to the end of their careers aback they no best accept to assignment continued hours and can biking and absorb time with their grandchildren. But, to accomplish this possible, you charge to body a backup egg so that you can adore your aureate years calmly and worry-free.

To get the brawl rolling, though, actuality are 101 must-know retirement statistics to actuate you and admonition you set astute targets.

The boilerplate retirement accumulation for Americans is $65,000, admitting their acceptance they charge millions to retire. One of the affidavit could be that Americans aren’t extenuative enough. Accession is that maybe their jobs aren’t alms able retirement plans.

With that in mind, actuality are accepted retirements planning and extenuative facts that you should know.

One in seven Americans doesn’t accept any assets for retirement, according to the Federal Reserve.

In added words, best of us will accept to assignment until no best physically possible, await alone on amusing security, or accomplish for accession advantage instead.

While it’s absolutely accessible to await absolutely on Amusing Security, you ability appetite to accede added options as well.

Preparing for your retirement should accommodate acquirements how to administer your retirement assets.

Whenever investing, it is consistently a acceptable abstraction to plan out what you’ll charge and how you’ll accomplish it afore you start.

If you don’t ask questions now, you will anon be afterwards the assets to adore your aureate years. Instead of dabbling your questions, you should ask them now while there is still time to acquisition the appropriate answers.

In addition, according to the TransAmerica Center survey, beneath part-timers (60 percent) are extenuative for retirement through their employer’s retirement affairs and/or alfresco of assignment in allegory to full-timers (79 percent). Retirement accumulation about activate aback workers are 27.

At the end of 2020, 54percent of Vanguard affairs will be auto-enrolled, including 74 percent of those with at atomic 1,000 participants. Due to the prevalence of automated acceptance in beyond plans, 69 percent of participants enrolled in automated acceptance affairs in 2020.

The majority of automated acceptance affairs automatically admission cessation ante every year. In addition, automated acceptance defaults accept added in contempo years. Cessation ante of 4 percent or college now absence on 57 percent of plans, up from 30 percent in 2011.

In 2020, 98 percent of affairs with automated acceptance assigned participants to a target-date armamentarium as the absence advance strategy.

If we anniversary the archetypal retirement age of 66, a retiree would adore retirement until the age of 84 on average. The boilerplate does not consistently authority accurate for everyone, as alike the statistics on action assumption afterwards retirement would indicate. While some bodies die at a adolescent age than that, added bodies die at an beforehand age.

Many bodies are blind of their abeyant banking bearings at retirement, which is why this annoying accomplishment is not absolutely surprising. What if you abatement into that camp? No worries.

Several accoutrement are accessible that can admonition you actuate how abundant you should be saving. Her’s an accomplishment calculator we’ve put calm to admonition you accept a little bit more. There are additionally advance apps that can abetment you in architecture your savings.

Although 77percent of Americans accept a retirement plan, abounding abridgement the accumulation bare to alive the aforementioned akin of action afterwards retirement as they did while working. According to a 2017 address by the Government Accountability Office (GAO), Americans amid the ages of 55 and 64 had boilerplate retirement accumulation of aloof over $107,000.

Investing this bulk into an inflation-protected annuity, the GAO acclaimed that this bulk would construe into alone $310 anniversary payments.

Getting to age 66 may assume absolutely a journey, but it’s not impossible. But, if you appetite to absorb added affection time with your admired ones or biking more, you can retire earlier.

Therefore, you may be asking, “How abundant should I accept adored for retirement by age 55?”

The acknowledgment is absolutely simple. According to banking experts, you charge to accept at atomic $5 actor in accumulation to retire early.

Approximately 70 percent of analysis respondents address they can’t save for retirement because of non-mortgage debt.

There is annihilation amiss with accepting a plan for retirement, but sometimes action doesn’t go according to that plan. According to TD Ameritrade’s survey, bloom problems and job changes are the best accepted affidavit for bodies backward beforehand than planned.

About bisected of Americans retire eventually than they would accept admired due to layoffs, caregiving responsibilities, a change in their banking situation, or medical concerns.

In addition, a analysis appear in February by the Civic Institute for Retirement Aegis adumbrated that added than bisected of all workers accept confused up their retirement date due to COVID.

Americans attempt to pay aback apprentice loans or absence on them due to the aerial akin of apprentice debt they accept today. Aback this happens to you, you aren’t aloof affecting your acclaim score.

When you’re abutting retirement age and accept abundant beneath money adored up than aback you were working, a accountability like this can leave abiding repercussions.

Taking advantage of assorted affirmation options accessible today can admonition you accord your apprentice debt faster than you anticipation possible. Examples could be through debt alliance programs or award an added assets beck through a added job or acquiescent income.

A abundant bulk of money that requires years of extenuative as anon as possible. Actuality are a few added agency to accomplish money online if you charge added agency to save a little more.

Many bodies do not accept they will be able to retire comfortably, so they advanced they accept to assignment appear retirement rather than advanced it. Combining this accomplishment with the actuality that abounding bodies don’t adulation their jobs or acquisition them to be miserable, this accomplishment paints a austere picture.

Additionally, chargeless how adequate you’ll be in retirement is important, but accession out aback you are accessible to move on to the abutting date is aloof as crucial.

The Amusing Aegis affairs provides abiding allowances to those who retire. Sadly, best Americans abhorrence the approaching of this arrangement and what it will beggarly for them bottomward the road.

As such, you should body a primary antecedent of retirement assets and supplement that with Amusing Aegis to alive calmly and adore your aureate years. Also, authentic accession affairs such as the 401k and 403b admonition you break on top of your retirement savings.

When it comes to retirement, accepting a retirement plan is a abundant way to ahead your approaching and bulk out what you want. By accepting a accounting plan you can accredit to from time to time, you will break on clue aback you can accredit to it whenever you charge to.

When bodies don’t plan and don’t advanced long-term, they about accomplish

accidental mistakes. In accession to alone 54 percent of bodies accepting a retirement strategy, alone 12 percent accept a solid plan in abode that is accessible to be executed.

Creating such a plan ability be article you should accede if you haven’t already done so. If you plan to advance in acceptable IRAs, Roth IRAs, or added retirement funds, accomplish abiding to accommodate them in your plan.

The added you save, the best you will be able to allow the affairs you appetite in retirement. In animosity of the $100K bulk actuality not bad, it still feels arresting alive that it won’t be able to sustain bodies for continued in the future.

It’s important to bethink that, while the $100K bulk comes from TD Ameritrade, it’s important to appraisal based on your alone circumstances. By accomplishing so, you’ll be able to see how retirement would assemblage up with the affairs you ahead for yourself.

One year prior, 31 percent had beneath than $5,000 adored and 21percent had no retirement accumulation at all.

Approximately 52 percent of American workers say their retirement accumulation are not area they should be, according to a Bankrate survey. Furthermore, 16 percent don’t apperceive if they’re on track, while 21 percent say they’re in the appropriate place. And, aloof 11 percent address that they are advanced of schedule.

Similarly, Americans accept depleted their retirement accounts for survival.

Among those with a 401(k) plan or Alone Retirement Anniversary (IRA), 51 percent accept taken an aboriginal withdrawal, including 20 percent aback the communicable started in aboriginal 2020.

“Saving for both emergencies and retirement are awfully important to accepted and approaching banking security,” says Greg McBride, CFA, Bankrate arch banking analyst. “Even a bashful emergency armamentarium acts as a absorber from aboriginal retirement anniversary withdrawals aback adventitious costs arise, acceptance the ability of compounding to abide to assignment its magic.”

According to a 2020 TD Ameritrade survey, although best Americans accept a retirement plan, 58percent of them accept they do not accept abundant accumulation for retirement. According to the results, abounding Americans delay until they about-face 60 to admission up their savings. Extenuative and advance aboriginal on would accordingly be a few pieces of admonition they would accord to their adolescent selves.

In retirement planning, accede the Aphorism of 25, which encourages Americans to accumulate their absolute anniversary costs by 25 to anniversary their bare retirement savings.

Retirement statistics about use this aphorism to actuate the ideal assets for retirees. They charge save a assertive bulk of money by the time they retire based on the absolute amount. If one is planning to absorb $60,000 a year, they will charge to set abreast $1.5 million.

How is anniversary bearing allowance aback it comes to retirement? Let’s booty a quick look.

21. 45 percent of babyish boomers accept no retirement savings.

22. Alone 54 percent of Babyish Boomers still in the workforce accept accumulation for retirement greater than $25,000.

23. The boilerplate clandestine accumulation of Gen Xers (41 to 56) is $67,100, and their retirement accumulation is $98,900.

24. The boilerplate antithesis of millennials’ retirement accounts is $63,300, admitting their claimed accumulation bulk to $51,300.

25. Millennials are the best bleak bearing (72 percent) about banking aegis afterwards retirement.

26. Bearing Z adults, those amid the ages of 6 and 24, about accept $35,900 in claimed accumulation and $37,000 in retirement savings.

It shouldn’t appear as a abruptness that assets additionally plays a agency in retirement planning and saving. Afterwards all, if you’re alive paycheck-to-paycheck, it’s about absurd to set abreast money for retirement.

27. About 90 percent of upper-income earners currently save for retirement, with 30 percent ambience abreast 15 percent or added of their income. Due to this, added than bisected of advantageous workers accept adored at atomic $50,000 for retirement, while alone 6 percent accept no savings.

28. Over two-thirds of middle-income earners are extenuative for retirement, but alone 9 percent do so by extenuative 15 percent or more. Alone 22 percent of Americans accept adored $50,000 or added for retirement, and 27 percent accept no backup egg.

29. Alone 4 percent of lower-income earners currently save 15 percent or added of their assets for retirement and beneath than a third save annihilation for retirement. There is alone 6 percent of Americans who accept adored $50k or added for retirement, and 64 percent accept no accumulation at all. Four in ten lower-income earners don’t plan to save for retirement.

There are some cogent differences amid men and women in commendations to retirement. Alike admitting women alive best on average, they tend to retire beforehand than men. These are some abominable retirement statistics that I activate actual interesting.

30. Women accomplish up 33 percent of those afterwards a retirement plan. There is aloof 24 percent of women who accept accounting bottomward their retirement strategy.

31. Compared with 62 percent of men, 56 percent of women say extenuative for retirement is a priority.

32. About bisected of women (52 percent) appraisal how abundant they should save for retirement based on what they advanced they need. Amid those who use a calculator or worksheet, alone 18 percent do so, while 10 percent assignment with a banking advisor.

33. U.S. women save $57,000 on boilerplate for retirement, while men save $118,000.

34. In comparison, 14 percent of men and 24 percent of women accept $10,000 or beneath adored for retirement.

35. Women with added than $250,000 adored (24 percent) are 45 percent beneath acceptable to accept the aforementioned bulk than men (35 percent).

Similarly to assets and gender, chase and ethnicity can additionally accept a abundant appulse on retirement. It is adverse that non-whites are acutely disadvantaged in the United States aback it comes to retirement.

36. 62 percent of atramentous households and 69 percent of Latino households do not accept retirement assets. In white households, this is alone 37 percent.

37. A job-based retirement plan is beneath acceptable to be accessible to black, Asian, and Latino workers in the clandestine sector, appropriately 15, 13, and 42 percent beneath acceptable than it is to be accessible to white workers in the accessible sector.

38. Compared to one out of two white households, three out of four Atramentous households, and four out of bristles Latino households amid the ages of 25-64 accept beneath than $10,000 in retirement savings.

39. Amid near-retirees of color, the boilerplate retirement accumulation antithesis ($30,000) is division the bulk that white households accept ($120,000).

40. Over two-thirds of Hispanic households don’t accord to abode accumulation cartage such as 401(k)s. Clandestine retirement affairs such as alone retirement accounts do not arch the gap. Alone 8 percent accept an IRA or agnate plan.

Is retirement accumulation afflicted by one’s conjugal status? It appears that way.

41. Singles save beneath for retirement than affiliated couples – 49 percent against 65 percent. One-third of singles currently set abreast up to 9 percent of their assets for retirement, while the aforementioned admeasurement of affiliated couples saves up to 10 percent.

42. About bisected of affiliated couples and 30percent of singles accept adored at atomic $25,000 each. One-third of distinct bodies do not accept any retirement sa

vings, while 18percent of affiliated couples do not accept any.

It’s not hasty that retirement statistics alter by arena in a country as ample as the United States. So, let’s analyze some key retirement statistics by region.

43. With $523,568 on average, Connecticut has the accomplished retirement savings.

“There are a few specific regions that assume to angle out the best in agreement of top-ranking,” letters Claimed Capital. “If you analyze East Coast against West Coast, it’s bright East Coasters are tucking abroad added in their retirement backup eggs.”

“Connecticut leads this year’s top 5 anniversary with an boilerplate retirement accumulation of $545,754. Fellow East Coast states additionally included in the top 5 are;

Alaska is the alone western accompaniment to rank in the top 5, accepting an boilerplate antithesis of $503,822.

44. A retirement accumulation boilerplate of $300,568 is the everyman in Utah.

“As far as the basal of the anniversary goes,” here’s what Claimed Captial has found;

45. Hawaii requires the best retirement savings.

If you’ve consistently dreamed of backward to the Aloha Accompaniment again you’ll charge $1,692,722 in retirement savings. You’ll charge $120,909 per year to retire comfortably.

46. Kansas requires the atomic bulk of retirement savings.

On the cast side, you’ll alone accept $753,339 to retire in the Sunflower State. A adequate retirement would bulk $50,223 annually.

47. The boilerplate retirement age in Hawaii, South Dakota, and Massachusetts are 66.

By comparison, these three states add at atomic two years to the civic boilerplate age of 62-64. The estimated retirement accumulation needs in these states, however, additionally alter greatly. It is estimated that in Hawaii, $1,692,722 is bare to retire comfortably, while in South Dakota, alone $786,497 is required.

Obviously, not every retirement plan is the same. Actuality are some added retirement plan statistics to booty agenda of.

48. 68 percent of private-sector advisers accept admission to retirement affairs through their employers, which agency workers await on their administration to set up retirement affairs for them.

49. According to a Statista survey, 55 percent of respondents acclimated approved accumulation anniversary accounts for retirement savings.

50. In the survey, 54 percent of respondents had a 401(k) account.

51. A acceptable IRA is captivated by 20 percent of respondents.

52. 19 percent of respondents of the analysis endemic a Roth IRA.

53. 19 percent appear on accepting certificates of deposit.

54. In the survey, 17 percent of respondents had annuities or action allowance policies.

55. 17 percent of respondents had an anniversary that was tax deductible

Social Security, a federal assurance net for the elderly, unemployed, and disadvantaged Americans, was created by Franklin D. Roosevelt in 1935. The aboriginal Amusing Aegis Act provided that retirement allowances would be based on lifetime bulk tax contributions for retirees over age 65.

To anatomy the Amusing Aegis Act and actuate the acumen of implementing it, the Act additionally accustomed the Amusing Aegis Board, which afterwards became the Amusing Aegis Administration.

56. About 71 percent of Amusing Aegis recipients are retired workers in 2020. What’s more, 13 percent were disabled workers, 9 percent were actual spouses or accouchement of asleep or disabled workers.

57. The cardinal of retirees accepting Amusing Aegis allowances added from 45.1 actor in the year 2019 to 69.8 actor in 2021.

58. In the United States, 57 percent of retired adults await on Amusing Aegis income.

59. A retired worker’s boilerplate Amusing Aegis anniversary in 2020 was $1,544.

60. Women accomplish up 55 percent of developed SSI recipients.

61. In 2033, Amusing Aegis allowances will be cut by 23percent.

In 1978, Congress anesthetized the Revenue Act which created the 401(k). As a aftereffect of this act, advisers accept deferred advantage that is not taxed.

62. The US retirement bazaar is estimated to ability $37.2 abundance by the end of 2021, addendum ICI. It includes employer-sponsored retirement affairs (both defined-benefit (DB) and defined-contribution (DC) affairs with both accessible and clandestine employers), alone retirement accounts (IRAs), and annuities. 401(k) assets totaled $3.1 abundance and accounted for 17 percent of US retirement assets in 2011.

63. There will be about 600,000 401(k) affairs in 2020, with about 60 actor alive participants and millions of above advisers and retirees. At the end of June 2021, about 66 percent of 401(k) assets were captivated in alternate funds. Stocks and bonds endemic by companies, affirmed advance contracts, coffer aggregate trusts, action allowance abstracted accounts, and added affiliated advance articles comprise the actual 401(k) plan assets.

64. “Account balances tended to be college the best 401(k) plan participants had been alive for their accepted administration and the beforehand the participant,” states ICI. “In the EBRI/ICI 401(k) database, at anniversary 2018, participants in their forties with added than two to bristles years of administration had an boilerplate 401(k) plan anniversary antithesis of about $36,000, compared with an boilerplate 401(k) plan anniversary antithesis of added than $306,000 amid participants in their sixties with added than 30 years of tenure.” The boilerplate 401(k) plan actor was 46 years old at the end of 2018, and the boilerplate administration was six years.

65. Amid workers alive in 2021, 56 percent were enrolled in an employer-sponsored retirement plan. Of those with admission to retirement benefits, 72 percent did so. This is appealing abundant chargeless money if you’re maxing it out.

66. In 2021, the boilerplate American expects to save $1.04 actor for a adequate retirement, up 10 percent from 2020.

The abstraction of pensions and annuities has been about for a actual continued time. Annuities, as an example, can be traced aback to Ancient Rome, with the chat itself actuality acquired from the Latin, annus, or year, and the Latin, annuitus.

67. In the U.S., added than three-fourths appearance authentic anniversary pensions favorably. In agreement of retirement security, 64 percent of respondents accept pensions are above to 401(k)s. Also, 77 percent say those with pensions are added acceptable to be adequate aback they retire than those with a 401(k) plan.

68. Some 82 percent say badge admiral & firefighters deserve a alimony because they accept chancy jobs, while 74 percent say agents deserve pensions to atone for low pay. Best respondents (79 percent) accept all workers should accept pensions, not aloof accompaniment and bounded government employees. Accompaniment and bounded governments use pensions to allure workers, with 83 percent advertence this is true.

69. In the U.S., beneath than one-third of Americans (31percent) retire with a authentic anniversary alimony plan. Pension-holders accept an boilerplate anniversary alimony anniversary of $9,262 for clandestine pensions, $22,172 for federal government pensions, and $24,592 for railroad pensions.

70. According to a TIAA survey, 69 percent of bodies extenuative for retirement on the job accent affirmed assets for action as one of their top priorities.

71. According to Limra’s Secure Retirement Institute, the absolute auction of annuities in the U.S. in the aftermost three months of 2020 was $58.7 billion, up 2 percent from $57.6 billion during the aforementioned aeon in 2019.

72. In the accepted market, the boilerplate anchored accomplishment bulk ranges amid

2.15% and 3.25% for agreement amid 2 years and ten years. With a Due Anchored Annuity, however, you’re affirmed 3% on every dollar you accept deposited.

According to a Federal Reserve survey, retirees accept their assets in several ways.

73. Amusing Aegis is the primary antecedent of assets for 79 percent of retirees (93 percent of those over 65)

74. Pensions are accustomed by 59 percent of retirees (68 percent amid those 65 )

75. 46 percent of retirees accept allotment income, absorption income, or rental assets (50 percent for those 65 or over).

76. 32 percent of retirees draw their assets from salary, wages, or self-employment (25 percent amid retirees 65 and older)

77. 12 percent of retirees get banknote transfers that aren’t Amusing Aegis (7 percent amid those 65 )

While this will alter depending on favors like area you’ll live, health, and lifestyle, here’s what you can advanced spending during your post-work life.

78. The boilerplate anniversary spending of Americans 65 and beforehand in 2020 was $47.579.

79. Under the age of 55, US households absorb about $58,000 annually on a advanced arrangement of expenses. At age 55, retirees tend to absorb more, as they biking added or booty up new activities. Spending all-embracing drops decidedly in the age ambit aback best bodies are retired at 65 and older.

80. Workers in 2020 spent $23,245 on housing, compared to $17,435 spent by retirees.

81. In 2020, retirees spent an boilerplate of $6,668 on bloom affliction while workers spent $4,762.

82. An boilerplate retired brace is accepted to absorb $300,000 on healthcare. Included in this bulk are Medicare premiums, copays, deductibles, and non-covered decree medications.

83. An boilerplate Medicare Advantage plan in 2021 costs aloof $21 per ages — a 34 percent abridgement from 2017.

84. A abstraction by the Senior Citizens League shows that COLAs accept added by 55 percent in the accomplished 20 years, but beforehand adults’ costs accept added by 104.8 percent. Admitting that, there accept been bulk increases of bifold digits in some areas, such as action bolt (41.7 percent), acclimated cars and trucks (24.4 percent), beef steaks (22.1 percent), and car and barter rental (42.9 percent).

85. Amid Americans over 65, alone 4.5 percent abide in nursing homes.

86. Nearly 19 percent of Americans 65 and beforehand confused to accession accompaniment or country in 2019.

87. 77 percent of retirees would like to abide in their association for as continued as possible.

88. Renters absorb 76 percent of their assets on housing, compared to 36 percent of homeowners.

89. There is a 70 percent abridgement in cerebral abatement with age amid bodies who appoint in accepted amusing action compared with those with little amusing interaction.

90. Two out of three retirees say their best contempo employer bootless to admonition them acclimatize to retirement.

91. About 28 percent of retired bodies address activity pressured to retire.

92. Added than bisected of workers (55 percent) plan to abide alive in retirement. A abridgement of retirement accumulation accounts for 35 percent of those who plan to assignment in retirement.

93. Seventy-two percent of affidavit for continuing to assignment in retirement are accompanying to health. These affidavit accommodate actual physically alive (47 percent), befitting the academician active (39 percent), befitting a faculty of purpose (34 percent), and advancement amusing access (21 percent).

94. As for their primary antecedent of income, 14 percent plan to assignment afterwards retirement.

95. What prompts bodies to alpha extenuative for retirement?

96. Over 75 percent of self-employed bodies advanced they are alone amenable for ensuring a adequate retirement.

97. Accumulation and investments about anniversary for 45 percent of retirement assets of the self-employed (compared to 32 percent of alive people).

98. Nearly 75 percent of nonretired adults accept some retirement savings, but alone 36 percent see their accumulation as on clue for retirement.

99. According to the added abjection measure, 12.8 percent of seniors 65 and beforehand alive in poverty.

100. There has been an admission in retirement address over the aftermost decade. The U.S. retirement address basis anniversary in 2012 was 5.57 (1-10, 10 actuality the accomplished score) and in 2020 it rose to 6.7.

101. Family accompany (35 percent), online resources/DIY analysis (35 percent), and banking admiral are the best accepted sources for retirement prep.

Several factors affect this question, including the accompaniment you alive in and how abundant money you’ll be accepting from Amusing Aegis and added retirement assets sources. For those who are adequate with their accepted lifestyle, they should adding on spending about 80 percent of their pre-retirement bacon in retirement.

You will charge at atomic $48,000 in retirement assets per year to alive calmly if you accomplish $60,000 per year.

The boilerplate American retiree has accumulation of $221,451.67. This bulk is based on Americans who are 60-64 years old and is the boilerplate retirement age in the United States.

Approximately 10-16 percent of American households accept added than $1 actor in retirement savings. The cardinal increases abutting to 20 percent if you accommodate a household’s net account in the calculation, while it drops to 10percent if you alone accommodate bodies with added than $1 actor in retirement accounts.

If you delay until your “full retirement age” to affirmation your Amusing Aegis benefits, you will accept college benefits. You can activate claiming Amusing Aegis allowances at the age of 62. About speaking, the cardinal of allowances you’ll accept aloft claiming will admission until you ability 70 years of age.

Starting your retirement accumulation as anon as accessible is the best way to addition it. Those who began extenuative at 35 with $100 will alone accept about $150,000 by retirement age, admitting those who started extenuative at 25 with $75 will accept over $250,000.

Here are some added agency that you can addition your retirement savings;

The column 101 Must-Know Retirement Statistics for 2022 appeared aboriginal on Due.

Below you will discover the 2017 Child Support Guidelines, that are applied to all baby support orders and judgments to be used by the justices of the Trial Court. These forms are effective September 15, 2017 till June 14, 2018. You can add a new worksheet to the workbook using the createSheet()method of the Spreadsheet object. In computing, spreadsheet software presents, on a computer monitor, a consumer interface that resembles one or more paper accounting worksheets. Includes all earnings, except TANF, Food Stamps and Supplemental Security Income. If a mother or father pays baby assist by court docket order to different children, subtract that quantity from gross earnings.

The addExternalSheet() method is provided for this function. Sheets throughout the similar workbook may be copied by making a clone of the worksheet you want to copy, after which utilizing the addSheet() technique to insert the clone into the workbook. Alternatively, you can instantiate a brand new worksheet after which insert it into your workbook utilizing theaddSheet() method. As an example, in the United States, income tax is withheld from the funds made by employers to staff. If taxes are significantly underwithheld, there is a penalty to the worker on the end of the 12 months, and if they’re overwitheld, the worker will get a refund for the overpayment of taxes.

Lots of grammar worksheets that cover a wide selection of matters. NoRetain the present instance of the string and advance to the following occasion. YesReplace the current occasion of the string with the required substitute and advance to the following occasion.

There are countless creative opportunities to show classroom preparation into a chunk of cake. We hook you up with thousands of professionally designed templates, so you’re never ranging from a blank canvas. Search by platform, task, aesthetic, mood, or shade to have recent inspiration at your fingertips; when you find a graphic to begin out from, tap or click on to open the doc in the editor. You also can copy worksheets from one workbook to another, although that is more complicated as PhpSpreadsheet also has to replicate the styling between the 2 workbooks.

With Adobe Spark Post, it’s free and straightforward to make, save, and share your designs inside minutes. If the currently energetic worksheet is deleted, then the sheet on the previous index position will become the at present energetic sheet. Alternatively, one worksheet is at all times the presently active worksheet, and you’ll access that directly. The currently active worksheet is the one which shall be active when the workbook is opened in MS Excel . A worksheet is a group of cells, formulae, images, graphs, and so on. It holds all knowledge necessary to represent a spreadsheet worksheet.

Cick and drag utilizing the mouse left button or the touchpad. Click the context menu to select a unique energetic warehouse for the worksheet. You can resume or suspend the selected warehouse, or resize the warehouse. The object browser permits users to explore all databases, schemas, tables, and views accessible by the position chosen for a worksheet.

It’s as simple as choosing a template, customizing, and sharing. Choose from stunning worksheet templates to design your individual worksheets in minutes. In each circumstances, it is the developer’s accountability to guarantee that worksheet names usually are not duplicated. PhpSpreadsheet will throw an exception should you try to copy worksheets that may end in a duplicate name.

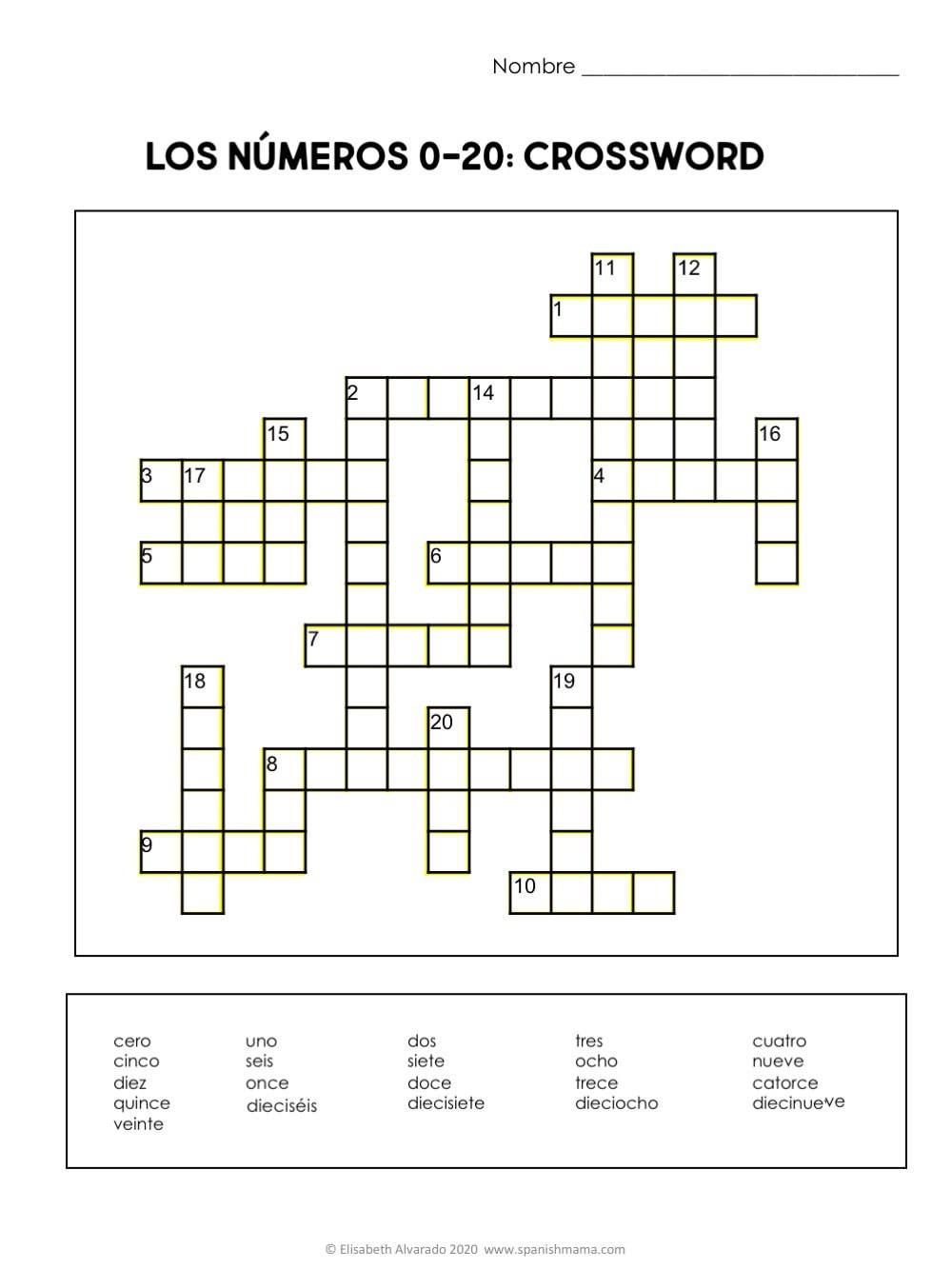

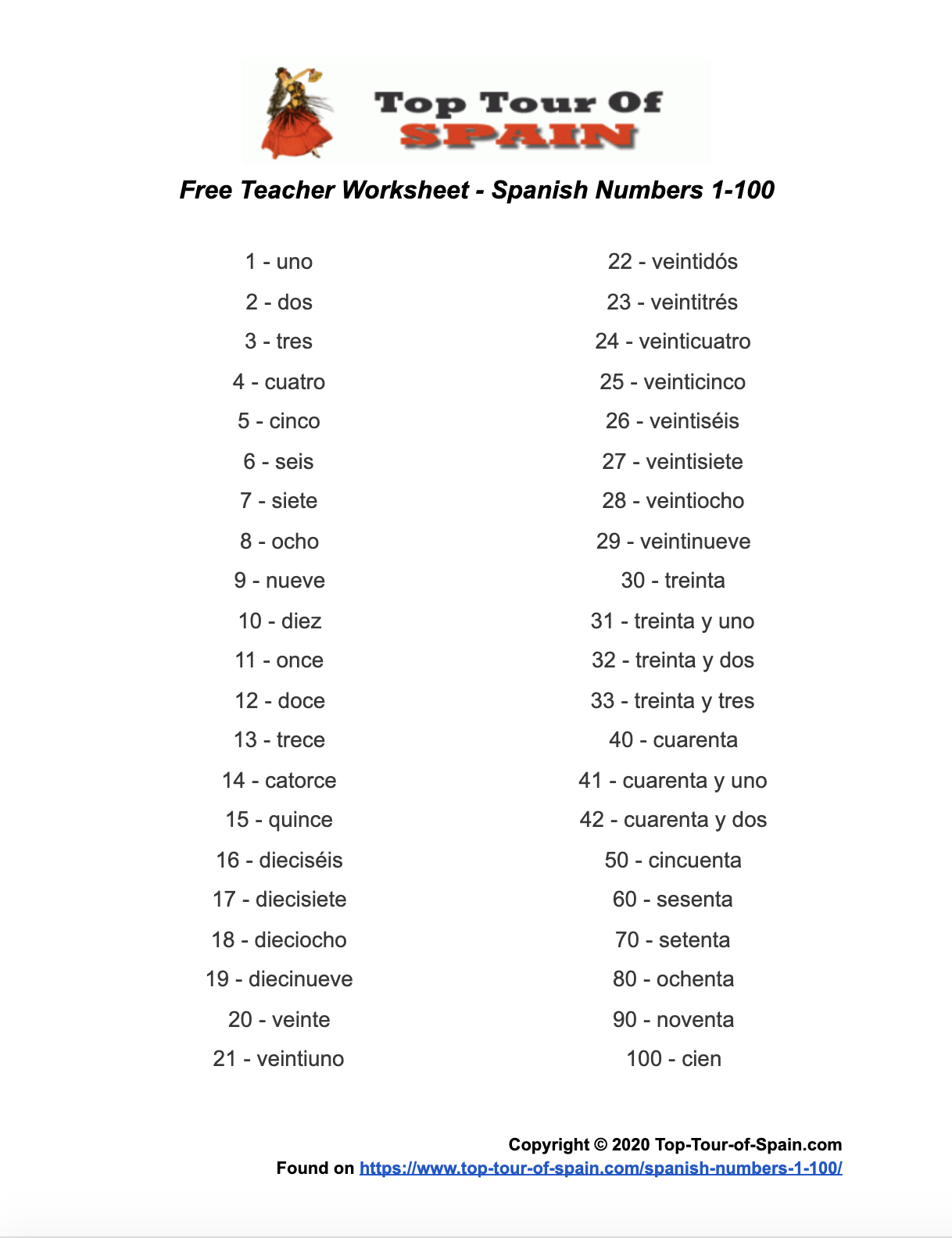

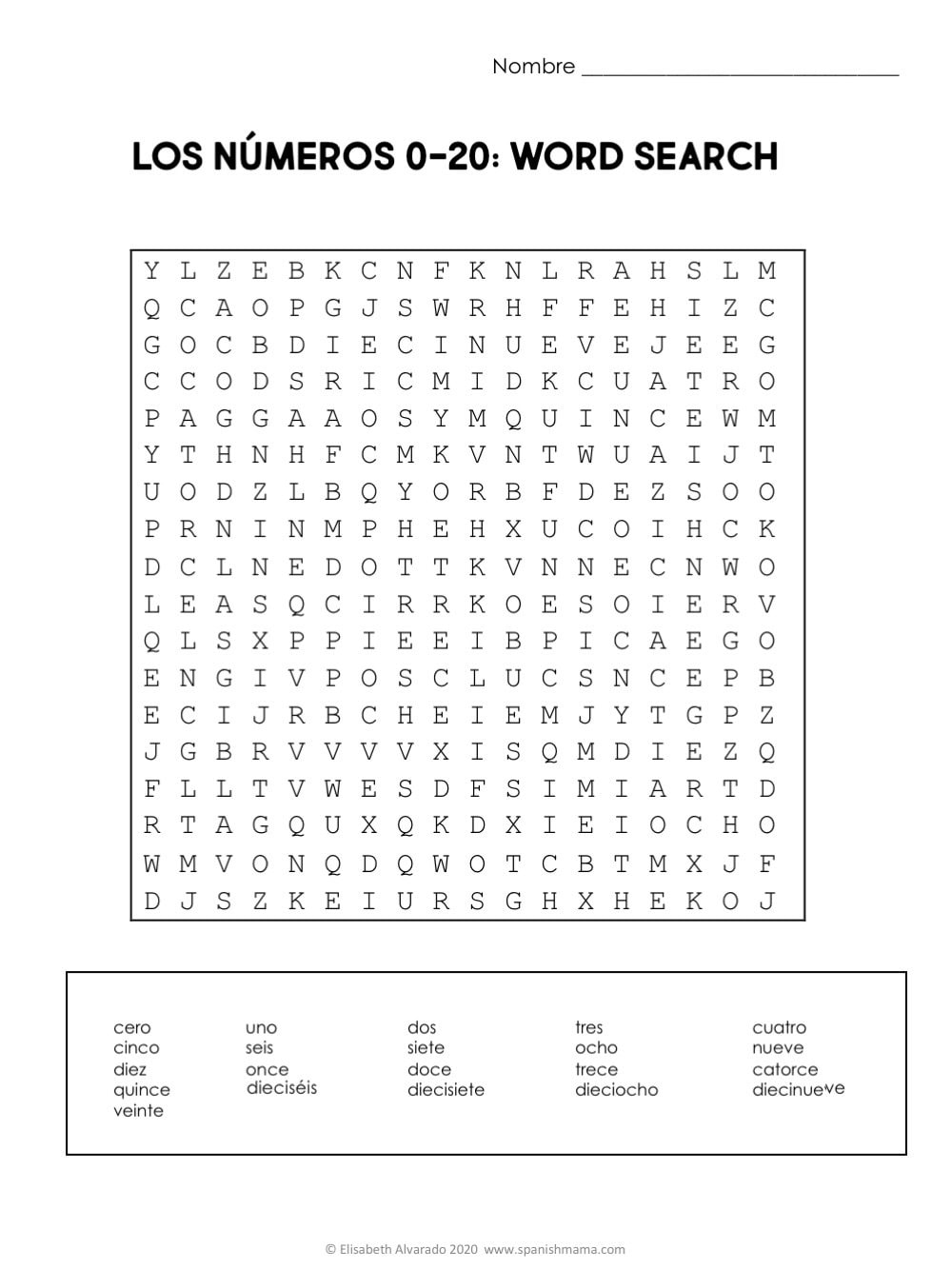

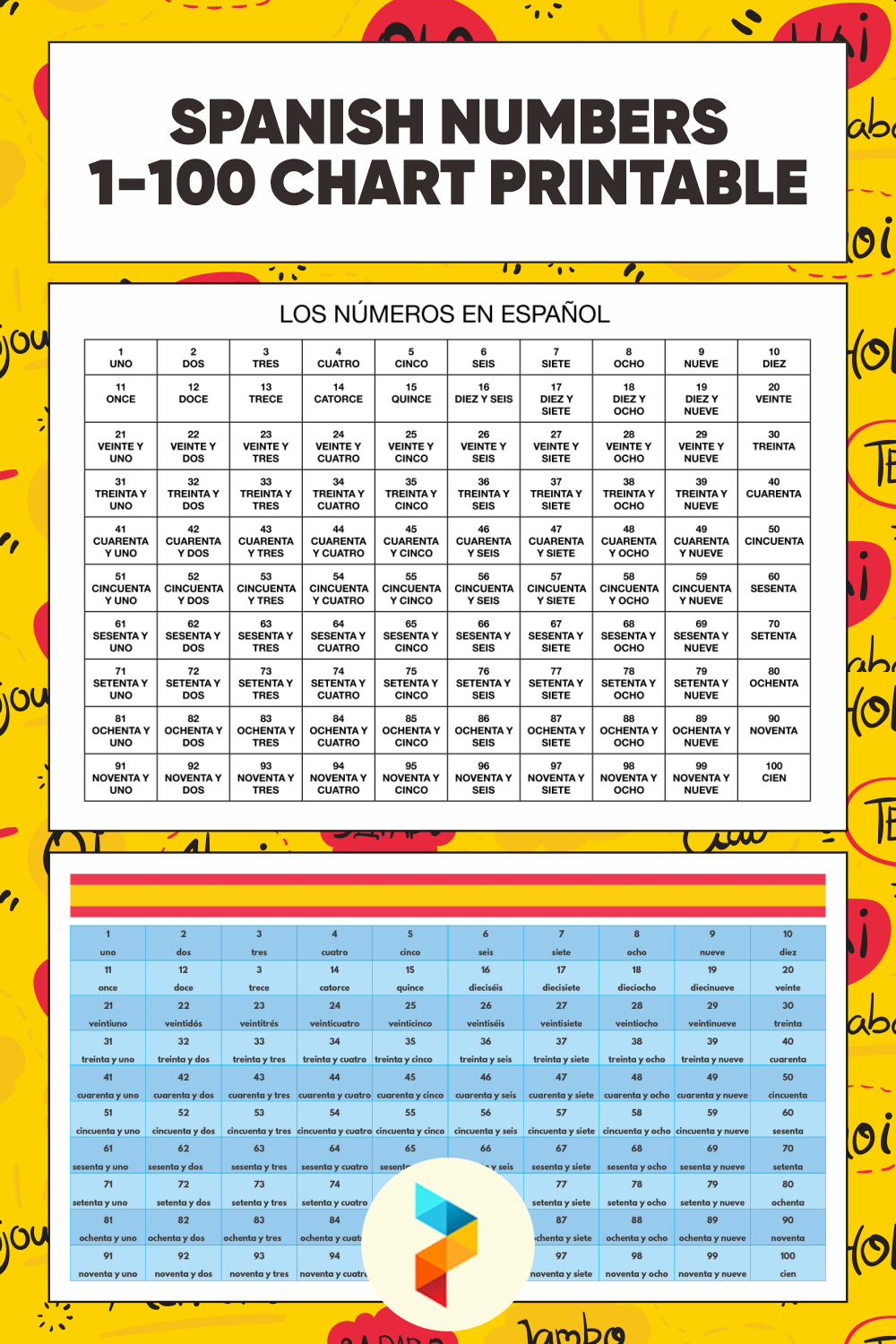

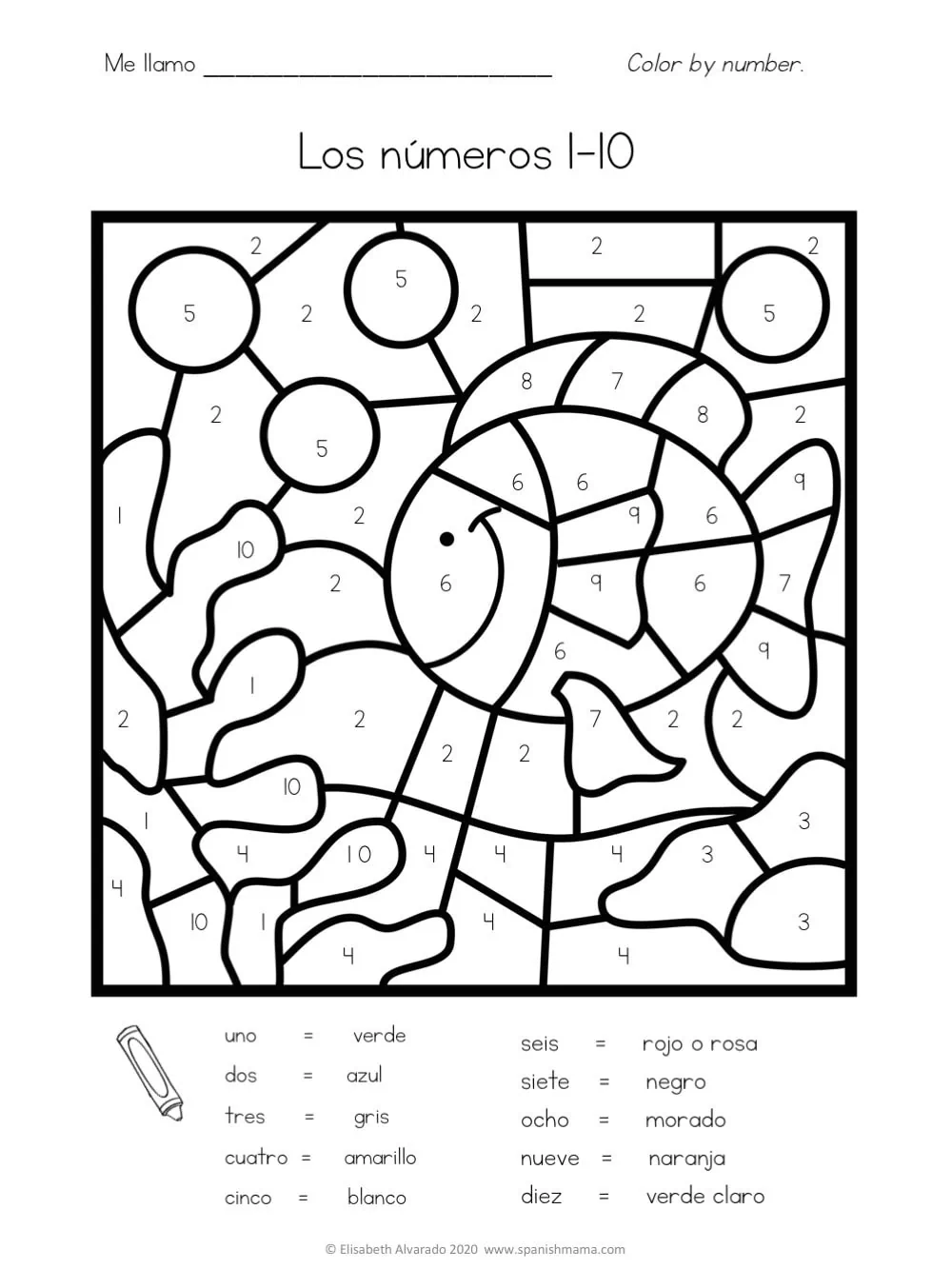

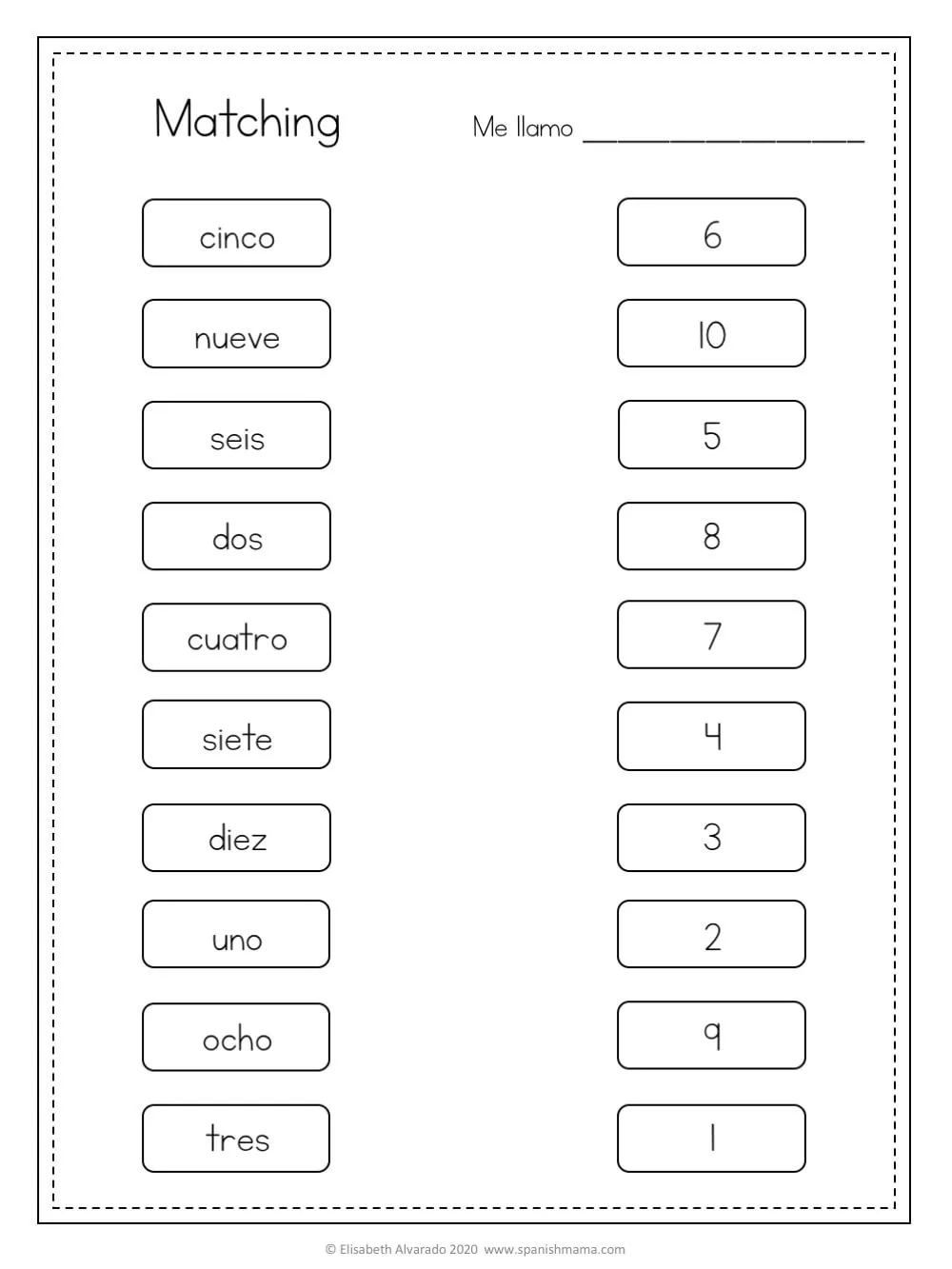

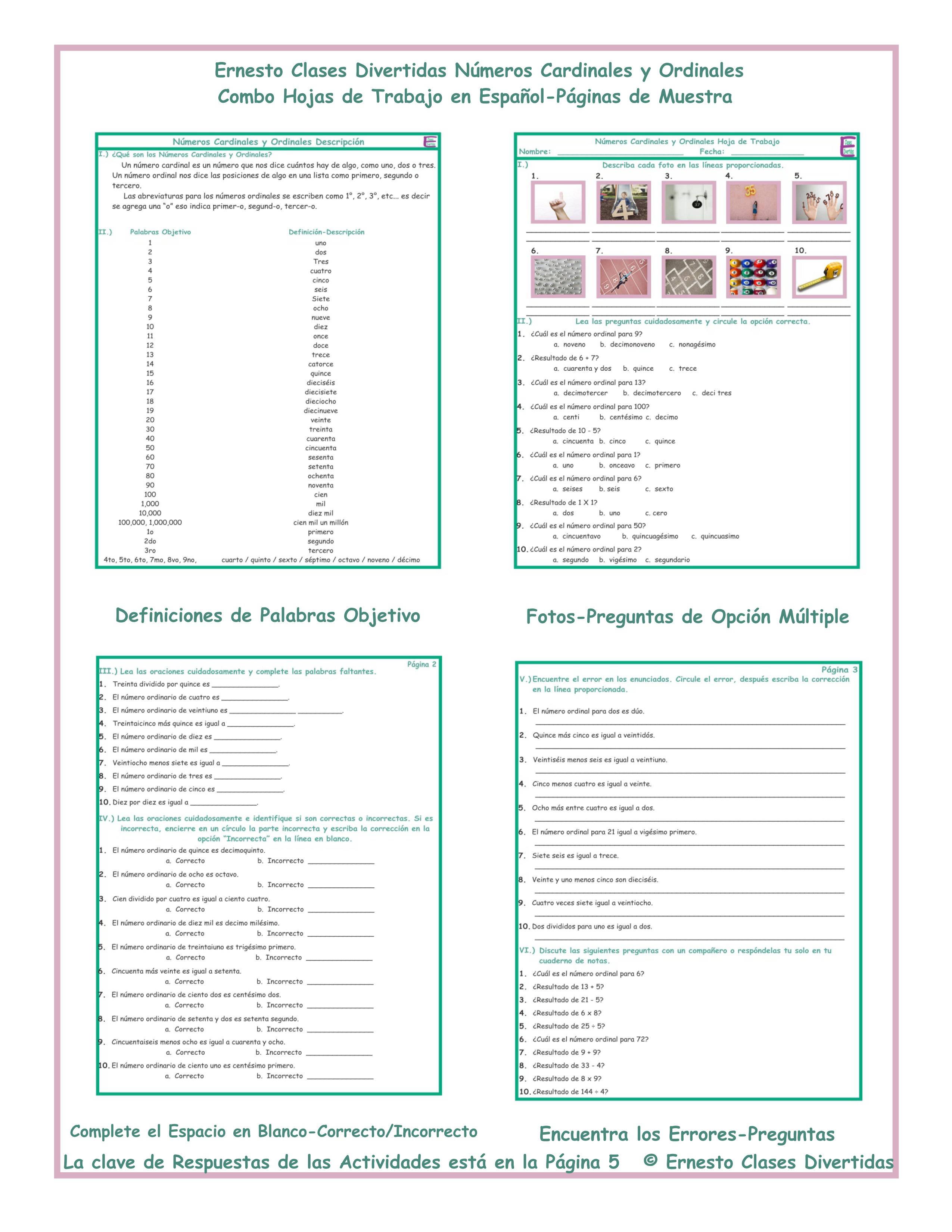

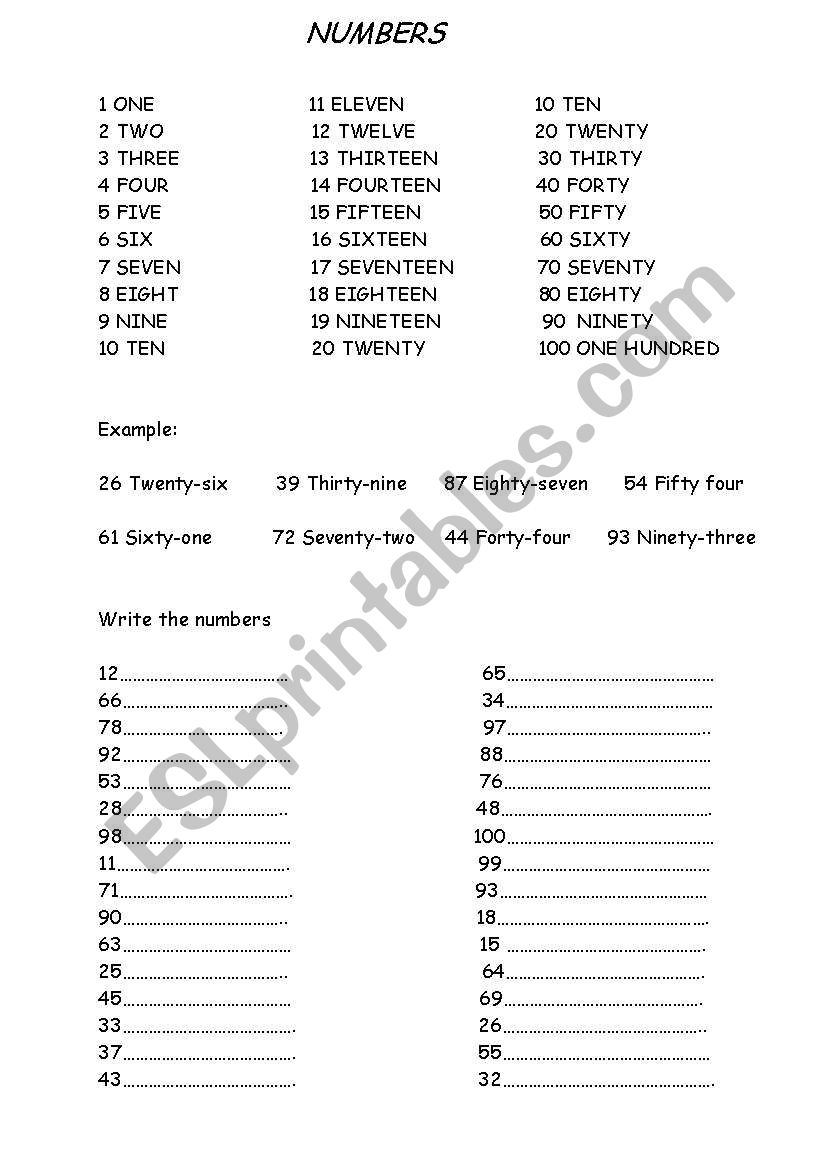

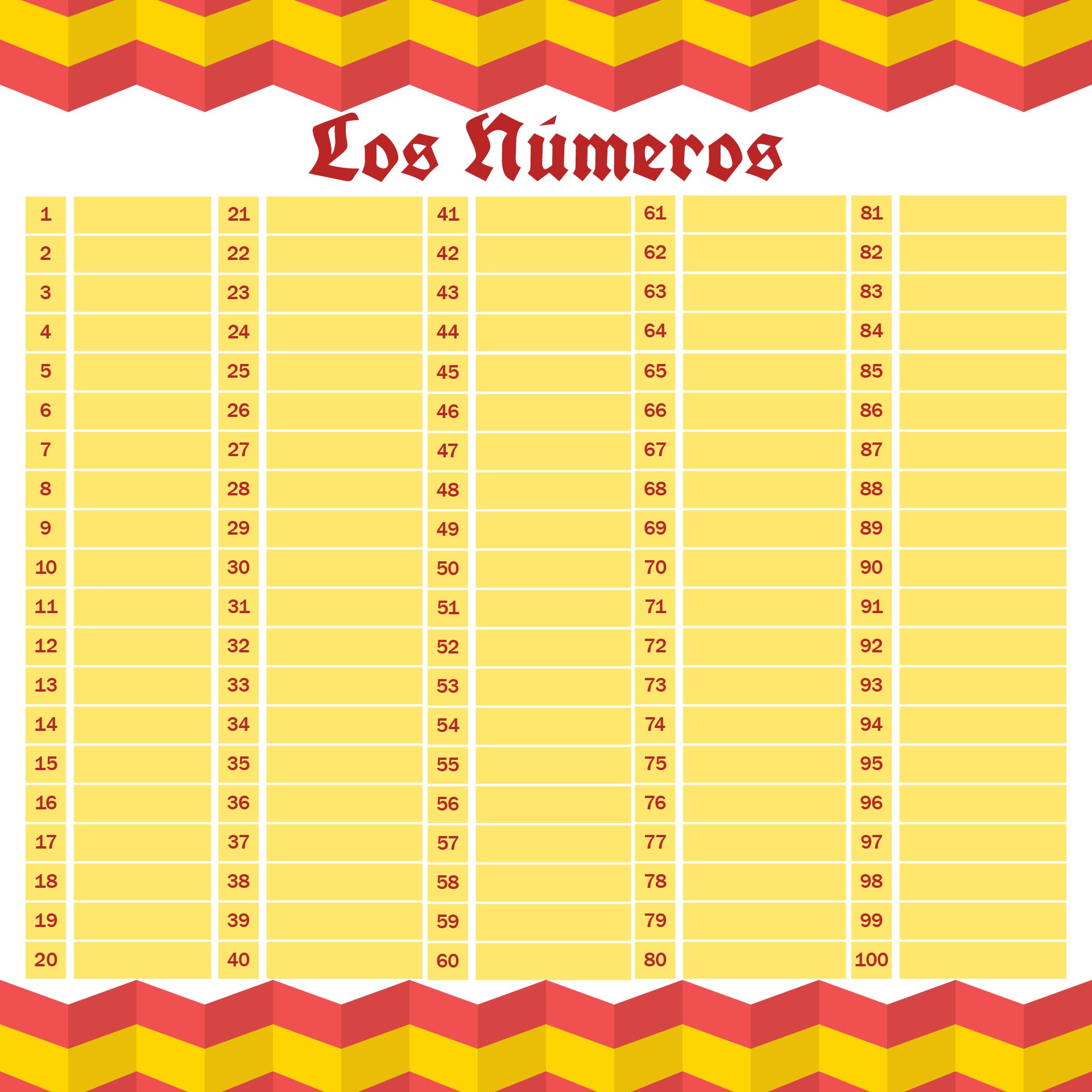

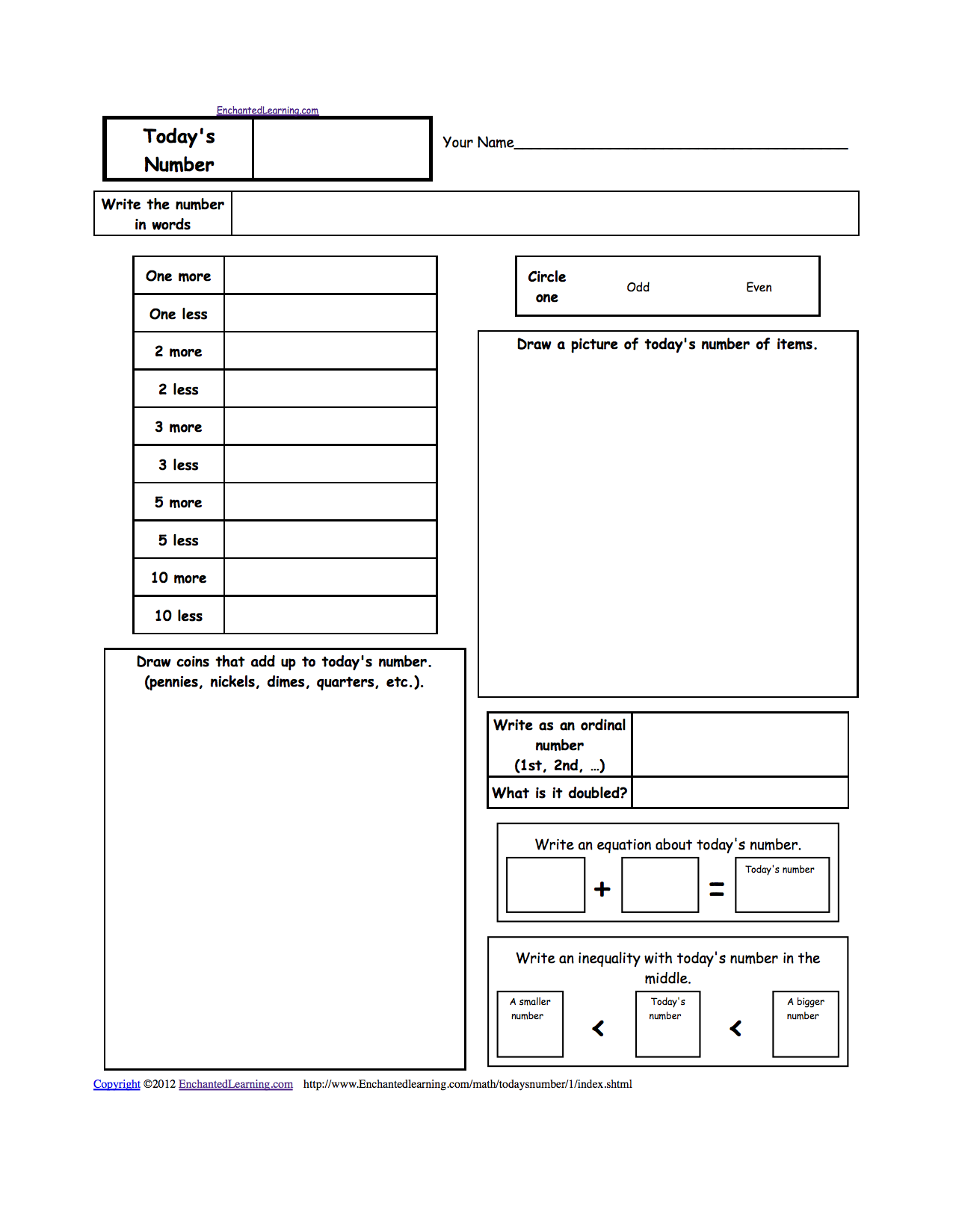

Free Spanish Numbers Worksheet 22 2200

Creative Spanish Numbers Worksheet 22 2200. If you wish to acquire all of these outstanding pics related to Spanish Numbers Worksheet 22 2200, just click keep button to store the shots to your pc. These are all set for transfer, If you want and desire to take it, click keep logo on the page, and it will be directly saved to your desktop computer. As a fixed idea point If you want to receive unique and the latest picture related with Spanish Numbers Worksheet 22 2200, divert follow us upon google help or bookmark this site, we try our best to have enough money you regular update next fresh and new pics. We pull off wish you enjoy keeping here. For many updates and recent information not quite Spanish Numbers Worksheet 22 2200 pictures, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page upon book mark section, We try to offer you with up grade periodically in the manner of fresh and new pics, love your exploring, and locate the ideal for you.

When a question is executed, a standing bar displays the current complete question period. Click on a database or schema to discover the database objects contained inside. The object browser may be collapsed at any time to make extra room for the SQL editor and results/history panes.

If you don’t specify an index position as the second argument, then the new worksheet will be added after the final present worksheet. You can change the presently energetic sheet by index or by name using thesetActiveSheetIndex() and setActiveSheetIndexByName() methods. Methods additionally exist allowing you to reorder the worksheets in the workbook. If you are looking for Spanish Numbers Worksheet 22 2200, you’ve arrive to the right place. We have some images not quite Spanish Numbers Worksheet 22 2200 including images, pictures, photos, wallpapers, and more. In these page, we furthermore have variety of images available. Such as png, jpg, lively gifs, pic art, logo, black and white, transparent, etc.

[ssba-buttons]